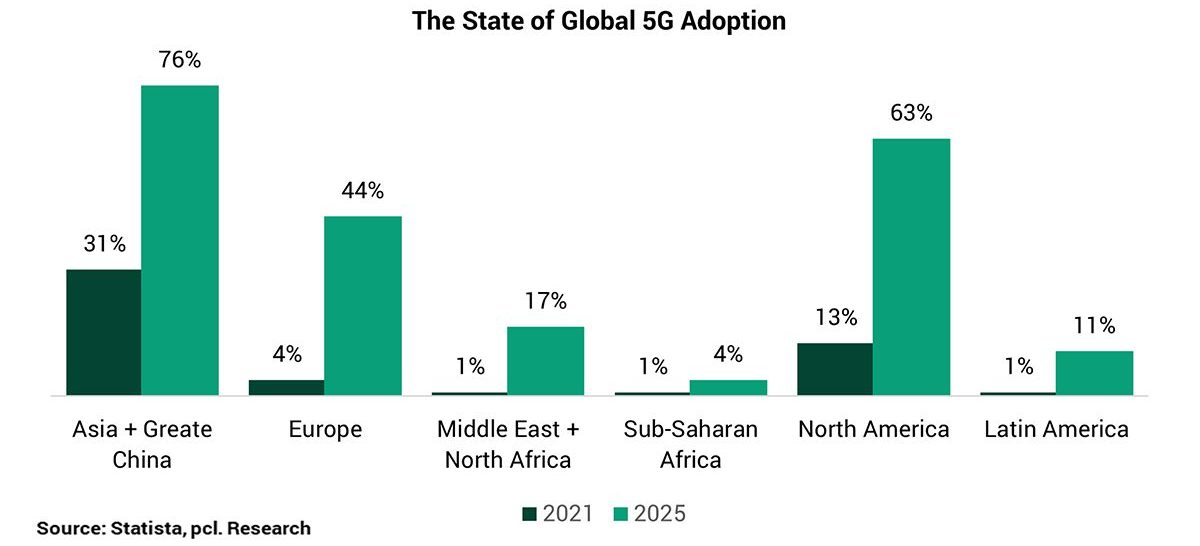

The 5G communication technology is the next step in the evolution of mobile communications technology, and it has the potential to spur economic growth by allowing new and innovative business models and unlocking market opportunities. The prospect for global 5G broadband penetration hinges on the mobile data traffic, which grew 10 percent between Q’4 2021 and Q’1 2022.

A recent prediction by a leading provider of 5G network equipment (Ericsson) showed that the total global mobile data traffic will grow 4x to 288EB (mobile internet traffic) per month in 2027. By 2035, the international 5G framework alone is estimated to generate $3.6 trillion in economic value and 22.3 million employments attributable to ultrafast, sophisticated network connectivity offered by 5G technology. This translates to $13.2 trillion in world economic value across industries (World Economic Forum, 2020). While several regions have begun to develop roadmaps for 5G deployment, others are lagging owing to a varied mix of issues that will need new levels of coordination between corporate, government, and the ecosystem.

Adoption of 5G technology: Global Perspectives

The number of cities having 5G networks has climbed to 1,336 globally (VIAVI Solutions Report). Sixty-one countries have established operational 5G networks since January 2020, with Asia making up the majority. However, the United States and China are far higher than other countries in bandwidth development and 5G deployment.

Figure 1: Number of Cities in which 5G is available in 2022, by country

Asia

In terms of 5G deployment, South Korea, Taiwan, and China are among the world leaders. The region’s leaders profited from their choice to release spectrum in the low 700-megahertz (MHz) band for testing in 2019. Federal aid in tax incentives, subsidies, and low-interest financing has been critical to Asia’s 5G development. Conversely, carriers in India and Malaysia have concentrated on obtaining funding for spectrum auctions from private investors and selling infrastructure assets. Overall, the region has benefited from tight regulatory monitoring.

Europe

The apparent favourable regulatory climate will accelerate Europe’s 5G deployment in 2021-22. The European Commission (EC) has set goals for EU member states, including providing continuous 5G coverage in cities by 2025. Some nations have made scope objectives a condition of obtaining spectrum licenses; for example, by 2024, Switzerland expects carriers to provide coverage to 50% of the inhabitants in the 700 MHz band and 25% in other frequencies.

Europe has deployed a large number of 5G base stations, which has boosted industrial adoption. Drones and robots are being used to prevent weeds from strangling crops, and autonomous minibuses and intelligent energy and water management systems are being tested. Some nations, like the Czech Republic, the United Kingdom, and Germany, have set aside a spectrum for companies who wish to build their own 5G network without the help of a mobile service provider.

Middle East

Saudi Arabia, the United Arab Emirates, and Kuwait are among the top ten nations in the world for average 5G download speeds. In reality, by the end of 2018, all six Gulf Cooperation Council (GCC) countries had completed 5G spectrum auctions and had deployed their first networks by the middle of 2019. As they attempt to construct commercial, technological, and industrial clusters, the region’s governments have incorporated 5G development into their economic diversification strategies. Despite this, most GCC member nations only have 50 per cent coverage of 5G networks.

North America

The United States is a worldwide leader in 5G, having already auctioned off enough 5G-ready spectrum to allow for early commercial deployment and extensive testing, which began in 2017-18. It has also implemented a 5G rollout strategy that includes spectrum release, infrastructure policy, regulatory modernisation, and private-sector investment. City-scale test beds and innovation centres are examples of government support for testing. Canada has made considerable strides as well. The government has its research facility, data analytics centre, and 5G test site, all targeted at fostering cross-sector collaboration, such as between mining, utilities, and hydrocarbons, to see how 5G might boost productivity.

Latin America

In terms of 5G readiness, Chile leads the Latin America region. It has auctioned off a considerable quantity of 5G-ready spectrum, established dynamic spectrum caps to encourage broad distribution among operators, introduced spectrum efficiency and effectiveness measures, and set aside US$3 billion for public investment in 5G between 2020 and 2025.

Brazil, Mexico, and Colombia are making progress as well. All three are working on 5G roadmaps and regulations and 5G trials and spectrum auctions, which they are either planning or completing. However, a lack of 5G-specific legislation, delayed or insufficient spectrum auctions, and insufficient governmental and private-sector investment are all thwarting growth in the region.

Africa

In Africa, progress has likewise been gradual, although still at its nascent stage. Ethiopia recently joined Botswana, Egypt, Gabon, Kenya, Lesotho, Madagascar, Mauritius, Nigeria, Senegal, Seychelles, South Africa, Uganda, and Zimbabwe, in testing 5G. In Nigeria, the Nigerian Communications Commission (NCC) have indicated that licensees are expected to commence the rollout of 5G services effective from August 2022. Recent statistics from Africa Digital Economy Forum showed that the 5G rollout in Africa could create economic value worth $2.2 trillion by 2034.

Assessing Nigeria’s Readiness for 5G Roll-out

In Nigeria, the need to meet technological requirements of faster connectivity, enhanced mobile broadband, and higher data capacity is moving forward from 2G, 3G and 4G broadband, with a focus now on 5G. The journey to 5G has commenced in Nigeria, despite the initial underlying challenges.

-

Infrastructure and Technology

The infrastructure and technology comprise current fixed and mobile infrastructure that will be utilised in 5G networks, as well as activities leading up to the deployment of the new technology, such as spectrum auctions, 5G testing, and commercial 5G network implementation.

The Nigeria telecommunications sector will require around N1.04 trillion in investment to close the infrastructure gap, particularly in base transceiver stations (BTS) across the country. BTS deployment across the nation has increased from 30,000 to 54,460 (NCC, 2021). That is, a 26,540 BTS shortfall compared to the 80,000 BTS necessary to cover the country’s vast area effectively. On a macrocosm, the infrastructural deficit in Nigeria stands as a bane towards the full deployment of 5G.

In addition, the unstable power supply will constitute a barrier to 5G technology in Nigeria, given that the power consumption of 5G hardware is between two and four times greater than 4G, posing unprecedented challenges for site infrastructure construction.

-

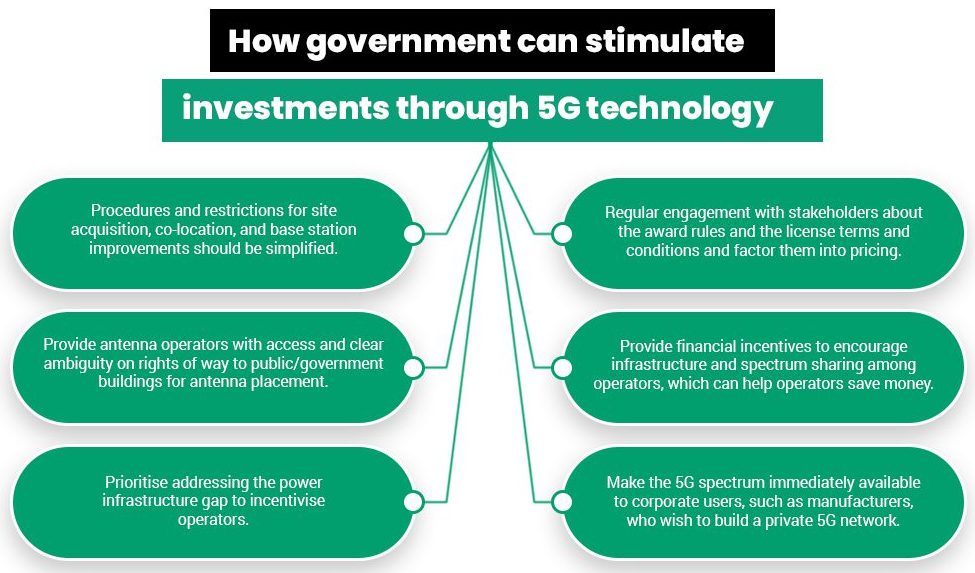

Regulation and Policy

The legal and policy frameworks that will be critical in facilitating the seamless and rapid implementation of 5G networks are pivotal. To meet urban capacity demands, networks must be densified, necessitating considerable new investment in additional locations and accompanying infrastructure, including fibre as backhaul. In Nigeria, the unwillingness of each level of government to legislate low-cost or no-cost access to telecom site locations would slow the adoption of 5G.

For example, the N145 pricing agreement for Right of Way for fibre optic cables is uneven for all operators, with high charges in around 29 states. Furthermore, the purported resistance of operators from local governments to the rural communities unless they pay specific fees currently constitutes a major barrier to broadband penetration in Nigeria.

-

Human Capital

The human capital component is related to expertise and training activities that might aid in deploying and adopting new technology. 5G is a brand-new technology that expertly blends current technologies to deliver the increased capabilities it offers. As a result, qualified personnel and strong technical skills will aid in the rapid development of 5G networks and the development of new and innovative applications and use cases of 5G’s features.

Unlocking Values Through the Deployment of 5G

-

New value-added services in partnership with digital service providers

With the disruptions introduced by 5G, most mobile network operators would derive additional revenue primarily from adding value-added products. With the arrival of 5G, some telecom operators may have to partner with digital services providers to develop more use cases and spill the economic benefits.

-

Network service offers to business customers through network slicing

In anticipation of the entry of non-telco operators, telecom operators could introduce network slicing services or enter the market segment of private networks for businesses.

-

Business model innovation

This could be adopted through outsourcing of infrastructure rollout to specialised neutral entities, network virtualisation to become more flexible in serving clients’ needs in more economical ways, dynamic spectrum sharing to lower cost and blending use of licensed and unlicensed spectrum.

Written by:

Temitope Abimbola

Research Associate