Recently, technology has changed how we live and view the world. Every accomplishment that has been achieved is mainly linked to technology. Many industries like the BFSI sector (Banking, Financial Sector, and Insurance) have embraced technology in many business processes. Automation and Digital Transformation have been the goal of most organisations in the BFSI sector. It has become imperative that they use these intelligent automation technologies like Robotic Process Automation (RPA). In a recent report from Fortune Business Insights, the global RPA market is set to make USD 6.81 billion by the end of 2026.

Organisations now use RPA technology to change the dynamics and drive automation in their processes to keep up with the rapidly evolving technological landscape. It is no longer news that Robotics is proving valuable and trustworthy in extremely diligent and time-consuming tasks in the financial technology space, and according to Tech Target, Robotics can reduce costs in Fintech by up to 25%.

How Does RPA Work?

RPA in Fintech means adopting specific tools and software to carry out repetitive, rule-based, and colossal volume tasks. The BFSI industry deals with a lot of data as it constantly interfaces with people, so choosing RPA is not a wrong choice for BFSI players as it helps solve many problems, thereby increasing the productivity and efficiency of their employees. This will, in turn, show enhanced business superiority and results. RPA benefits Fintech/BFSI organisations more because it is used in all business processes like account opening, anti-money laundering, claims processing, KYC processes, risk and compliance management, streamlined accounting, etc.

Most BFSI organisations actively implement RPA to enhance process efficiency and plummet running expenses. When intelligent automation, i.e., RPA, is appropriately implemented or deployed in a Fintech organisation, according to Dashdevs, stakeholders can discover up to 10-25 % cost reduction. More so, Dashdevs also pointed out that the revenue from RPA in BFSI companies is estimated to be over $1 billion by 2023.

This is not to say that humans will lose their jobs to RPA; instead, it will give employees time to work on more complicated and higher-order work. Work like launching innovative and creative marketing campaigns and attending to queries related to their speciality.

Reshaping Operations Management Through RPA

- Customer Onboarding: In Financial institutions, customer onboarding is one of the first processes that is carried out. This process involves a complex and manual verification of numerous identity documents from the clients. Also, because Know-Your-Customer (KYC) is an integral part of the onboarding process, it entails assisting customers in validating those documents, thereby taking up a lot of time and effort.

A recent survey by Thomson Reuters shows that the cost of running KYC compliance and customer due diligence can be high, ranging from US$52 million a year (for a bank) to approximately US$384 million. Suppose RPA in line with AI is implemented in a BFSI company. In that case, it can simplify this process by automatically picking up the information from the KYC document and then matching it with the multiple data fields in different forms across the application with Optical Character Recognition (OCR) technology. This automation will help remove all manual errors and save the employees time and effort.

- Fraud Detection and Anti-money Laundering (AML): It is challenging for banks to keep track of all transactions to identify fraudulent ones. Automation of Anti-money laundering is exceptionally a massive relief for the banking industry. Before RPA came into existence, investigating AML took about 30 to 45 days to investigate a single case depending on the complexity and availability of information in varying applications. But now, with the emergence of RPA, these recurring and rule-based tasks can be easily automated, enabling over a 60% reduction in the process turnaround time. A recent report by Booz Allen Hamilton states that AML analysts spend only 10% of their time on analysis. The majority of their effort, about 75%, goes into data collection, and the other 15% goes into data entry and organisation. In real-time, RPA monitors any transaction and can single out any fraudulent pattern, thereby reducing the delay in response. RPA can also hinder fraudulent activities and situations by blocking accounts and stopping transactions.

- Automated Report Generation: Fraudulent activities are constantly occurring in the BFSI industry, both locally and globally, and as a result, creating Suspicious Activity Reports (SAR) is a standard. Many banks and financial institutions are using RPA to automate manual processes in report generation, which has made them realise a quick return on investment (ROI). In using RPA for Automated Report Generation, a range of activities is carried out, such as optimisation of data extraction, standardisation of data aggregation process, as well as the development of templates for review, reconciliation, and, most importantly, reporting.

- Contact Center Optimisation: COVID-19 made physical interaction with clients very limited, and as a result, banks are faced with a heap load of calls at their contact centers. However, RPA has dramatically helped to alleviate this concern as the use of chatbots has significantly helped to reduce the inbound call traffic and increased profitability in contact centres. Considering the number of queries each contact centre receives daily, implementing the use of RPA will make a huge difference in easing this strain. Chatbots can handle routine customer requests ranging from data management, transaction implementation, optimised services, data modification in the system, and frequent calls. In contrast, the proposition that needs human intervention is escalated to the appropriate subject matter experts (SMEs). In a recent report on Nanonets, RPA technologies can reduce a customer care agent’s time spent on typical processes activities by up to 40% by 2027.

- Loan Processing: According to Government Computer News (GCN), RPA is set to take the BFSI industry by storm with its ability to reduce the loan processing time by 80%. Loan processing is a tedious and complicated task and the most pivotal process in lending. It involves the manual process of collecting information from paper documents, emails, fax, or other online portals, followed by a 360-degree screening for completeness, background review, and credit check of the applicant. Sometimes this process of getting information is inaccurate, and unfortunately, loan officers get it wrong because they rely on this information to process loans. However, with the implementation of RPA in the loan processing system, the end-to-end processing of loans, from loan origination, screening, and validation to loan management, has been wholly or partly automated. Now, loan officers handle loan processing and underwriting in about 15 minutes.

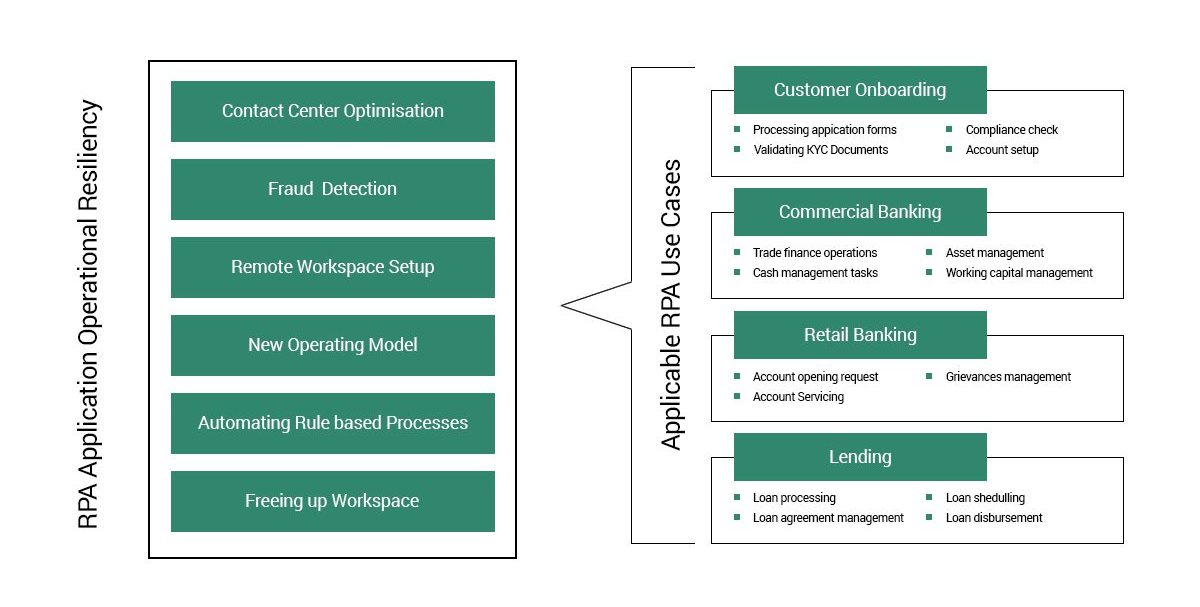

There are many processes in which RPA is used in financial institutions, in addition to the ones explained above. However, the diagram below shows an overview of most of the numerous processes that use RPA in the banking industry.

In conclusion, the implementation of RPA in the banking industry is snowballing. Any company that has not incorporated RPA in most of its processes needs to consider this urgently. With the wave caused by the pandemic, the BFSI is continuously exploring options to optimise costs and grow revenue. RPA is vital in driving the cost optimisation and digitisation agenda.

Written by:

Ogonna Okorie

Senior Analyst