Across Nigeria’s public and private sectors, the pressure to improve accountability, transparency, and performance has never been greater. Governance, Risk, and Compliance (GRC), alongside adherence to ISO standards, remain critical for organisations navigating complex regulatory frameworks and safeguarding institutional integrity. Yet, despite the proliferation of compliance frameworks, manual and semi-automated systems continue to hinder efficiency, leaving room for inconsistency and operational risk.

Recent data from the Standards Organisation of Nigeria (SON) reveals that fewer than 30 per cent of Nigerian manufacturing firms are certified to internationally recognised ISO standards, primarily due to the high cost and procedural delays associated with compliance audits. Meanwhile, in a 2023 study by NOI Polls, 62 per cent of surveyed businesses in Lagos, Abuja, and Port Harcourt acknowledged that inadequate monitoring systems and data management tools were significant obstacles to sustaining compliance with corporate governance standards.

As regulatory expectations increase, fuelled by local reforms and global trade requirements, organisations must rethink traditional approaches to compliance. Artificial Intelligence (AI), blockchain, robotic process automation (RPA), and other emerging technologies are no longer futuristic buzzwords. They are powerful tools that transform compliance from a reactive task into a proactive and intelligent function. In Nigeria’s financial sector, for instance, the Central Bank of Nigeria’s regulatory sandbox has already encouraged the adoption of AI-driven regulatory technology solutions, enabling real-time monitoring and enhanced decision-making across institutions.

This article explores how AI and other emerging technologies are revolutionising GRC and ISO compliance in Nigeria, not just by improving accuracy and speed, but by redefining what it means to be compliant in an era of digital transformation.

Key Trends Driving Change in GRC and ISO Compliance in Nigeria

1. Increased Regulatory Complexity: In Nigeria, regulatory landscapes are becoming increasingly complex as government agencies and industry regulators introduce new policies to address emerging challenges in cybersecurity, financial transparency, and data protection. Laws such as the Nigerian Data Protection Act (NDPA) and sector-specific guidelines from institutions like the Central Bank of Nigeria (CBN), the Nigerian Communications Commission (NCC), and the Securities and Exchange Commission (SEC) have added multiple layers of compliance requirements.

Organisations are now expected to demonstrate a more structured and dynamic compliance posture, particularly in fintech, manufacturing, and oil and gas industries. In response, businesses are beginning to explore automated tools for real-time policy tracking and compliance adaptation to remain competitive and avoid regulatory sanctions.

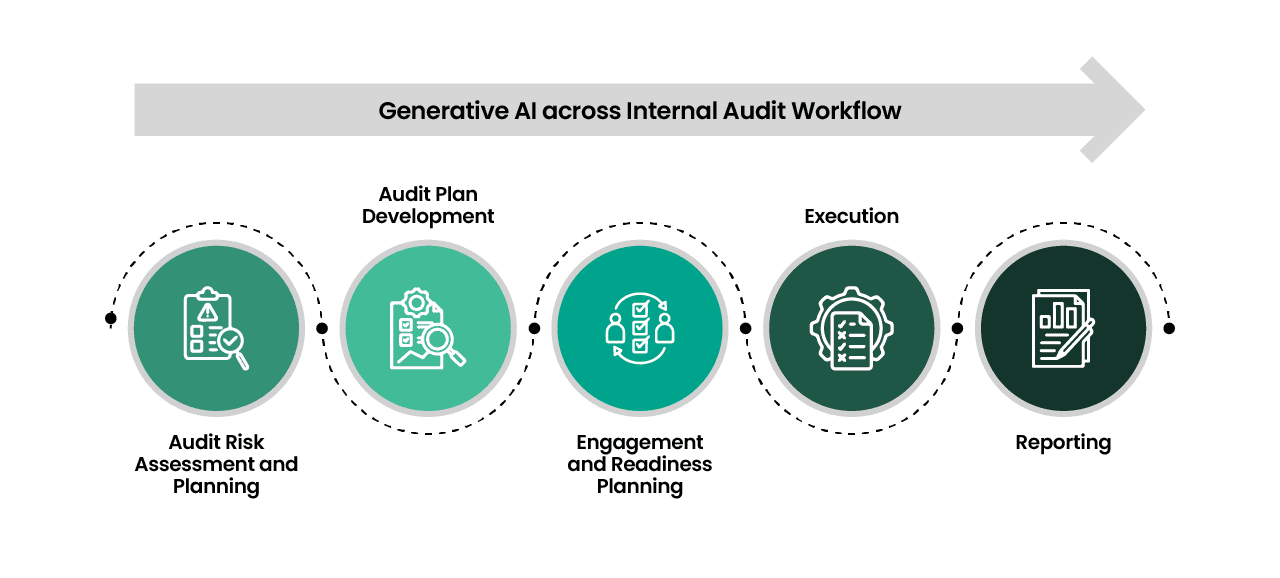

2. AI and Automation: Artificial Intelligence is beginning to reshape how Nigerian organisations approach GRC functions. From compliance monitoring to risk assessment, AI tools offer the ability to automate regulatory intelligence, reducing the dependency on manual processes. Several Nigerian financial institutions have integrated AI-driven systems that track policy changes from the CBN and other regulators, triggering automated internal controls and procedures adjustments. This automation improves audit preparedness and enables faster, more data-driven decisions. With rising scrutiny from regulators and investors alike, organisations recognise that AI adoption is no longer optional but a strategic imperative for compliance resilience.

3. Big Data and Analytics: The volume of operational, transactional, and regulatory data available to Nigerian enterprises continues to grow, especially in sectors such as telecommunications, banking, and e-commerce. Leveraging big data through AI-powered analytics allows organisations to identify compliance vulnerabilities, track emerging risks, and generate actionable insights. For instance, predictive analytics is increasingly used by Nigerian banks to forecast fraud risks and by health sector firms to anticipate potential regulatory breaches. This capability to analyse large datasets in real time strengthens risk management frameworks and minimises the likelihood of financial or reputational damage.

5. Cloud Computing and Blockchain: As digital transformation accelerates across Nigeria, cloud computing has become central to GRC implementation. Organisations are migrating to cloud-based platforms that enable secure, centralised storage of compliance data, support remote audits, and facilitate continuous monitoring. These systems are especially relevant in multi-location organisations and government parastatals where traditional documentation methods are inefficient. Additionally, blockchain is emerging as a promising tool for compliance due to its immutable record-keeping features. Nigerian logistics and supply chain startups are exploring blockchain to enhance transparency and accountability. At the same time, smart contracts are being piloted to automate regulatory reporting and enforce contractual obligations.

(ScienceDirect.com – Blockchain technology for bridging trust, traceability and transparency in the circular supply chain – https://images.app.goo.gl/5Bc6twKyFKkMhjMU8)

Practical Applications of AI in Nigerian Compliance Systems

Artificial Intelligence is no longer an abstract concept within Nigeria’s regulatory and business environment. As organisations confront rising regulatory obligations and increasing pressure to demonstrate compliance maturity, AI is delivering practical, scalable solutions across sectors.

1. Real-Time Regulatory Monitoring

One of the most significant applications of AI in the Nigerian compliance landscape is tracking regulatory changes across multiple jurisdictions. Numerous agencies, such as the Central Bank of Nigeria (CBN), National Information Technology Development Agency (NITDA), Nigerian Electricity Regulatory Commission (NERC), and Nigerian Communications Commission (NCC), issue frequent policy updates, so organisations often struggle to stay informed. AI-powered tools can monitor regulatory bulletins, classify changes by relevance, and automatically notify compliance officers, allowing for faster implementation of internal adjustments.

2. Automated Risk Assessment and Control Testing

In finance and oil and gas sectors, where regulators closely monitor operational and environmental risks, AI systems are deployed to assess risk exposure in real time. Machine learning models can analyse historical data to detect patterns indicative of non-compliance, equipment failure, or operational anomalies. These systems can also conduct automated control tests, ensuring that internal processes remain aligned with compliance frameworks based on local laws or ISO standards such as ISO 27001 (information security) or ISO 9001 (quality management).

3. Intelligent Audit Preparation

Preparing for audits remains a resource-intensive activity for many Nigerian businesses. AI simplifies this process by organising and validating documentation, flagging inconsistencies, and generating audit-ready reports. Some Nigerian financial institutions and fast-moving consumer goods (FMCG) companies have integrated natural language processing tools that extract key compliance narratives from large volumes of operational data, reducing preparation time and enhancing accuracy.

4. Fraud Detection and Anti-Money Laundering (AML)

With the growing sophistication of financial crimes, especially within the digital banking and payment sectors, AI is playing a pivotal role in fraud detection and anti-money laundering efforts. Nigerian fintechs and commercial banks employ AI models that learn from transaction histories to identify suspicious patterns and trigger alerts. These tools support compliance teams by enhancing investigative capabilities and ensuring adherence to CBN’s AML and Know Your Customer (KYC) regulations.

5. Enhancing Data Privacy and Protection

Following the enactment of the Nigerian Data Protection Act (NDPA), organisations are under renewed obligation to safeguard personal data. AI-driven systems can support compliance by identifying personal data across systems, enforcing access controls, and monitoring data usage in line with NDPA requirements. These tools also aid in responding to data subject access requests and breach reporting, ensuring timely compliance with statutory obligations.

Challenges and Ethical Considerations of Adopting AI in GRC and ISO Compliance

While integrating Artificial Intelligence into Governance, Risk, and Compliance (GRC) and ISO frameworks offers significant advantages, it also presents several challenges and ethical considerations that must be addressed to ensure its sustainable and responsible adoption in Nigeria.

1. Data Quality and Infrastructure Limitations

One of the foremost challenges facing Nigerian organisations is the inconsistent quality and availability of structured data required to train AI systems effectively. Many institutions rely on outdated or fragmented data storage practices, particularly in the public sector and small and medium-sized enterprises (SMEs). Without access to reliable, clean, and comprehensive datasets, AI tools may generate inaccurate insights, increasing the risk of compliance failure rather than mitigating it. Inadequate digital infrastructure and limited access to cloud computing services compound this issue, particularly outside major urban centres.

2. Skills Gap and Change Management

Implementing AI-driven compliance systems requires specialised expertise in data science, machine learning, cybersecurity, and regulatory frameworks. In Nigeria, the shortage of qualified professionals in these fields poses a significant barrier to adoption. Organisations must also contend with internal resistance to change, particularly where traditional compliance methods are deeply entrenched. Without adequate training and change management strategies, employees may be reluctant to trust or use AI tools, limiting their effectiveness.

3. Cost of Adoption

The financial outlay required to deploy and maintain AI-enabled compliance systems can be prohibitive for many Nigerian businesses, especially those operating with limited budgets. The costs associated with procuring software, customising solutions, training staff, and upgrading digital infrastructure may deter organisations from investing in such technologies, despite the long-term benefits. There is also a concern that the digital divide may widen if only large corporations and multinationals can afford advanced compliance solutions.

4. Algorithmic Bias and Fairness

AI systems are only as objective as the data on which they are trained. If historical data contains biases, AI models may inadvertently reinforce discriminatory practices or produce unfair outcomes. This is particularly relevant in regulatory environments involving human resources, customer service, or credit scoring. For example, a flawed algorithm used in an internal audit could flag specific departments or individuals unfairly, raising ethical and reputational concerns.

5. Data Privacy and Security Risks

As organisations collect and process large volumes of sensitive data using AI tools, the risk of unauthorised access, data breaches, or misuse increases. In Nigeria, where data protection regulations are still evolving, the deployment of AI must be carefully aligned with the Nigerian Data Protection Act (NDPA) and international best practices. Ensuring that AI systems comply with privacy principles such as data minimisation, purpose limitation, and user consent is essential to maintaining public trust and regulatory compliance.

6. Accountability and Transparency

One of the critical ethical concerns in AI adoption is the challenge of accountability. In a compliance breach or regulatory infraction, determining whether the fault lies with the human operator, the AI system, or the data inputs can be difficult. This ambiguity poses risks not only for legal liability but also for organisational governance. Nigerian regulators may increasingly demand explanations of how automated decisions are made, pushing organisations to ensure that AI systems are explainable and auditable.

How can AI Technologies in GRC and ISO Standards in Nigeria be effectively implemented?

Implementing AI technologies in GRC and ISO standards involves a careful, structured approach. Here’s how organisations can do it:

1. Conduct a Compliance Readiness Assessment

Before adopting AI, organisations must evaluate their compliance structure, IT infrastructure, and data maturity.

- Assess Internal Controls: Review existing compliance mechanisms, risk registers, and audit trails.

- Evaluate Data Quality: Determine the availability, accuracy, and consistency of structured data necessary to train AI models.

- Understand Regulatory Requirements: Align assessments with relevant Nigerian laws such as the Nigeria Data Protection Act (NDPA) and sector-specific regulations from bodies like NAICOM, CBN, or SEC.

2. Build a Clear AI Compliance Strategy

A successful implementation begins with a well-defined strategy that outlines:

- Compliance Goals: What problems will AI solve? Examples include automating policy updates, monitoring for fraud, or streamlining audit processes.

- Use Cases: Select AI use cases with quick wins, such as real-time transaction monitoring or vendor due diligence automation.

- Regulatory Mapping: AI is used to map regulatory obligations from Nigerian regulations and ISO standards like ISO 27001 (Information Security), ISO 31000 (Risk Management), and ISO 37301 (Compliance Management Systems).

3. Invest in Local Talent and Training

Given Nigeria’s skills gap in data science and AI, capacity building is essential.

- Train Internal Teams: Offer certified training in AI for compliance, ethical AI governance, and ISO standards.

- Partner with Local Institutions: Collaborate with Nigerian universities and AI research centres like Data Science Nigeria to build tailored training programmes.

- Encourage Interdisciplinary Learning: Ensure legal, IT, audit, and operations teams understand AI capabilities in GRC.

4. Choose Scalable and Localised AI Solutions

Deploy cloud-compatible AI tools, which are low-code and designed to suit Nigerian organisations’ budget and technical capacity.

- Cloud Deployment: Use Nigerian-based cloud service providers or regional data centres for data residency compliance.

- Local Vendors: Explore partnerships with Nigerian or African AI vendors who understand local nuances.

- Customisable Tools: Opt for AI platforms that can be integrated with your existing compliance tools, ERP systems, and audit software.

5. Strengthen Data Governance and Cybersecurity

Robust data governance is essential for trustworthy AI systems in compliance.

- Data Classification and Labelling: Ensure sensitive data is appropriately labelled and secured.

- Encryption and Access Controls: Align with ISO 27001 requirements for information security management.

- Auditability and Traceability: Ensure every AI-generated decision is logged and explainable.

6. Implement Pilot Programmes with ISO Benchmarks

Start small, test thoroughly, then scale.

- Pilot Projects: Begin with a department (e.g., internal audit or procurement) and automate one ISO-related process.

- Measure Against ISO KPIS: Evaluate improvements in accuracy, time efficiency, and regulatory reporting based on ISO-defined performance indicators.

- Iterate and Improve: Use feedback from pilot results to optimise the technology for full-scale rollout.

7. Establish Ethical Oversight and AI Governance

Nigerian businesses must prevent misuse and build trust in AI systems.

- Form an Ethics Committee: Include IT, the compliance officer, HR, and external legal advisors.

- Adopt Ethical AI Frameworks: Ensure AI tools are fair, explainable, and free from bias.

- Comply with Local Data Laws: Regularly audit AI practices for compliance with the NDPA and similar global standards, such as GDPR, where applicable.

8. Engage with Regulators and Industry Networks

To ensure long-term success:

- Collaborate with Regulators: Proactively engage with NITDA, NCC, and NCC’s Emerging Technologies Department to align regulatory expectations.

- Participate in Industry Working Groups: Engage with groups like the Standards Organisation of Nigeria (SON) and the ISACA Abuja or Lagos chapters to influence AI policy and best practice development.

- Advocate for Policy Reform: Join the conversation on developing national AI ethics guidelines and compliance technology incentives.

Conclusion

Integrating AI and other emerging technologies into GRC and ISO compliance frameworks presents significant opportunities for organisations to enhance efficiency, accuracy, and risk management. However, these benefits come with challenges like data privacy risks, regulatory uncertainty, and algorithmic biases. Organisations must adopt a strategic approach, leveraging AI-powered tools while maintaining ethical AI governance and robust data protection measures. By doing so, they can ensure sustainable compliance, minimise risks, and capitalise on AI’s transformative potential in governance and compliance.

pcl. helps organisations adopt AI for GRC and ISO compliance by assessing readiness, mapping regulatory needs, and developing tailored strategies. We also support tool selection, build internal capabilities, and establish ethical AI governance to ensure efficient, risk-aware, and future-proof compliance systems. Ready to transform your compliance strategy with AI? Let pcl. guide your journey. Reach out today at enquiry@phillipsconsulting.net to get started.

Written by:

Charles Kogolo

Consultant