Open banking is a practice that provides third-party financial service providers open access to consumer banking, transaction and other financial data from banks and non-bank financial institutions using Application Programming Interfaces (APIs). As the technological revolution continues, it has facilitated a progressive opening and reshaping of the banking industry.

Open Banking has drastically altered the way corporations and individuals manage their data and money, leading to the improved transparency and democratisation of the financial services market. Breaking into the banking industry used to be a significant hurdle for new, innovative fintech and financial service providers. Now, Open Banking makes it, more or less, an equal playing field between the traditional big banks and new fintech and financial service providers on the truism that the banks do not own the data they collect; the customers do. The customers can decide how that data can be used. Thus, Open Banking promotes competition in banking and other financial services and puts the power of financial data back into the customers’ hands, transforming the landscape of the banking industry as we know it.

How Does Open Banking Work?

Open Banking is a system in which customers’ financial data can be shared between third-party applications and banks at their request. With Open Banking, users can completely view their financials across different banks, move funds around at will, make payments, and find better deals on interest rates, credit facilities, and more.

None of this will be possible without APIs, which allow data to flow between users, applications, and service providers in a safe, secure way. Think of APIs as intermediaries or middlemen between the banks and third-party financial applications, facilitating communication between different applications. Open Banking APIs enable Third Party Providers (TPPs) to aggregate and present all this data in a simple and easy-to-navigate user interface for customers.

We can draw a parallel between travel websites and Open Banking platforms at the most basic level. Travel websites provide a central platform that gives travellers a quick and easy comparison of ticket prices, schedules, and itineraries across several airlines at a glance, allowing travellers to select the best travel options for themselves. Similarly, Open Banking platforms, in one place, provide information on various payments and remittance services, collection and disbursement services, credit, mortgage, interest rates, and other financial services. This allows for a better customer experience and smarter money management as the financial world is open to customers. They can choose from a variety of personalised financing options that best meet their needs instead of being limited to ‘one-size fits all’ financial options provided by traditional banks.

Adoption And Regulation

In recent years, open Banking has seen increased adoption in developed countries, with the United Kingdom taking the lead. A Centre for Economics and Business Research (CEBR) study estimates that Open Banking could boost UK GDP by £1 billion annually. Business Insider Intelligence estimates the revenue potential in the UK made through Open Banking-enabled small and medium-sized businesses (SMBs) and retail customer propositions to reach $2 billion by 2024 – a 25% compound annual growth rate (CAGR). Statista – a market leader in providing market and business data, shows that in 2020, over 24 million individuals worldwide used Open Banking services. This number is forecasted to reach over 130 million users by 2024. This shows that Open Banking has many potentials to improve the financial services and banking sectors and the country’s economy.

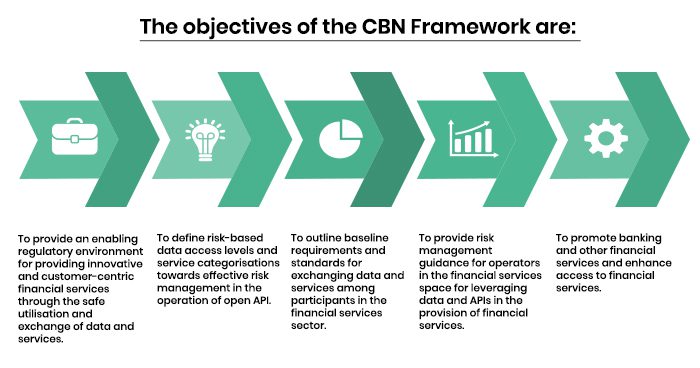

With these prospects, it is of little wonder why the Central Bank of Nigeria (CBN), in February 2021, issued the Regulatory Framework for Open Banking in Nigeria in response to the growing adoption and integration of banks and other financial institutions. This framework fosters the sharing and leverage of customer-permission data by banks and Third Party Providers (TPPs) to build solutions and services that provide efficiency, greater financial transparency, broad options for account holders, and enhance access to financial information services in the country.

The opportunities offered by Open Banking for boosting financial inclusion, enhancing competition in the financial services space, and promoting better, more personalised financial services to consumers are convincing cases for the implementation of Open Banking in Nigeria.

It Takes Two To Tango

With the demand for financial services increasing, traditional banks constantly face fierce competition from fintech. However, Open Banking offers them the opportunity to partner instead of competing with them. Open Banking builds on current systems and leverages the customer data in the custody of traditional banks to offer better services. This can increase revenue streams and expand customer reach for both parties. A revenue-sharing ecosystem can be created whereby traditional banks give their customers access to services developed by TPPs while profiting from a subscription or referral basis. Additionally, Open Banking provides an opportunity for traditional banks to commercialise their data – in accordance with relevant privacy regulations such as the Nigeria Data Protection Regulation (NDPR) and the General Data Protection Regulation (GDPR), and infrastructure by moving into the Banking as a Service (BaaS) domain and providing core services to fintech and other TPPs looking to make use of and benefit from customers’ financial data.

For the objectives of Open Banking to be achieved, the support and collaboration of incumbent or traditional banks and new players such as fintech are essential to take the financial services industry to new heights. Open Banking is on track to be truly groundbreaking for traditional banks, their fintech partners and billions of banking customers worldwide.

At pcl., we help banks implement and review Open Banking systems and practices per CBN’s Regulatory Framework for Open Banking and UK’s Open Banking standard. These standards enable banks to implement systems and processes aligned with Open Banking best practices, identify nonconformities and develop corrective action and improvement plans to optimise their Open Banking capabilities. In addition, we offer technology consulting services and products from Cybersecurity, Data Analytics, Standards & Compliance, and Training. Do reach out to us!

Written by:

Ikenna Ndukwe

Assistant Consultant