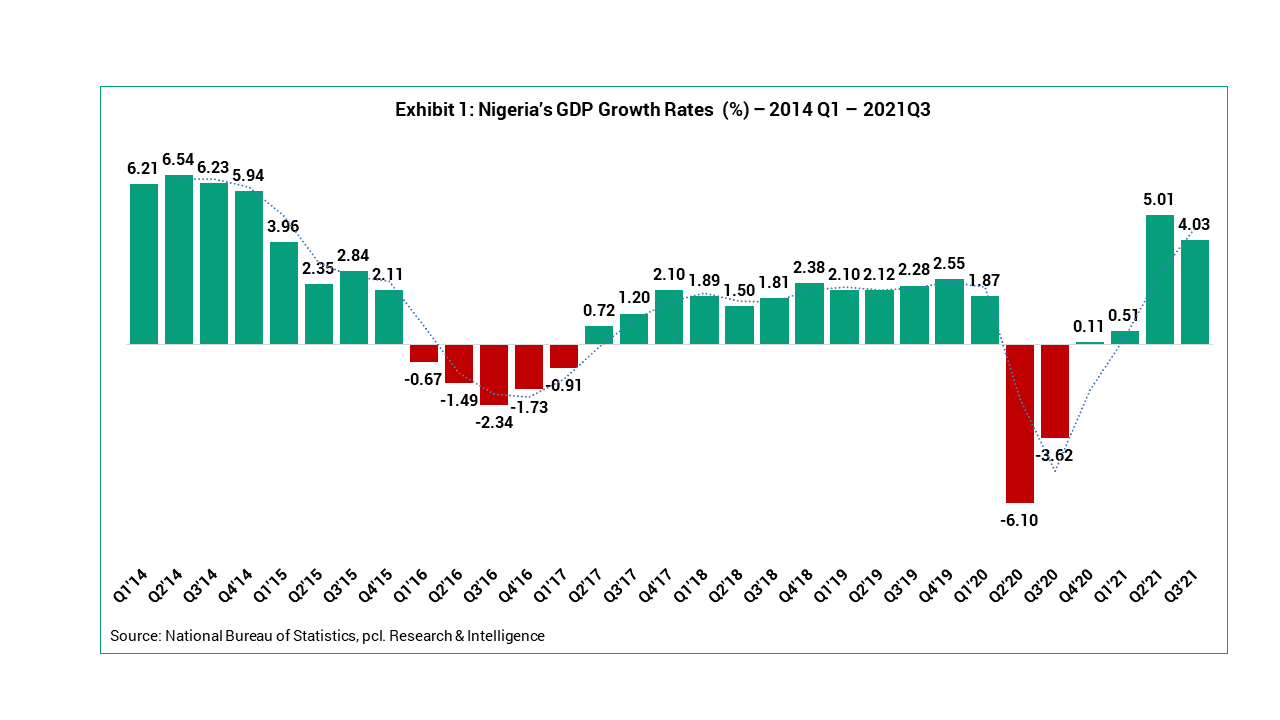

The Nigerian economy has continued to recover steadily from the historic downturn printed in 2020, attributable to increased vaccine rollout bolstering consumer confidence and stimulating economic activities. According to the report recently published by the National Bureau of Statistics, the country’s GDP grew at 4.07% (YoY) in the third quarter of 2021 (Q3’21), up from 5.36% in the previous quarter and -3.14% in Q3’20.

While the country’s growth slowed down in Q3’21 as the high base effect continued to wane, the growth rate printed in Q3’21 was stronger than most analysts’ forecasts. Recall, in Q2’21, output rose by 5.4% (y-o-y), mainly reflecting base effects from transport and trade sectors and continued strong growth in the IT sector. According to the World Bank and IMF, the Nigerian economy is expected to grow at 2.7% and 2.6% in 2021. The strong growth posted in the past two quarters indicates that business and economic activity are inching towards the pre-pandemic level.

Recovery Through the Non-Oil Sector

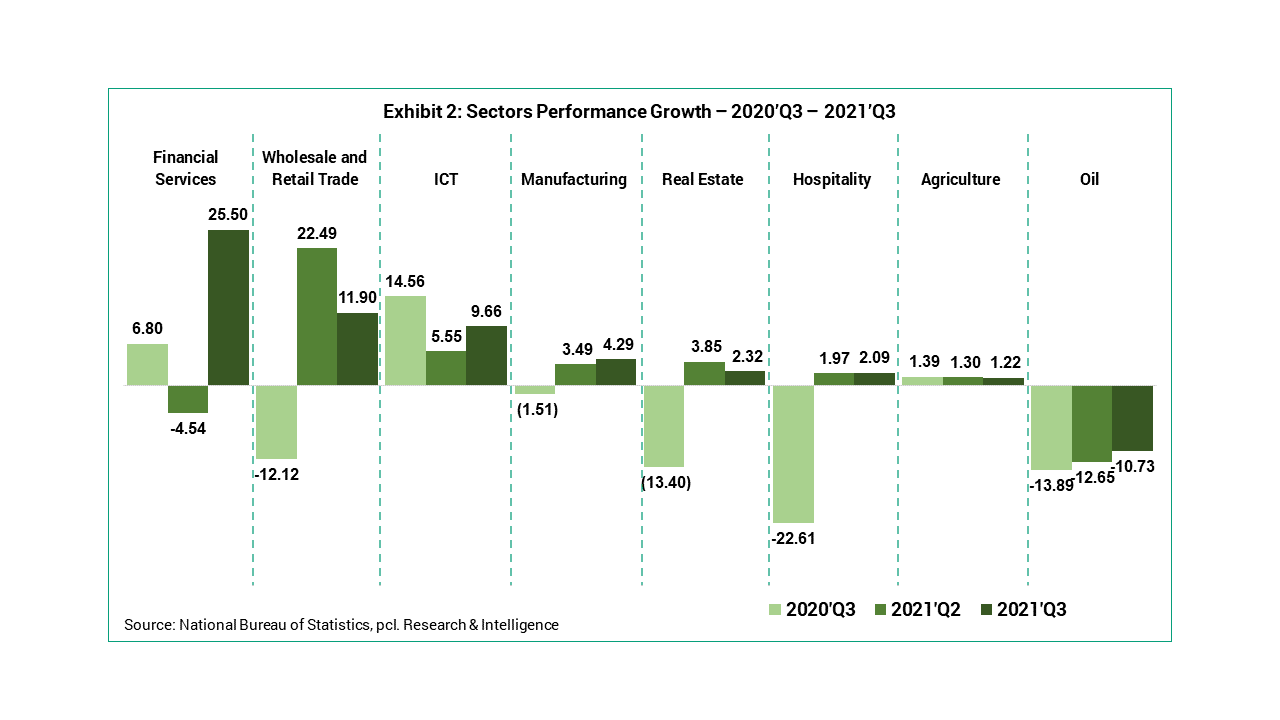

Buoyed by the easing lockdown measures and government pro-growth policy support and interventions, the non-oil sector continues to drive the economy on the path of recovery. In Q3’21, the non-oil sector printed an impressive 5.44% growth, up from -2.52% in the corresponding period of 2020. Broad sector breakdown performance shows that the service continues to move in a positive trajectory, driven by a strong rebound in the financial services and ICT sector. The financial sector rebounded in Q3’21, printing a growth of 25.5% on the back of increased money in circulation. After contracting in the previous quarter, the ICT sector rebounded with a growth of 9.66% during the quarter. Other non-oil sectors that posted grew in the quarter include manufacturing (4.29%), construction (4.10%), Arts and Entertainment (3.68%) and Hospitality (2.09%).

Instructive to note that in Q3’21, the Manufacturing sector posted its highest GDP quarterly growth rate since 2014. During the quarter, the sector grew at 4.29% compared to 3.49% in the previous quarter. The growth momentum sustained in the manufacturing sector is traceable to reopening the country’s land borders, buoyed by improved business and economic activities.

However, quarter-on-quarter, the non-oil sector slowed down slightly compared to the 6.74% growth posted in the previous quarter. Notably, the slow-down in the non-oil sector was driven by sectors including Agriculture, Real Estate Trade, Road Transport. For instance, the agriculture sector recorded a modest growth of 1.22% in Q3’21 from 1.30% in Q2’21. The lower-than-expected growth recorded in the agriculture sector is driven by rising insecurity in key farming areas in Nigeria’s northern and central states and shrinking consumer purchasing power. Other Non-oil sub-sectors that slowed in Q3’21 include trade (11.90%), transportation (20.61%), real estate (2.32%) and professional services (1.11%).

Oil Sector – A Subdued Growth

Growth in Nigeria’s oil sector is subdued and has continued in a negative trajectory. During the last quarter, the oil sector (responsible for 88.7% of exports in 2020) saw a 10.7% y-o-y contraction in Q3’21, largely because of weakening oil production, which fell 6.0% y-o-y to 1.57mn b/d due to OPEC+ restrictions and limited investment in production infrastructure.

According to the U.S Energy Information Administration (EIA), global energy demand has eclipsed the pre-pandemic level, estimated at 98.59 million barrels per day in Q3’21. Forecast from EIA also showed crude oil price (Brent) would remain strong in the fourth quarter of the year on the back of global oil consumption currently outpacing the supply. However, sustained OPEC+ production restrictions for member countries continue to neutralise expected gains for the country.

Notably, the upstream production is expected to remain hamstrung by OPEC+ production for the bulk of 2021. The OPEC+ group intends to continue reducing the production curbs until they reach zero, currently forecast in September 2022.

Muddling Through a Fragile Outlook

Nigeria’s economy is expected to print a modest recovery through the year-end. However, the outlook for 2022 remains fragile on the back of subsisting pressure points.

FX Pressure

The “big elephant in the room”, as many analysts describe it.

Despite the ongoing unification effort by the policymaker, the FX policy environment remains under pressure. Given the advantage of the current global conditions, improving current accounts and robust oil prices, efforts must be accelerated to unify the rates. According to the recent Article IV released by the IMF, the continued dependence of Nigeria on administrative measures to address FX shortages underscore uncertainties and increases the risks of a sudden and large adjustment in the exchange rate.

Inflationary Pressure

Nigeria’s inflation rate has continued to decelerate in recent months. In October 2021, headline inflation dropped further to 15.99% from 16.63% recorded in September 2021. This indicates that the headline inflation rate has now declined for a straight 7-month. However, given the implementation of cost-reflective electricity tariffs, FX rate adjustment, pending subsidy removal, and insecurity (farmer-harder crisis), inflation is projected to remain double-digits, further stoking consumer purchasing power.

Financing the Budget

Nigeria recently passed a 16.39 trillion-naira budget appropriation expenditure, with a deficit of 6.26 trillion naira. Meanwhile, with a revenue target for the 2022 budget estimated at N8.4 trillion, it implies that the fiscal deficit (the gap between income and spending) stood at a whooping N6.3 trillion (3.39% of GDP). The budgetary deficit slightly above the 3% threshold set by the Fiscal Responsibility Act 2007 constitutes a major pressure point for implementing the 2022 budget.

Lingering Fuel and Electricity Subsidy

The lingering fuel and electricity subsidies continue to stoke pressure on the government financing capacity. As the economy recovers, fuel subsidies must be removed to a market-based pricing mechanism stipulated in the 2021 Petroleum Industry Act. In addition to this, the quick implementation of cost-reflective electricity tariffs scheduled for January 2022 is encouraged.

On the upside, the economy will be supported by implementing the landmark Petroleum Industry Act, which is expected to unlock opportunities in the oil sector in the coming quarters, resulting in higher output and stronger growth in fixed investment and exports.

Socio-Political Landscape

Investment climate is pressured, exacerbated by heightened insecurity across the country. In the first half (H1) of 2021, Nigeria’s foreign direct investment inflow was estimated at 232.74 $million compared to $362.84 million in 2020, implying a 36% decline.

Like other sub-Saharan African countries, insecurity, uncertain political climate, and deteriorating security situation in Nigeria will continue to significantly shape the recovery in domestic demand, investment, and long-term economic growth.

Written by:

Samuel Bamidele

Head, Research and Intelligence