As Nigeria embarks on a new fiscal year, the government has unveiled an ambitious economic agenda encapsulated in the 2025 budget, aptly titled the “Budget of Restoration: Securing Peace, Rebuilding Prosperity” This fiscal roadmap addresses pressing challenges such as economic stagnation, high inflation, and unsustainable debt levels while fostering an enabling environment for sustainable growth.

As Africa’s largest economy by GDP, Nigeria faces the dual burden of recovering from the global pandemic and mitigating the impact of volatile oil prices, its primary revenue source. These challenges underscore the need for a transformative fiscal policy framework in 2025.

The approved budget, valued at ₦54.99 trillion, reflects a commitment to reposition Nigeria’s economy on a path of sustained growth. This figure represents a significant increase from the initially proposed ₦47 trillion, highlighting the government’s responsive adjustments to emerging economic realities. However, this expansion also underscores the monumental task ahead as the government grapples with a projected deficit of ₦13.08 trillion, equivalent to 3.89% of GDP. Addressing this shortfall will require innovative revenue mobilisation strategies and disciplined expenditure management. With inflation hovering at double digits and the naira under immense pressure, the 2025 fiscal policy aims to balance economic growth with fiscal stability.

Revenue Generation: Enhancing Fiscal Capacity

Building on its fiscal goals, the government has prioritised revenue generation as a cornerstone of economic recovery. Lessons from global success stories, such as Brazil’s structural reforms, highlight the need for diversification and efficient revenue collection mechanisms.

Nigeria’s fiscal sustainability journey parallels Brazil’s 1990s economic reforms, where structural adjustments and revenue diversification were pivotal. The government has set an ambitious revenue target of ₦34.8 trillion, prioritising enhanced tax efficiency, restructuring revenue agencies, and diversifying income streams. A key aspect of this strategy is optimising the solid minerals sector to reduce reliance on oil revenues, which accounted for 48% of total revenue in 2024.

Implementing the Petroleum Industry Act (PIA) remains central to this agenda. The Act aims to reform Nigeria’s oil and gas sector by addressing inefficiencies and promoting transparency. Effective implementation is crucial to achieving these objectives. Another critical measure addresses Nigeria’s low tax-to-GDP ratio of 7.9%, which significantly lags behind the Sub-Saharan African average of 16%.

Comparatively, countries like Ghana and Kenya, with ratios exceeding 12%, have successfully leveraged digital taxation frameworks. Nigeria plans to bridge this gap by simplifying tax collection processes, expanding digital platforms, and incentivising compliance through public-private partnerships (PPPs). These measures, while promising, must be balanced with efforts to integrate the informal sector, which constitutes over 60% of the economy, to ensure broad-based growth without economic exclusion.

Public sector reforms must align with private sector innovations and civil society engagement to sustain these initiatives. A transparent monitoring framework will maintain public trust and ensure long-term progress.

To bridge these gaps, the government has outlined several initiatives:

- The government has prioritised Public Financial Management Reforms by implementing Integrated Financial Management Information Systems (IFMIS) to enhance transparency, improve budgeting, and strengthen accountability in public financial operations. This initiative aims to streamline processes, reduce corruption, and ensure more effective use of public funds.

- Regarding Digital Economy Integration, the government is expanding digital payment platforms to support economic growth by improving tax compliance, ensuring better revenue collection, and promoting financial inclusion. This shift towards a digital economy facilitates access to financial services, particularly for underserved populations, and encourages electronic transactions.

- The Social Protection Framework focuses on developing targeted, conditional cash transfer programs to protect vulnerable groups such as low-income households, older people, and children. These programs are designed to reduce poverty, foster economic inclusion, and provide a safety net to those most in need, contributing to overall social stability.

Economic Growth: Building Resilience Amid Challenges

Revenue generation alone will not suffice. The 2025 budget underscores the importance of strategic expenditure to drive inclusive development. The government aims to address pressing challenges by allocating resources to critical sectors while laying the foundation for long-term prosperity.

The 2025 budget allocates ₦4.91 trillion (8.9%) for defence and security, reflecting the urgent need to address ongoing security challenges. Infrastructure receives ₦4.06 trillion (7.4%), targeting energy, transportation, and housing. Education and health, critical for human capital development, receive ₦3.52 trillion (6.4%) and ₦2.48 trillion (4.5%), respectively. Additionally, agriculture, a key sector for food security and economic growth, is allocated ₦0.83 trillion (1.7%) to enhance productivity and sustainability.

While these allocations signal progress, they fall short of the United Nations-recommended benchmark of 15% of national budgets for health and education. Bridging this gap requires increased funding, improved efficiency, and targeted investments to maximise impact.

With a vision to double the economic growth rate from 3.5% to 7% in two years, the government is focusing on stabilising the naira, reducing inflation, and attracting foreign investments. Achieving these ambitious goals requires balancing fiscal stability with economic growth.

Rebuilding investor confidence is vital, especially with Foreign Direct Investment (FDI) declining by 25% in 2024. The government’s reforms to improve the ease of doing business, particularly in non-oil sectors such as technology, agriculture, and manufacturing, are steps in the right direction. Emmanuel Ijewere, Vice President of the Nigerian Agri-business Group, aptly noted, “Unlocking the potential of agriculture and solid minerals is key to Nigeria’s fiscal sustainability.”

Potential Hurdles: Navigating Implementation Challenges

Despite its ambitious goals, Nigeria’s 2025 fiscal policy faces several challenges that could impede its successful implementation. These hurdles stem from systemic governance issues, corruption, and external economic shocks, among other factors.

-

Governance and Institutional Weaknesses

- Policy Inconsistencies: A history of abrupt policy reversals and implementation delays could undermine investor confidence and derail planned reforms.

- Weak Institutional Capacity: Revenue-collection agencies like the Federal Inland Revenue Service (FIRS) and Customs Service often struggle with inefficiencies, outdated processes, and inadequate training.

- Bureaucratic Bottlenecks: Lengthy approval processes and inter-agency conflicts could slow down key projects and discourage private sector participation.

-

Corruption and Financial Leakages

- Revenue Leakages: Corruption in tax collection, customs, and oil revenue management remains a significant challenge. For example, reports of crude oil theft and underreporting of proceeds from the oil sector have consistently affected revenue targets.

- Mismanagement of Funds: Poor oversight and lack of accountability in project execution can lead to the misallocation of resources, undermining the government’s fiscal priorities.

- Lack of Transparency: Limited public access to budget implementation reports and financial audits reduces citizen engagement and hinders the fight against corruption.

-

External Economic Shocks

- Global Oil Price Volatility: As oil revenues still account for a significant portion of government income, fluctuations in global crude prices could disrupt revenue projections and amplify fiscal deficits.

- Exchange Rate Pressures: The depreciation of the naira increases the cost of servicing external debts and importing critical goods, further straining the fiscal framework.

- Global Economic Slowdowns: A downturn in the global economy, such as reduced demand for exports or tighter financial conditions, could limit foreign direct investment and concessional financing opportunities.

-

Socioeconomic and Security Challenges

- Security Instability: Ongoing security issues, particularly in the North-East and North-West regions, could disrupt economic activities and deter private sector investments in agriculture, mining, and manufacturing.

- Public Resistance: Policies such as subsidy removal or tax hikes could face significant pushback from citizens, leading to protests, strikes, or political instability.

- High Unemployment: With unemployment rates remaining high, the government may face difficulties in implementing fiscal policies that are perceived as disproportionately burdening low-income households.

-

Limited Access to Financing

- Debt Sustainability: Nigeria’s high debt servicing costs limit the fiscal space available for capital expenditure and development programs, leaving the government reliant on new borrowings.

- Private Sector Reluctance: Concerns over policy consistency, security, and ease of doing business could deter private sector partners from participating in critical infrastructure projects.

-

Monitoring and Evaluation Gaps

- Ineffective Oversight: Weak mechanisms for tracking budget performance and outcomes make it difficult to assess the effectiveness of fiscal initiatives.

- Data Deficiencies: Inaccurate or outdated data could hamper decision-making and the ability to address emerging challenges effectively.

Addressing these hurdles requires the government to prioritise institutional reforms, enhance transparency, and strengthen stakeholder collaboration. A proactive approach to mitigating these challenges is crucial for the success of the 2025 fiscal policy and its long-term impact on Nigeria’s economy.

Debt Management: Steering Towards Sustainability

The approved 2025 budget allocates ₦14.3 trillion for debt servicing, with a fiscal deficit of ₦13 trillion and a deficit-to-GDP ratio of 1.5%. The government’s debt management strategy includes restructuring existing loans and leveraging concessional financing options to reduce borrowing costs—a cap on new borrowings at ₦13.1 trillion signals a shift towards fiscal discipline. The budget also earmarks ₦14.8 trillion for recurrent expenditure, representing a 19.66% increase from the previous year.

Domestic resource mobilisation will be vital in reducing reliance on external debt. This includes enhancing non-oil revenue streams and improving public expenditure efficiency through digital governance systems.

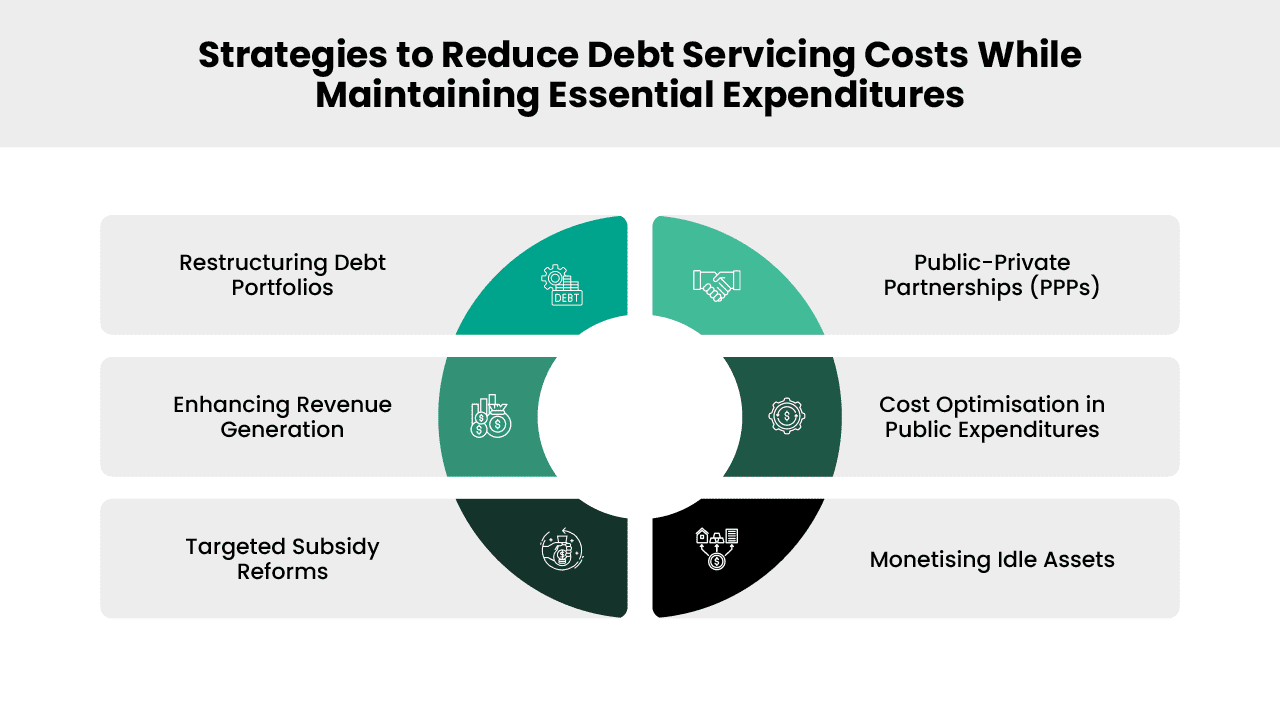

Strategies to Reduce Debt Servicing Costs While Maintaining Essential Expenditures

The rising cost of debt servicing, projected at ₦15.81 trillion in 2025, requires innovative strategies to ensure fiscal sustainability without compromising essential expenditures:

-

Restructuring Debt Portfolios:

- Refinancing high-interest debts with concessional loans from international financial institutions like the World Bank or African Development Bank.

- Extending the maturity profiles of domestic and foreign debts to reduce annual repayment obligations.

-

Enhancing Revenue Generation:

- Expanding non-oil revenue streams through tax reforms and increased efficiency in collection.

- Unlocking revenue potential in underutilised sectors like solid minerals, agriculture, and technology.

-

Targeted Subsidy Reforms:

- Gradually phasing out inefficient subsidies while redirecting savings toward critical development projects and social safety nets.

-

Public-Private Partnerships (PPPs):

- Engaging private sector investors to fund infrastructure and other capital-intensive projects, reducing the need for government borrowing.

-

Cost Optimisation in Public Expenditures:

- Conducting comprehensive audits of government spending to identify and eliminate wasteful expenditures.

- Implementing zero-based budgeting to ensure that every naira spent is aligned with national priorities.

-

Monetising Idle Assets:

- Selling or leasing underutilised government assets to generate immediate revenue for debt servicing.

By combining these strategies, the government can achieve a more sustainable debt structure while maintaining its commitment to social and economic development.

Measures for Fiscal Sustainability: A Roadmap for Stability

To achieve fiscal sustainability, the Nigerian government has outlined several key measures to address the growing debt burden and enhance economic stability:

- Tax Reforms and Enhanced Compliance: Efforts are underway to broaden the tax base and improve compliance, aiming to increase government revenues without imposing additional burdens on citizens. This includes leveraging technology and ensuring equitable taxation.

- Removal of Fuel Subsidies: The government has eliminated longstanding petrol subsidies, redirecting the savings to targeted social programmes such as conditional cash transfers and public transportation initiatives to support vulnerable populations.

- Exchange Rate Unification: Steps have been taken to unify exchange rates, enhancing the credibility of the naira and stabilising the foreign exchange market.

- Budgetary Allocations for Key Sectors: The 2025 budget, termed the “Budget of Restoration,” allocates significant funds to security, infrastructure development, and human capital investment to restore stability and foster inclusive economic growth.

- Debt Management Strategies: The government is establishing public debt-tracking platforms to enhance public confidence and ensure effective debt management. These platforms will be designed to provide citizens and stakeholders with precise, real-time information on debt servicing obligations and how borrowed funds are being utilised. This level of transparency will help mitigate mismanagement risks and promote accountability in public spending, ensuring that funds are used efficiently for growth-oriented projects.

While the fiscal deficit is projected to increase due to factors like the new minimum wage and rising debt service costs, the government plans to finance this through a combination of domestic and external borrowings, as well as public-private partnerships, with a commitment to ensuring that debt servicing does not crowd out investments in critical sectors.

- Regional Economic Integration: Nigeria is leveraging its African Continental Free Trade Area (AfCFTA) membership to expand its export markets and attract foreign investments. By increasing trade with other African nations and improving access to continental markets, Nigeria aims to boost its economic output, diversify its revenue sources, and create job opportunities.

These measures reflect the government’s commitment to addressing fiscal challenges and laying a foundation for sustainable economic growth.

Conclusion: Navigating the Path to Prosperity

Nigeria’s fiscal policy for 2025 reflects a bold attempt to tackle the country’s economic challenges while laying the groundwork for long-term prosperity. By focusing on revenue diversification, expenditure prioritisation, and debt sustainability, the government has demonstrated a commitment to economic resilience. However, success will depend on effective implementation, transparency, and fostering collaboration across public and private sectors.

For Nigeria to truly achieve its fiscal ambitions, policymakers must take decisive steps to ensure accountability, streamline governance, and foster deeper collaboration with private sector investors. Strengthening institutional frameworks, enhancing financial discipline, and promoting inclusive economic policies will be crucial in transforming policy objectives into tangible outcomes.

At pcl., we help organisations achieve long-term sustainability by offering strategic guidance on revenue optimisation, operational efficiency, and effective governance. Through comprehensive assessments, we support businesses and government agencies in implementing best practices for resource management, fostering innovation, and enhancing transparency. By leveraging data-driven insights and facilitating capacity building, pcl. enables organisations to navigate fiscal challenges, improve stakeholder engagement, and adopt sustainable practices that drive growth and resilience.

With the right mix of policies, strategic execution, and stakeholder collaboration, Nigeria can unlock opportunities for its population, cementing its position as Africa’s economic powerhouse and a model for resource-dependent nations.

Written by:

Sunday Kolawole

Analyst

![]()