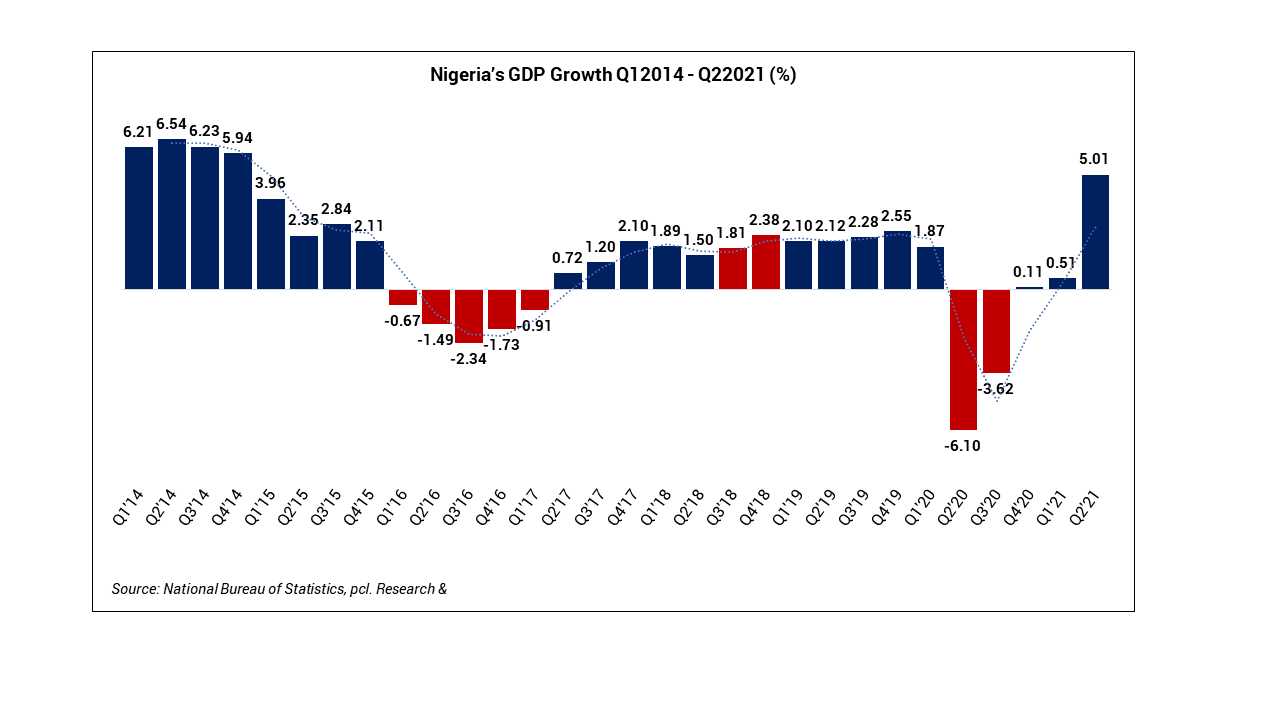

The Nigerian economy printed a surprise rebound in the second quarter of 2021, posting the fastest GDP quarterly growth rate since 2014. According to the report published by the National Bureau of Statistics, the country’s GDP grew at 5.01% (YoY) in the second quarter of 2021 (Q2’21), up from 0.51% in the previous quarter and -6.10% in Q2’20.

The strong growth posted indicates that business and economic activity may have started to near the pre-pandemic level. Recall that in 2020, the global economy slumped into recession on the back of covid-19 pandemic induced lockdown, disruption in trade flow, shut-down in domestic and international flights and restriction in intercity travels.

A cursory look at the report showed that the Nigerian economy might have finally weathered the storm that emanated from twin shocks (covid-19 pandemic and low oil price). According to the World Bank and IMF, Nigeria is expected to grow at 1.9% & 1.5%, respectively, in 2021. Meanwhile, the latest report showed that Nigeria printed 2.76% at the end of H1 2021, indicating a quarterly growth rate sharper than predictions.

Impressive growth across critical Sectors: Oil vs Non-Oil GDP

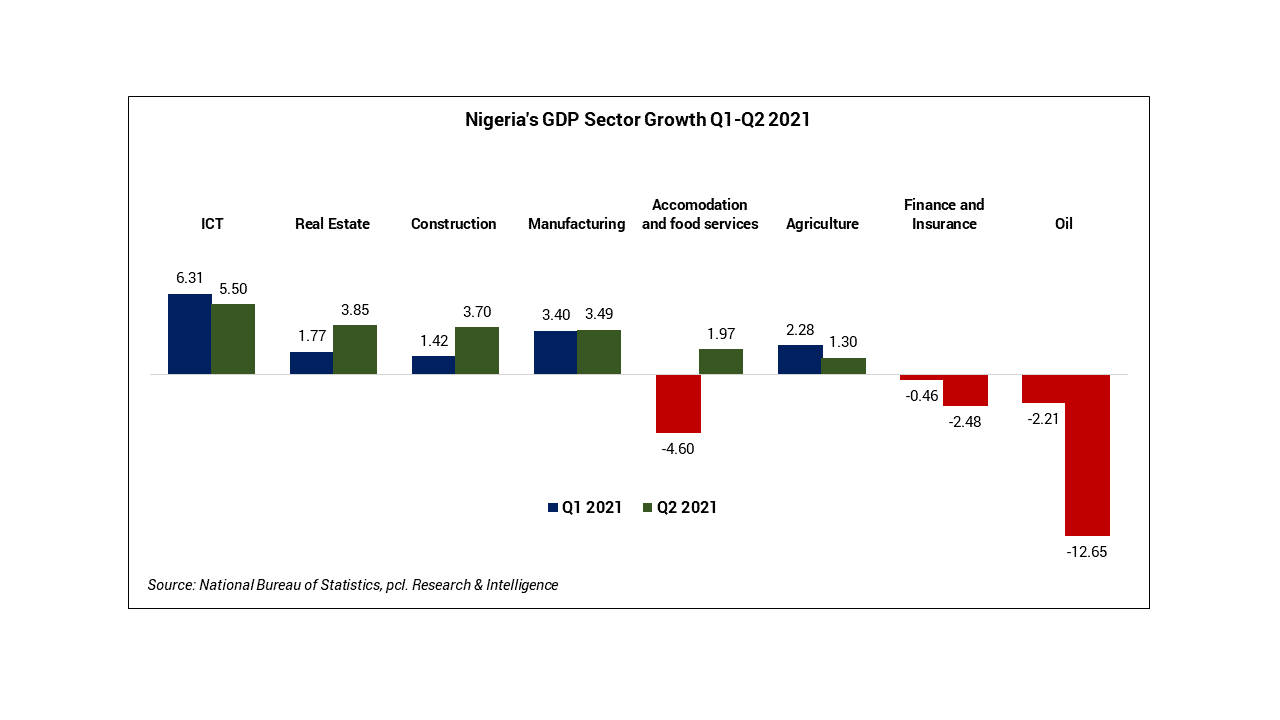

In the first half of 2021 (H1), the growth recorded in the Nigerian economy was driven by impressive performance across critical non-oil sectors, contributing approximately 93% to Nigeria’s GDP. Noticeably, critical sectors strongly hit by covid-19 induced lockdown have started to rebound.

Analysis of the report showed that in Q2 2021, the non-oil sector continued in the positive trajectory, posting an impressive 6.74% growth in Q2 2020, up from 0.76% Q1 and -6.05% in the corresponding period of 2020. Improvement in the non-oil sector suggests that the various government interventions, stimulus packages and economic reforms have started to yield the intended impact.

In the non-oil sector, the trade sector recorded the fastest rebound, printing a growth of 22.49% in Q2 2021 compared to -2.43% in the corresponding period of 2020. The strong growth recorded in the trade sector is traceable to reopening the country’s land borders and improved business and economic activities. Similarly, the ICT sector sustained its strong momentum with a 5.5% growth rate, slightly lower to 6.3% recorded in the previous quarter. The lower-than-expected growth recorded in the ICT sector may be due to the extension of the NIN-SIM verification deadline to October and shrinking consumer purchasing power.

Nigeria’s agriculture sector grew at 1.3%, lower than 2.28% recorded in the preceding quarter, and this is traceable to rising insecurity and planting season. Other non-oil sectors, including manufacturing (3.49%), real estate (3.85%), construction (3.70%) and accommodation and food services (1.97%), posted a positive growth.

Conversely, Nigeria’s biggest revenue source, the oil sector, contracted by -12.65% in Q2 2021, down from -2.21% recorded in the previous quarter. The contraction in the oil sector was largely down to lower oil production on the back of OPEC production cut. Nigeria’s domestic oil production declined to 1.61mbpd in Q2’21 from 1.72mbpd in Q1’21 and 1.81mbpd in Q2’20.

A big leap or masked recovery?

A year and a half since the onset of the COVID-19 pandemic, the global economy is poised to stage its most robust post-recession recovery in 80 years.

In Nigeria, the Q2’21 GDP growth indicates a relatively modest economic recovery, considering the substantial contraction in 2020. However, the seemingly impressive performance or big leap is “masked”, driven by three major factors: intervention policy, reopening of the domestic and global economy and the base year effects.

The intervention policy of the government may have started to yield expected impacts across key sectors. In 2020, on the back of the covid-19 shocks, the Federal Government of Nigeria announced a N500 billion (0.3% of GDP) COVID-19 intervention fund included in the revised budget to channel resources to additional health-related current and capital spending while the Central Bank made a liquidity injection of 3.6 trillion (2.4% of GDP) into the banking system.

Similarly, countries across the globe are gradually removing stringent covid-19 rules and opening their economies on the back of increased vaccination. According to The New York Times covid-19 vaccination tracker, more than 5.18 billion vaccine doses have been administered worldwide, equal to 67 doses for every 100 people. As economies open, Nigeria, like many other countries, inches closer to its pre-pandemic growth level. This is evidenced in Q2’21 GDP, with the trade sector emerging as one of the fastest-growing sectors (22.49%), driven by a combination of improved cross border trade and the reopening of the country’s land border.

Lastly, the Q2’21 growth is significantly linked to the base effect. A base effect is a form of distortion in growth figures resulting from abnormally high or low levels in the corresponding year-ago period. A base effect can make it difficult to assess growth levels over time accurately. With a sharp contraction of -6.1% in Q2’20, Q2’21 is not surprising and is expected to wane in the year’s second half.

Navigating a modest outlook

Nigeria’s economy is expected to print a modest recovery at the end of 2021. While it remains unlikely to actualise the growth rate target of 3% in the 2021 budget, policymakers must address subsisting key pressure points across the following key areas:

Vaccination – The emergence of the covid-19 delta variant constitutes a major pressure point in the Nigerian economy. While another lockdown is not in sight, the low rate of vaccination remains a major risk. According to the report, only 1.2% of the Nigerian population had received at least one dose of vaccine, below regional peers such as Senegal (6.2%), Cote d’Ivoire (4.4%) and Ghana (2.8%).

Policy – The policy environment is still characterised by heterodox policy changes. A major policy within the monetary landscape that constitutes a risk for businesses is the uncertain foreign exchange environment. Despite the CBN’s FX unification drive, the exchange rate premium (NAFEX-parallel market) stands at c.26%, with the attendant FX backlog estimated at $2billion.

Inflation erosion – Nigeria’s inflation rate showed a moderate decline to 17.38% from 17.75% recorded in June. Nigeria’s headline inflation peaked at 18.17% in March 2021, driven by inherent structural factors, including the heightened security tensions in the many parts of the country and deteriorating public infrastructure. The inflation rate remains above the Central Bank’s 6-9% target, implying a key pressure point for consumers and investors.

Socio-political risks – Rising insecurity and unemployment constitute key risks to the Nigerian economy. The World Bank recently estimated that over 11 million more Nigerians are expected to fall into poverty during 2020-22 due to the impact of Covid. With 86.9 million Nigerians currently living in severe poverty and unemployment at 33%, strategic effort geared towards job creation and creating an enabling environment for businesses is required.

Similarly, the investment climate is pressured, underpinned by heightened insecurity across the country. Heightened insecurity continues to significantly weigh on investment climate, dragging down economic growth and job creation in the economy.

Written by:

Samuel Bamidele

Head, Research and Intelligence