Investing in Nigeria can present exciting opportunities, but it also comes with a significant amount of risk. Faced with political instability and infrastructure challenges, investors often have to navigate a complex landscape before deciding. However, data-driven insights can dramatically reduce these risks, guiding investors toward smarter choices. One such valuable resource/tool is the pcl. State Performance Index 2025 (pSPI), which provides detailed data about the performance of Nigeria’s states across various sectors, including governance, infrastructure, financial strength, and public service delivery.

In this article, we explore how leveraging the pSPI can help investors make more informed decisions, minimise investment risk, and identify promising opportunities in Nigeria’s diverse state landscape.

Understanding the pcl. State Performance Index (pSPI): What It Offers

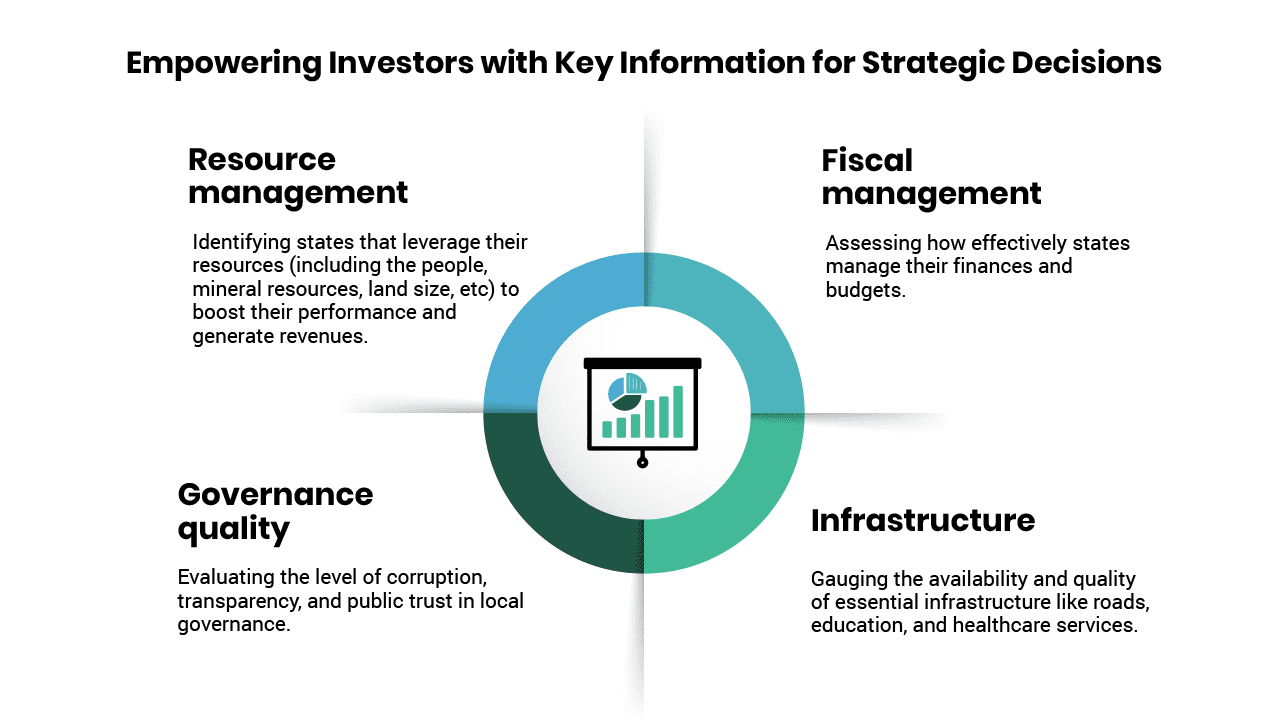

The pSPI is a comprehensive data tool that measures and compares the performance of Nigeria’s 36 states and the Federal Capital Territory (FCT) across multiple indicators, including governance quality, fiscal responsibility, public health, education, infrastructure, and more. Each year, the index evaluates these states’ performance, offering a snapshot of each state’s strengths and weaknesses.

The pSPI offers a strategic lens for evaluating Nigeria’s subnational economies, delivering credible, data-driven insights across governance, infrastructure, human capital, and economic performance. How can data guide smarter decisions on where to invest, what sectors to prioritise, and which states offer the most enabling environment for growth?

Using pSPI data will give investors a clearer picture of where their capital will be most effectively deployed and where the risks of financial instability, regulatory challenges, or social unrest might be higher.

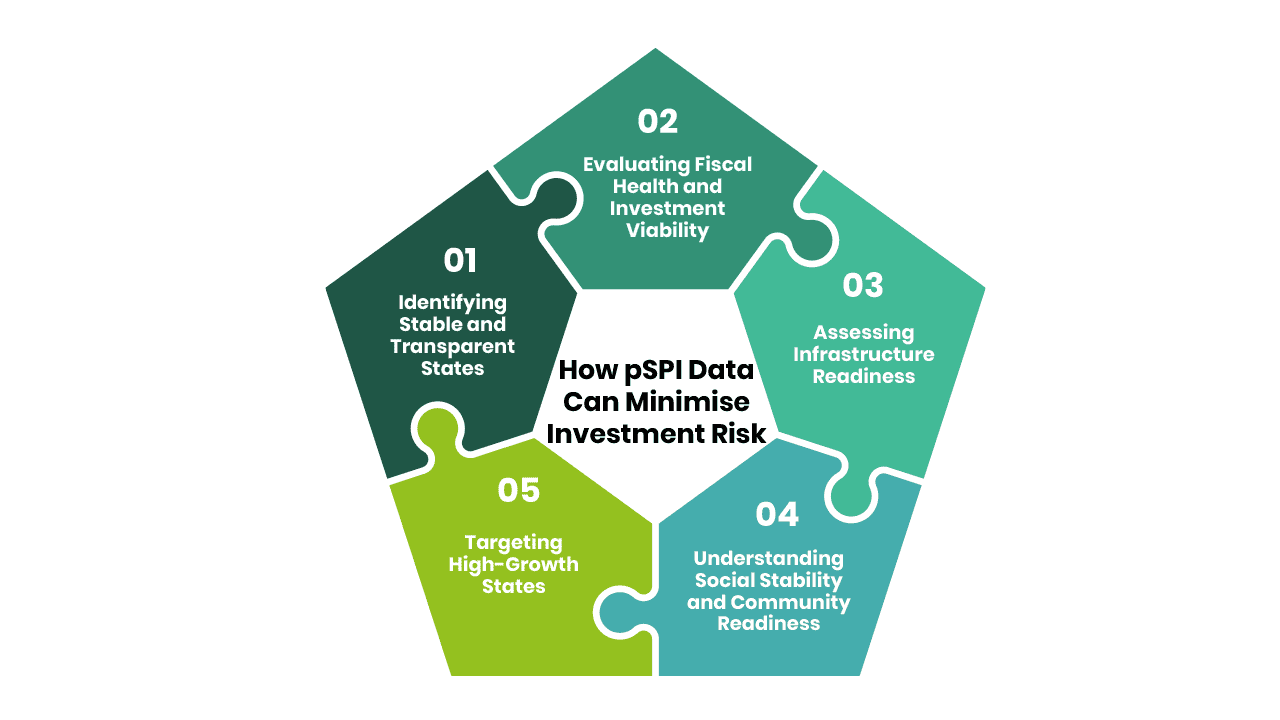

How pSPI Data Can Minimise Investment Risk

1. Identifying Stable and Transparent States

Political and institutional stability is crucial for investors seeking long-term returns. Closely analysing the pSPI data, investors can begin to identify states with transparent governance, low levels of corruption, and a history of stable policies. States with poor governance and high corruption levels may present higher risks, as they are more prone to abrupt policy changes, regulatory inconsistencies, and public unrest.

The index integrated an indicator to measure the effectiveness of transparency. Indicators like Awareness of Government Policy and Programmes, Honesty of Public Servants, Buying, Registering and Owning Landed Property, Availability of Legal Economic Opportunities, and Attitude of State-Controlled Law Enforcement Agents are all indicators to look out for in terms of how stable and transparent a state can be.

2. Evaluating Fiscal Health and Investment Viability

The pSPI’s fiscal performance indicators help investors evaluate states’ financial health and their capacity to fund development projects, repay debts, and sustain infrastructure initiatives. Investors looking to deploy capital in infrastructure projects or public-private partnerships (PPPs) can use these metrics to gauge which states are most likely to honour contracts and commitments.

For instance, states like Ogun and Niger, which perform well in terms of fiscal discipline and revenue generation, might be more attractive for investors looking to engage in long-term infrastructure projects. On the other hand, states with weak revenue performance may pose a risk for investors seeking financial stability.

3. Assessing Infrastructure Readiness

Infrastructure readiness is often a key consideration for investors, particularly in sectors like real estate, manufacturing, and agriculture. The pSPI provides insights into the availability and quality of public infrastructure in different states, including the quality of roads, cleanliness of the environment, healthcare facilities, and educational institutions.

For example, Kano may be a prime location for investors in the agriculture sector, given its relatively better infrastructure in transport and public services. Meanwhile, investors in the FCT (Abuja) can take advantage of a more developed infrastructure network, which may be appealing for businesses in tech or service industries.

4. Understanding Social Stability and Community Readiness

The pSPI highlights social and community readiness to accept investments. States with higher public satisfaction and trust in their government tend to have lower risks of social unrest, which could otherwise jeopardise investments. Using pSPI’s perception data will lead investors to assess the public sentiment and social stability in various regions.

For instance, Cross River may offer better opportunities for community-driven projects due to moderate public satisfaction with service delivery, while states with lower scores on public trust, such as Zamfara, may require more risk mitigation strategies.

5. Targeting High-Growth States

pSPI also provides data on economic growth potential, helping investors identify high-performing states that are likely to experience future growth. For example, Kaduna and Lagos have demonstrated strong economic growth, driven by industrial expansion, improved fiscal management, and strategic investments in infrastructure. These states are prime candidates for investors looking for high-return opportunities in sectors like manufacturing, technology, and finance.

Case Study: Using pSPI for Smarter Investment in Lagos and Ogun

A practical example of leveraging pSPI data to reduce investment risk can be seen in Lagos and Ogun. Both states consistently score high in infrastructure, fiscal management, and ease of doing business.

An investor looking to establish a manufacturing plant could consider Ogun, which has invested heavily in industrial zones and boasts strong fiscal management. With pSPI data showing Ogun’s growing economy and favourable business environment, investors can confidently make their decisions, knowing that infrastructure, political stability, and fiscal health are in their favour.

In contrast, a tech investor might find Lagos more attractive, given its strong infrastructure, robust digital economy, and transparency in governance. The pSPI data helps the investor avoid risk by confirming that Lagos offers a conducive environment for growth and profitability in the tech sector.

Conclusion

The pcl. State Performance Index (pSPI) is a strategic tool for investors and international development partners looking to navigate Nigeria’s complex and varied subnational landscape.

Developed by Phillips Consulting, the pSPI ranks Nigerian states based on key performance indicators such as revenue strength, financial health, infrastructure, education, healthcare, access to clean water, and overall governance. It provides a clear, evidence-based view of where states are excelling, where gaps exist, and where growth opportunities lie.

For investors, this means being able to make informed decisions, pinpointing states with stronger fiscal discipline, better infrastructure, and more stable governance structures. Instead of relying on assumptions, investors can align their capital with data-backed insights that reduce uncertainty and exposure to risks such as political instability, poor service delivery, or weak institutions.

Likewise, international development partners can use the pSPI to channel resources more effectively, targeting states that demonstrate readiness for reform or require focused capacity building. It helps reduce the risk of wasted interventions, ensuring that funding and support go where they are most needed and likely to produce measurable outcomes.

Ultimately, the pSPI helps investors and development institutions minimise risk by replacing guesswork with data and enabling smarter, more strategic engagement across Nigeria. The right information is the best risk management strategy in a high-stakes environment.

To gain more insights, download the pcl. State Performance Index 2025 Report today and see the future of governance in Nigeria.

Written by:

Auwal Abubakar

Abuja