The Banking sector is on the verge of multiple disruptions, all changing the face of learning in the industry. The confluence of disruptions the sector faces is like every business’s challenge; the difference is in the details. Banking institutions are rethinking everything, from their number of brick-and-mortar branches to their collections processes. All these considerations affect their training strategy.

The Banking industry handles all the cash, credit, and financial transactions of individuals and ventures worldwide. The modern economy depends so heavily on these activities to meet the realities of the 21st century. According to Statista, In 2022, the global digital payments industry recorded $8.38 trillion worth of transactions, 11% more than the year before. It was projected that the market in 2023 will witness even more significant growth of 13% year-over-year, with digital payments reaching nearly $9.47 trillion in transaction value.

As a result of the high growth rate in the sector, managing human resources has become a daunting task with a plethora of detail. Since it is a sector that involves immense risk, as minor mistakes can cost millions, precise training is vital and can be delivered via Digital Learning to manage the time challenge of most bankers.

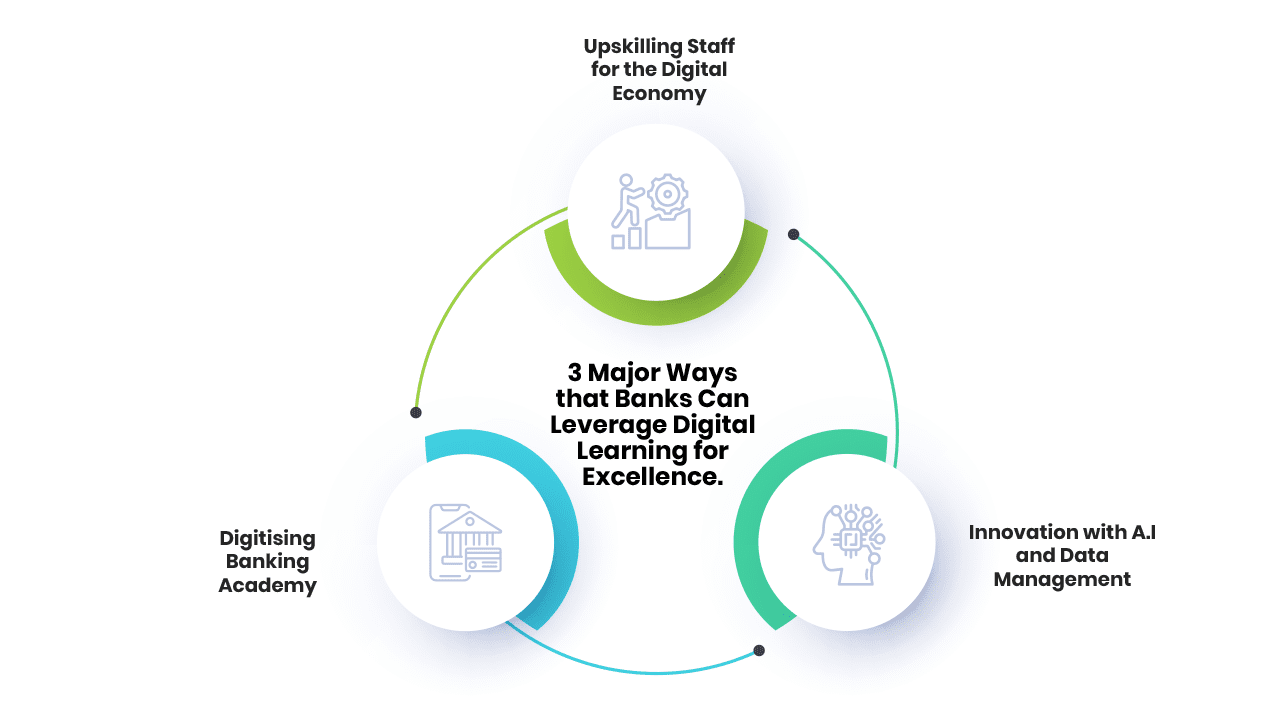

Three Major Ways that Banks Can Leverage Digital Learning for Excellence.

1. Digitising Banking Academy

Digitising a bank academy involves leveraging technology to deliver training and learning resources to bank employees in a digital format.

Implement a Learning Management System (LMS): Deploy a robust Learning Management System to serve as the foundation of your digital academy. An LMS enables organisations to organise, deliver, and track training materials, courses, and assessments in a centralised online platform.

- Content Creation: Develop digital training content such as videos, interactive modules, e-books, and online presentations. Consider using multimedia elements to make the content engaging and interactive. Ensure the content is relevant, up-to-date, and aligned with the bank’s objectives and regulatory requirements.

- Virtual Instructor-Led Training (VILT): Offer live online training sessions through webinars or virtual classrooms. This allows for real-time interaction between trainers and employees, fostering engagement and collaboration. VILT can be particularly useful for complex topics or interactive discussions

- Gamification: Incorporate gamification elements into the training process to enhance employee engagement and motivation. Use leaderboards, badges, and rewards to recognise achievements and encourage healthy employee competition. Gamification can make learning more enjoyable and encourage participation.

- Mobile Accessibility: Ensure that the digital academy is accessible via mobile devices. Develop a mobile app or ensure the academy platform is responsive and optimised for mobile viewing. This allows employees to access training materials on the go, making learning convenient and flexible.

2. Upskilling Staff for the Digital Economy

Upskilling staff for the digital economy is crucial to ensure they have the knowledge and skills to thrive in a technology-driven workplace. Here are some steps to help upskill your staff:

- Identify Skills Gap: Assess your staff’s current skills and the skills required to succeed in the digital economy. Determine the areas where gaps exists between existing skills and the skills needed for digital transformation.

- Define Digital Skills Framework: Develop a digital skills framework that outlines the core competencies and skills required for the digital economy. This framework will help in designing training programs and evaluating progress.

- Develop Customised Training Programs: Design training programs that address the identified skills gap.

- Embrace Digital Tools and Technologies: Introduce employees to the digital tools and technologies relevant to their roles.

- Internal Knowledge Sharing: Encourage employees to share their knowledge and expertise with others.

- Provide Mentoring and Coaching: Assign mentors or coaches to support employees in their upskilling journey.

- Measure Progress and Provide Feedback: Regularly assess the progress of employees’ upskilling efforts and provide constructive feedback.

3. Innovation with A.I and Data Management

AI and data management can transform how banks educate and train their employees. Here are some key areas where AI and data management can bring innovation to learning in the banking industry:

- Adaptive Learning: AI-powered adaptive learning systems can tailor training content and experiences based on bank employees’ needs and preferences. AI algorithms can deliver personalised learning paths, ensuring employees receive the right content at the right time.

- Intelligent Tutoring Systems: AI-based tutoring systems can provide real-time guidance and support to bank employees during their learning journey. These systems can assess learner progress, identify areas where additional help is needed, and provide targeted feedback and recommendations for improvement.

- Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies can create immersive learning experiences for bank employees. They can be used to simulate real-life scenarios, such as customer interactions or complex banking operations, allowing employees to practice and refine their skills in a safe and controlled environment.

- Microlearning and Bite-sized Content: AI and data management can support the development of microlearning modules and bite-sized learning content. These short, focused modules can be delivered through various digital platforms, making learning more accessible and flexible for employees. AI algorithms can track and recommend relevant microlearning modules based on employee needs and performance.

- Natural Language Processing (NLP) for Learning Support: NLP capabilities can be used to develop intelligent chatbots or virtual assistants that can answer employee questions, provide learning resources, and guide them through training materials. NLP algorithms can understand and respond to natural language queries, creating a conversational and interactive learning experience.

- Data Privacy and Security Training: AI and data management can be utilised to provide comprehensive training on data privacy and security practices. Simulations, scenario-based learning, and interactive modules can help employees understand the importance of protecting customer data and complying with regulatory requirements.

It’s important for banks to prioritise data privacy and security while implementing AI and data management solutions. Compliance with regulatory frameworks and ethical considerations should be integral parts of any innovation strategy in the banking sector. Banks should also strike a balance between technology-driven learning and human interaction. While AI and data management can enhance learning experiences, it’s crucial to maintain a human touch and provide opportunities for face-to-face interactions and mentorship.

Overall, leveraging digital learning in banking can enhance employee skills, knowledge, and performance while providing flexibility, convenience, and significant cost savings. Banks can create a comprehensive digital learning ecosystem that promotes excellence in the industry by incorporating interactive modules, virtual simulations, mobile learning apps, gamification, and collaboration platforms.

Our team at Phillips Consulting specialises in creating custom digital learning programs tailored to specific organisational needs. Organisations can benefit from our expertise in Learning Platforms, Content Digitisation, Gamification, and Microlearning by partnering with us. We would be delighted to discuss further how our digital learning expertise can align with your goals and contribute to the growth and excellence of your organisation.

Written by:

Onesimus Ocheho

Senior Digital Learning Advisor