Technologies are playing an increasingly important part in the development of today’s financial services. Financial technology (fintech) has altered various aspects of the financial industries, transforming how financial employees think, work, and how their customers operate. Fintech has also developed several emerging technologies to help progress the sector. These advancements are centred on improving transactions, building an effective business model, better services, improving client experiences, and providing security in the financial sectors.

In recent times, technology advancement has significantly disrupted organisational processes in the fintech space. The birth of a new generation of FinTech has changed organisation’s processes and how customers perform transactions.

Financial services User group report stated that venture capital investment in FinTech’s tripled from 2013 to $12.21 billion in 2014. Investment nearly doubled to 22.2$ billion and in the first quarter of 2016 reached $5.3 billion, a 67 per cent increase over the same period in 2019. Financial institutions have developed and improved their tools, services, and products to remain relevant, increase client trust, and outperform competitors. This transformation brings us to the concept of big data and how big data technology revolutionised fintech.

Overview of Big Data

Big Data is the process of modelling large amounts of data to identify and communicate important information and trends to aid decision-making and suggest conclusions. Big Data can also be described as a collection of organised and unstructured data using techniques to determine valuable data about human interactions and behaviours.

The advent of big data has changed the approach of gathering, displaying, and evaluating data. The question of how to leverage data to generate new business models has gotten much attention recently, and recent technological advancements have made it possible to produce data much faster than ever before.

Big data is becoming increasingly important as one of the crucial enablers of financial services innovation. Billions of data are generated by financial institutions daily. According to a survey by Alacer, “banks in the United States presently keep roughly 1 exabyte of data, equivalent to 273 billion mp3s”. Big data has turned this massive amount of data into tangible benefits; the impact of this change has made big data to be one of the most vital sources for analytical purposes in fintech products and services. Big data has stimulated changes in the financial institutions’ traditional business processes and has proven successful in supporting decision-making in fintech.

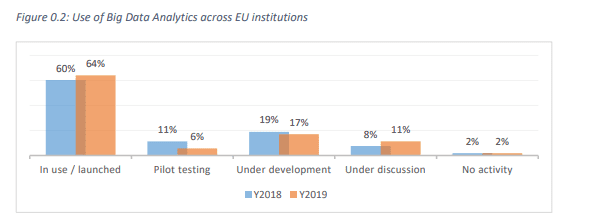

According to the 2018/2019 assessment questionnaire report by European Banking Authority (EBA), institutions use big data and advance analytics to a large extent. As seen in Figure 0.2, 64 per cent of institutions had already implemented big data and advanced analytics solutions, and about 5% of institutions said they had moved from the pilot testing and development phase to deployment within a year. Nearly every institution is looking into using big data and advanced analytics in some way.

Now, let us look into the impact of Big Data in fintech.

Risk Management

Financial institutions must make an informed decision that considers all factors to prevent risks and financial harm; Big Data enables fintech to achieve this result by conducting a complete background check on customers. Big Data detects early potential threats, such as bad debts, mitigates significant losses that would occur, and prevent them from progressing down dangerous paths. It can assess large-scale problems and break those problems into smaller viable units using analytics.

Detection of Fraud

As online banking and internet transactions become increasingly prevalent, customers and the financial services sector are more vulnerable to fraud.

In 2018, the financial industry lost $14.7 billion due to credit and debit card fraud alone. Big data enables financial institutions to understand each customer’s purchasing habits or places that do not match the profile and typical online behaviours. If the organisation detects strange activity, the account will be reported for review, and the account holder will be contacted or alerted about a potentially malicious transaction.

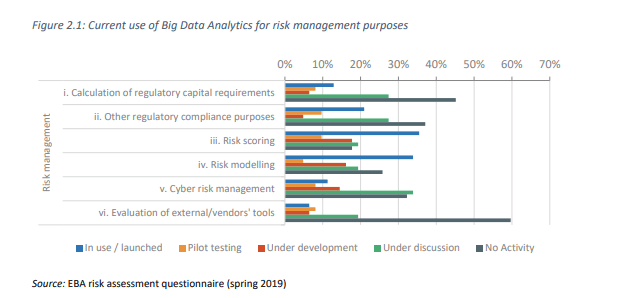

The European Banking Authority (EBA) report’s assessment questionnaire report states that big data and advanced analytics (BD&AA) for government regulations and risk management appear to be beneficial in financial institutions, as shown in Figure 2.1.

For instance, BD&AA are helping fintech to detect fraud in payment transactions, particularly in real-time, and identify high-risk clients.

Customer Segmentation

It is always beneficial for financial organisations to gain a deeper understanding of their consumers to provide better services to them. On the other hand, big data has the potential to classify clients and deliver information on products that fit their needs. This classification will help fintech market promotions to target audiences based on the services that will be helpful to them and, in turn, aid in developing stronger client relationships.

Financial advice and fund management

Big Data will help fintech determine when potential clients may require specific financial services by understanding their customers’ spending habits. The Spending habits can aid in identifying the most valued clients, and the information gathered can be used to make financial offers that will make them feel more appreciated as a customer.

The outcome from the spending habits can identify high-risk customers, advise them on how to manage their finances by alerting them before reaching the budget threshold, and save clients from possible financial issues in the future.

Personalised offerings

52% of Customers now want personalised product offerings all the time; this went up from 49 per cent in 2019. 66% of customers expect businesses to understand their specific needs and expectations, according to a salesforce.com report; this means that customers are more receptive to offerings that meet their needs.

Big data can help fintech to strengthen its relationship with clients and aid in understanding them better. Big Data enables banks to deliver more personalised assistance by providing detailed information about their customers. Big data can use customers’ current and previous behavioural patterns to retain existing clients and attract new customers.

When customers discover that they are receiving all they require, the brand instantly improves. The sector will receive positive feedback from existing customers and attracts new ones as well.

Conclusion

Advancement in technology has impacted the financial services sector; businesses are adopting emerging technologies to provide better service, increase profitability, and give internal and external clients a better experience.

This new development has changed business processes, culture, and client demands. Forbes report states that every day, around 2.5 quintillion bytes of data are generated worldwide, and the data is projected to rise as businesses progress. Big data plays a significant role in the fintech space by collecting and converting the data into meaningful benefits based on human behaviour and other patterns. Big Data has changed fintech, particularly in fraud detection and prevention, risk assessments, customer segmentation, personalised offerings, financial advice, fund management, and many more.

Written by:

|

|

|

| Adenike Danmole

Senior Consultant |

Adaugo Amah

Analyst |

Henry Ogbu

Head of Delivery, Fintech |

References