Over time, Nigeria’s economy has significantly relied upon the oil and agricultural sectors as its primary pillars of growth and development. However, a notable paradigm shift has been observed as small and medium-sized enterprises (SMEs) have emerged as pivotal drivers of economic expansion within the country. These SMEs are critical in Nigeria’s economic landscape, contributing substantially to employment generation and gross domestic product (GDP).

According to the Nigerian Small and Medium Enterprises Development Agency (SMEDAN), SMEs in Nigeria account for more than 50% of industrial employment and contribute approximately 48% to the country’s GDP. This remarkable contribution has not only propelled economic growth but has also garnered international recognition, showcasing the immense potential of Nigeria’s SME sector in fostering progress and advancement.

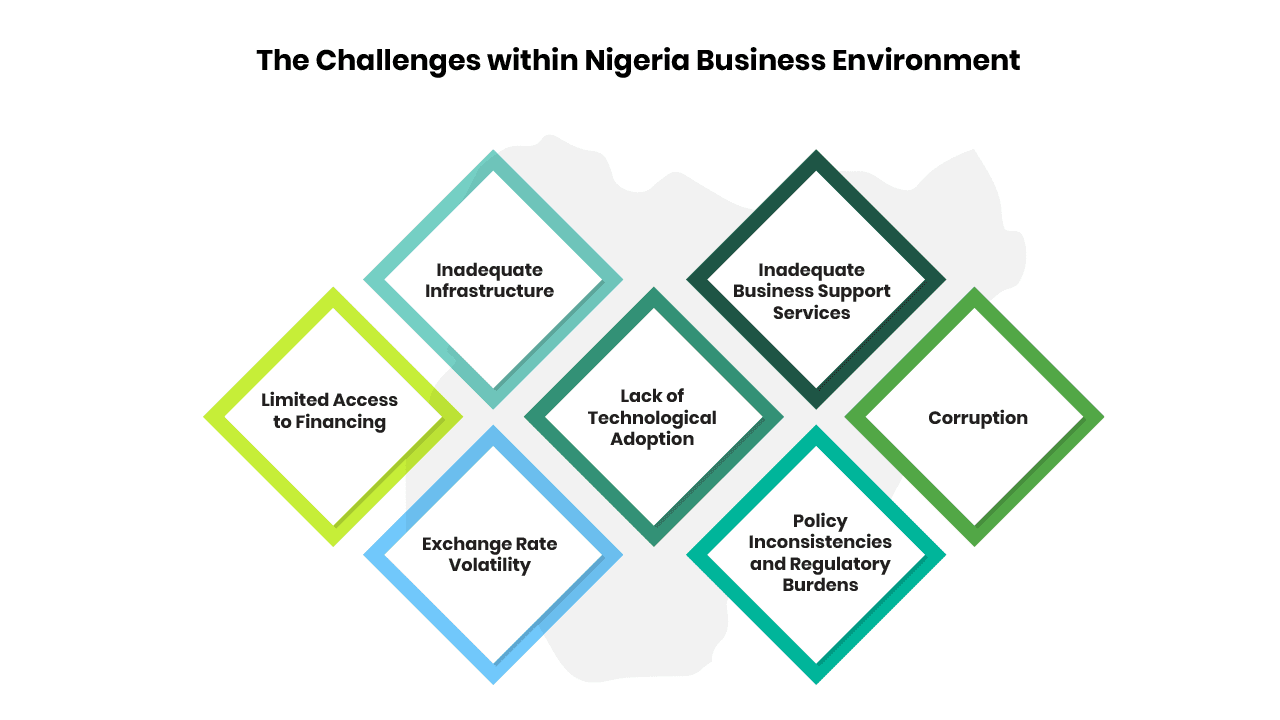

The contributions of SMEs encompass a wide array of aspects, including but not limited to job creation, economic diversification, local economic development, innovation, entrepreneurship, and poverty eradication. Despite their significant contributions, SMEs in Nigeria face a myriad of challenges, collectively referred to as the “Nigerian Factor.”

The term “Nigerian Factor” refers to the challenges and hindrances within Nigeria’s business environment that can impede the expansion and success of small and medium-sized enterprises. This article explores these challenges and discusses potential solutions to empower SMEs and cultivate a thriving entrepreneurial ecosystem in Nigeria.

The Challenges:

- Limited Access to Financing: One of the predominant hurdles faced by small and medium enterprises (SMEs) in Nigeria revolves around the challenge of accessing viable financing options. According to the World Bank’s Enterprise Surveys for Nigeria, access to finance consistently emerges as a paramount business constraint. In the 2019 survey, 48% of Nigerian firms identified access to finance as a significant constraint, underscoring the pervasive nature of this issue. Despite numerous financial institutions in the country, SMEs often find themselves compelled to self-fund for various compelling reasons. These encompass onerous collateral prerequisites, excessively high-interest rates, and the absence of an established credit history, impeding their capacity to secure loans.

To confront this pressing challenge, it is imperative that innovative financing avenues, such as Venture capital funds, angel investors, and microfinance organisations, furnish SMEs with specialised financial solutions tailored to their unique requirements. These alternatives offer the necessary support and flexibility that conventional lenders cannot provide, especially for SMEs with high-growth potential.

Furthermore, the government can play a pivotal role in redressing this issue by instating financial initiatives to furnish SMEs with favourable loan terms. Such initiatives empower SMEs to access the required funds more advantageously, enabling them to expand and prosper. Additionally, bolstering financial literacy among SME proprietors and entrepreneurs can substantially contribute to their proficiency in navigating the intricate financing terrain, comprehending loan conditions, and effectively managing their credit. This can be achieved through targeted training programs and workshops.

- Inadequate Infrastructure: Nigeria faces significant infrastructure hurdles, including recurrent power interruptions, inadequate transportation systems, and limited access to reliable internet services. The World Bank’s annual Doing Business report consistently underscores these challenges. In the 2021 report, Nigeria ranked 171st out of 190 countries in the “Getting Electricity” category, indicating significant difficulties in securing dependable power. These obstacles place considerable financial burdens on businesses and hinder the smooth operations of small and medium enterprises (SMEs), constraining their long-term growth potential.

To tackle these issues, the government must prioritise infrastructure development, especially in areas densely populated with SMEs. This entails substantial investments in power generation and distribution systems to mitigate frequent outages, collaborating with a telecommunications company to expand broadband infrastructure for enhanced nationwide internet connectivity, and facilitating the effective use of digital tools and platforms for business operations, communication, and online market access. Additionally, enhancing transportation networks, encompassing roads, ports, and logistics infrastructure, will bolster connectivity and reduce transportation expenses for SMEs.

The government can also create a supportive environment conducive to SME growth by leveraging the potential of public-private partnerships (PPPs) in infrastructure projects. This approach will alleviate the strain on public finances, ensuring efficient project implementation. Consequently, it will attract investments, foster entrepreneurial ventures, and stimulate economic growth, benefiting SMEs and the broader economy.

- Exchange Rate Volatility: Nigeria’s recent adoption of rate unification or floating rate policies has substantially impacted small and medium-sized enterprises (SMEs), especially considering the country’s dependence on imports. The consequences of this policy on businesses will be contingent on various factors. However, the volatility in exchange rates can pose challenges for SMEs in terms of planning, budgeting, and handling their exposure to foreign exchange.

Research from the International Journal of Economics, Commerce, and Management (IJECM) underscores the significance of government involvement in aiding SMEs in dealing with currency risks. Providing access to hedging tools and implementing financial education programs can bolster SMEs’ capacity to withstand fluctuations in exchange rates (Reference: IJECM, Vol. 7, No. 2, February 2019).

SMEs can employ risk management techniques like hedging to mitigate potential currency risks. Hedging involves using financial instruments or methods to protect against unfavourable shifts in exchange rates. By implementing hedging strategies, SMEs can proficiently handle their exposure to currency fluctuations and decrease the potential adverse impact on their operations. Additionally, SMEs should closely monitor exchange rate dynamics, stay well-informed about market conditions, and seek expert guidance to determine the most suitable risk management strategies for their specific circumstances. This approach will enable them to make well-informed decisions regarding their exposure to foreign exchange.

- Lack of Technological Adoption: A study by the National Bureau of Statistics (NBS) in Nigeria indicated that a significant portion of SMEs in the country still operate with minimal or no technological integration in their business processes. This study highlighted that only a small percentage of SMEs had adopted modern technologies.

In Nigeria, adopting contemporary technology is paramount for small and medium-sized enterprises (SMEs) to enhance their competitiveness in the global market and achieve scalability.

However, many SMEs in the country still rely on outdated practices, significantly limiting their growth potential. To effectively address this issue and foster a conducive environment for technological advancement, the government must implement comprehensive measures that support the development of digital infrastructure and encourage SMEs to embrace technology, which can be done by providing robust training programs tailored to their specific needs. The World Bank, in its report on global competitiveness, has emphasised the crucial role of technology adoption for SMEs to stay competitive and thrive in today’s rapidly evolving business landscape.

These programs should offer comprehensive training and capacity-building initiatives to equip SME owners and employees with the necessary skills and knowledge to leverage contemporary technologies effectively. By enhancing their digital literacy and technical expertise, SMEs can overcome barriers and confidently embrace innovative tools and practices.

- Inadequate Business Support Services: To effectively address the challenge of insufficient business support services for small and medium-sized enterprises (SMEs), it is highly recommended that the government establish a supportive ecosystem. This can be achieved by establishing business development centres and incubation hubs nationwide. These centres would serve as knowledge hubs, providing SMEs with vital resources, mentoring, training programs, and access to market data. Furthermore, establishing such centres is intended to foster the growth, sustainability, and overall success of SMEs in the country.

- Policy Inconsistencies and Regulatory Burdens: Policy inconsistencies and regulatory burdens for Small and Medium-sized Enterprises (SMEs) in Nigeria have been longstanding challenges that hinder the growth and development of this crucial sector. Here are some of the key aspects contributing to the problem:

– Frequent Policy Changes: SMEs in Nigeria often face challenges due to the frequent changes in policies and regulations. These sudden and unpredictable changes make it difficult for businesses to plan and invest long-term.

– Lack of Coordination: There is often a lack of coordination and coherence among various government agencies responsible for regulating SMEs. This leads to confusion and inefficiencies in compliance, as businesses may receive conflicting information from different sources.

– Complex Registration and Licensing Procedures: Registering and obtaining licenses for SMEs can be complex and time-consuming. This can discourage potential entrepreneurs and lead to a significant portion of the informal economy.

– Taxation and Multiple Levies: SMEs often face challenges related to taxation. There are multiple levels of taxation, including federal, state, and local government levies. The complexity and sometimes arbitrary nature of these taxes can significantly burden SMEs.

– Inconsistent Enforcement of Regulations: Even when regulations exist, enforcement can be inconsistent. This can lead to unfair competition and a lack of a level playing field for SMEs.

A comprehensive analysis conducted by the World Bank Group under the title “Doing Business 2020: Comparing Business Regulation in 190 Economies” underscores the profound impact of regulatory conditions on SMEs. It highlights the critical necessity of streamlining administrative procedures and simplifying regulatory frameworks to promote and support business development.

To promote the growth of SMEs, it is essential to streamline administrative processes, simplify regulatory frameworks, and establish policy consistency. By undertaking these measures, a more favourable business environment can be created, fostering the development and success of SMEs.

- Corruption: Nigeria grapples with persistent corruption issues, with far-reaching consequences for its small and medium-sized enterprises (SMEs). The World Bank conducts rigorous Enterprise Surveys to evaluate the business landscape across different nations, Nigeria included. These assessments consistently spotlight corruption-related hurdles SMEs encounter, such as irregular payments and bribery. Corruption takes on various forms, including bribery and extortion, creating significant barriers for SMEs when navigating official procedures, obtaining necessary permits, and accessing crucial resources. Furthermore, corruption erodes trust and confidence in the commercial sphere, making it increasingly challenging for SMEs to secure investments and establish valuable partnerships. Effectively tackling corruption is crucial for establishing a just and transparent business environment that nurtures the growth and prosperity of SMEs in Nigeria.

In summary, by empowering Small and Medium Enterprises (SMEs) in Nigeria and strategically resolving pertinent challenges, the nation stands poised to unleash the untapped potential within its SME sector. This, in turn, will catalyse a sustained surge in economic growth and overall development for the country.

Written by:

Oluwashola Achara

Learning Experience Designer