“It is taking too long to get an unsuccessful transaction reversed. I’ve got some that have been pending for 8 weeks now”, says one of Nigeria’s bank customers in our survey.

The recent new currency design and cash scarcity in Nigeria have mirrored the state of digital infrastructure in Nigeria’s banking space. According to the Phillips Consulting (pcl.) 2023 banking channels survey, about 60% of respondents are unsatisfied with the challenges associated with ATM debit without cash dispensed and the corresponding transaction reversal waiting period. In most cases, the problem has always been a technical glitch in technology infrastructure along the value chain. While the reversal period efficiency has dramatically improved since the 24 and 48 hours CBN transaction reversal policy for ON-US and NOT-ON-US, respectively, customers’ experiences still vary across different banks. The reality for many customers is that sometimes the failure is on their last money, needed for an obligation that cannot wait 24 hours, let alone 48 hours.

The big question is, can this reversal period be reduced to zero? The answer is an emphatic Yes. If the answer is yes, why have the banks not done it, or could it be such a vast technological investment? It is a design choice rather than a technical challenge, but before we blame the banks, let’s dive deeper into the designs.

Design Model A (Pay-Before-Service)

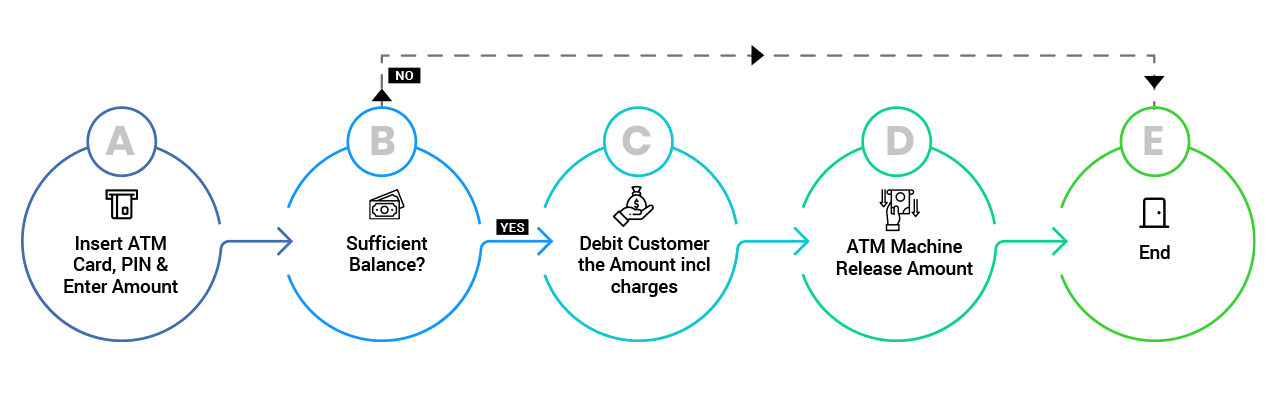

Pay before service is a household slogan in the Nigerian marketplace, and it is the same model the banks default to during transaction setup. This model is where a customer is made to release their money before accessing a service or having a desired product. This is the language on the street presumably understood by Nigerians, so our banks have designed their ATM withdrawal services and other money transfer services to follow suit. The workflow below shows what happens when a customer tries to withdraw cash from an ATM.

This design has nothing terrible with the right technology infrastructure to support it. The illustration above clearly shows that what happens at point D determines whether a customer who has already been debited at point C would get service (Money). If the transaction fails at point D, why should the customer bear the brunt of the bank’s ATM failure? The CBN has tried to respond to customer pains by mandating the cardholder’s bank to reverse the transaction immediately or within 24 or 48 hours, whether the ATM is theirs or another bank’s, respectively.

Let us look at the next model and see how a little tweak in the flowchart can make much difference when prioritising the customer.

Design Model B (Service-Before-Pay)

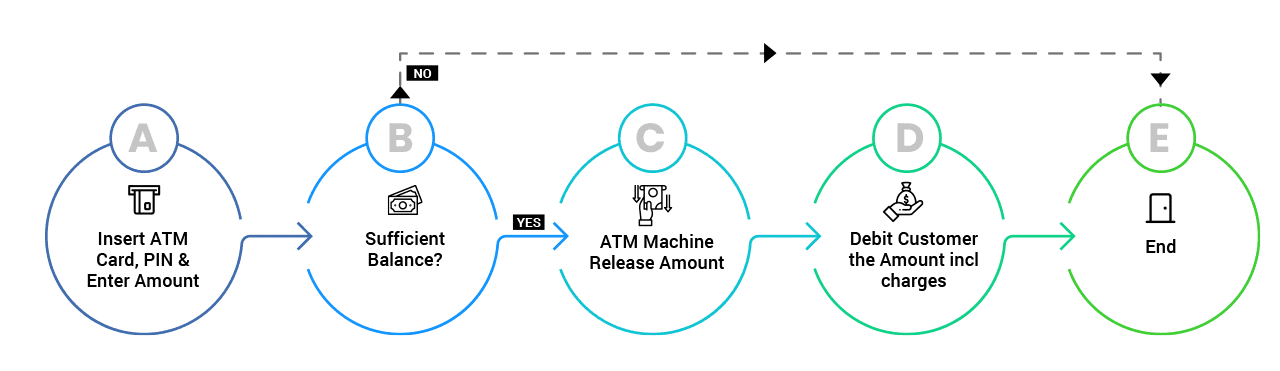

While the traditional Pay-Before-Service model has been very prevalent, it is noteworthy that many progressive and customer-focused businesses are aggressively transforming to the Service-Before-Pay model. The flow chart below shows that once the bank confirms that the customer has sufficient balance, the money is released to him, followed by the debit of his account.

The failure of the ATM at point C does not affect the customer, who moves on with his money to wherever they can access the service. This model does not require CBN regulatory intervention and the hassles associated with monitoring compliance.

This model puts the customer first; however, challenges and risks must be addressed to keep the bank afloat. Let us examine the two significant challenges and possible mitigations.

1. Trust:

A significant drawback of this model is that when value is given to a customer, and the account is not debited immediately, they might move to another ATM, if not the same ATM, to withdraw the money or more. This can happen when there is a technical glitch at point D. This is not a hypothesis, as many banks have witnessed massive losses due to this scenario. This may have informed them to stick with the Pay-Before-Service model this long; who knows? It could be to mitigate this risk.

First, the banks can place a lien (hold) on the withdrawal amount during the account balance check at point B and then release the cash at point C. The failure at point D would ensure that the customer cannot access this amount.

Secondly, the banks can pass direct debit to the customer’s other bank accounts with them or a 3rd party financial institution in Nigeria. We have a CBN Global Standing Instruction (GSI) policy that can be extended to cover this scenario.

2. Reconciliation:

The failure of technology to accomplish the debit of a customer account can be internal (ON-US – customer using ATM card on their bank’s ATM) or external (NOT-ON-US – customer using their ATM card on another bank’s ATM). Transaction reconciliation is a tedious operational process, especially in retail banking. However, the banks can improve the processes by automating them and deploying software robots.

Transitioning from Pay-Before-Service to Service-Before-Pay Model in Nigeria

Service quality is a measure of your quality delivery against customer expectations. It impacts organisational reputation and eventual profitability. The major differentiator in the banking and financial services industry soon would be hinged on service quality. Consequently, time is running out on the Pay-Before-Service model on which our core banking systems are wired. In the working world, no one expects to part with their money without getting promised service, let alone waiting days for the reversal of funds.

As a nation, we can safely transition into this new world through a well-crafted policy by the CBN and a revolutionary new business model, likely to be driven by the fintech startups.

CBN Regulatory Obligations:

Our customer-focused CBN can move the bar a notch higher from the current transaction reversal policy by adopting the Service-Before-Pay model, which would insulate the customers from the financial services practitioners’ internal and external bureaucracies and shortcomings. A holistic and robust policy in this direction will open the industry to more innovative solutions that would create more opportunities and deepen the government’s financial inclusion drive.

New Revolutionary Models:

It is no longer news that with their disruptive innovations, Nigerian fintech startups are wiping out old traditional business models through modern technologies and witty inventions. Nigeria’s most valued financial services entities are the new fintech players under ten years old. The players in this space can be trusted to unlock the vast potentials trapped in the Service-Before-Pay model through the innovative application of emerging technology tools in the domains of Artificial Intelligence (AI), Robotic Process Automation (RPA), Blockchain, Big Data, Cloud Computing, etc.; to assess and mitigate associated risks.

Written by:

Henry Ogbu

Head of Delivery, Fintech