The launch of the Dangote Refinery, Africa’s largest and one of the world’s most ambitious petroleum refining projects, was met with fanfare and high hopes for Nigeria’s economy. With a refining capacity of 650,000 barrels per day, Nigeria was projected to transform from a net importer of refined petroleum products into a self-sufficient producer. The refinery was not just a symbol of economic power but also an anticipated solution to Nigeria’s chronic fuel shortages, high import bills, and the volatility of global oil markets. However, the ongoing controversy surrounding the pricing of petrol and its impact on the Nigerian economy has sparked debate. Has the Dangote Refinery fulfilled its promise, or has it become an economic burden for the average Nigerian?

For decades, Nigeria has paradoxically struggled with fuel shortages and high prices despite being one of the world’s largest crude oil producers. The country imports over 90% of its refined petroleum products due to the inefficiency and undercapacity of its four state-owned refineries, which are often offline due to technical issues. In 2023, Nigeria spent $25 billion on petroleum imports, according to the Nigerian National Petroleum Corporation (NNPC). These imports, paid for in U.S. dollars, have placed immense pressure on Nigeria’s foreign reserves and contributed to the depreciation of the naira.

When the Dangote Refinery project was conceived, it was hailed as a game-changer. Estimates suggested that the refinery could save Nigeria $12 billion annually in foreign exchange by reducing import dependency and creating over 100,000 jobs. Furthermore, the refinery was expected to supply the entire domestic demand for refined products—consisting of about 60 million litres of petrol daily—and have excess production for export. The overall economic benefits were projected to be transformative, potentially significantly boosting Nigeria’s GDP and alleviating the fiscal burdens associated with fuel imports.

However, several months into its operations, the economic impact has not been as pronounced as anticipated. Instead, petrol prices have soared, sparking widespread dissatisfaction and protests nationwide.

The Subsidy Conundrum and Its Impact on Nigerians

The economic policies in place have affected Nigerians in different ways every day. For Kola, a small business owner in Lagos, the rising cost of petrol has become an overwhelming burden. “I used to spend about ₦10,000 on fuel for my generator each week, but now it’s more than ₦54,000. It’s hard to keep my business afloat,” he shared. Stories like Kola’s highlight the urgency for measures to alleviate the burden on small businesses, which form the backbone of Nigeria’s economy.

In rural areas, farmers face increased transportation costs, which have affected the price of food and other agricultural products. Many are now looking for innovative solutions, such as forming cooperatives to share transportation costs and adopting modern farming techniques to boost productivity.

Fuel subsidies had been a cornerstone of Nigeria’s economic policy for decades, keeping petrol prices artificially low to shield citizens from the full brunt of global oil market fluctuations. However, the subsidy system came at a high cost. In 2023, Nigeria spent an estimated ₦5 trillion on fuel subsidies, according to the Central Bank of Nigeria (CBN). Critics argued that the subsidies were unsustainable, prone to corruption, and disproportionately benefited the wealthy, who consumed more fuel.

Nigeria’s economic landscape has been undergoing a transformative period, especially with the commissioning of the Dangote Refinery and the removal of fuel subsidies. The removal of these subsidies in May 2023 was part of the government’s broader economic reform agenda to free up resources for infrastructure development, healthcare, and education. Yet, the immediate aftermath of the subsidy removal has left many Nigerians facing financial strain. According to the National Bureau of Statistics (NBS), inflation surged to 27.5% in August 2024, its highest level in two decades.

Food prices, transportation costs, and even essential services have all increased, eroding the purchasing power of the average Nigerian. The Nigerian Labour Congress (NLC) has organised several protests, calling for reversing the subsidy removal and reducing petrol prices, arguing that the current situation is unsustainable. While the government argues that this is necessary for fiscal sustainability, the immediate impact on Nigerians has been harsh. Consumers now spend more on transportation, which has led to a ripple effect on food prices and other essential goods.

One of the most significant challenges facing the Nigerian economy is currency devaluation. As the government shifts towards a market-determined exchange rate, the naira has depreciated against major currencies, exacerbating the inflationary pressure. The foreign exchange reserves, approximately $30 billion in 2024, have also been under strain as the Central Bank attempts to stabilise the naira.

This has had a direct impact on petrol prices at the pump. Petrol, which was once sold at ₦165 per litre during the subsidy era, now averages between ₦770 and ₦1150 per litre, depending on the region. In some parts of the country, prices have reached as high as ₦950 per litre, significantly raising the cost of living for millions of Nigerians.

Despite these challenges, the government believes that removing subsidies will free up resources for more productive investments in the long term. The Dangote Refinery, now operational, is expected to play a vital role in addressing some of these issues by reducing Nigeria’s dependence on imported refined petroleum products.

Global Oil Prices and the Realities of Local Refining

One of the key factors fueling the controversy around Dangote’s petrol prices is the continued influence of global oil market dynamics. Despite the refinery’s local production, Nigeria is not insulated from fluctuations in global crude oil prices. In June 2024, Brent crude oil prices surged to $88 per barrel due to supply cuts by major oil producers like Saudi Arabia and Russia. By September 2024, it had declined to around $72 per barrel. Since Dangote’s refinery sources crude oil at global rates, the cost of refined petroleum products, including petrol, remains tied to these external factors.

In recent months, fuel scarcity has hit major cities across Nigeria, with attendant effects on businesses and households. This has prompted commercial bus drivers to increase their fares in major towns and cities, including the nation’s capital. As a result, black marketers have made brisk business selling to willing buyers at higher prices ranging from ₦1,200 to ₦1,500.

Today, the price of octane-95 gasoline in Nigeria is 770.54 Nigerian Naira per litre. However, the Nigerian National Petroleum Corporation (NNPC) recently increased the pump price of fuel from ₦617 per litre to ₦898 per litre.

Fuel Pricing Controversy in Nigeria

According to Sahara Reporters, NNPCL dispatched about 300 trucks to the 650,000 barrels per day capacity refinery in Lagos on September 14, 2024, with loading operations beginning on Sunday, September 15, 2024.

On Sunday, the Nigerian National Petroleum Company (NNPC) Limited announced that it had purchased fuel from the Dangote Refinery at N898 per litre. This announcement sparked immediate reactions and raised questions about the refinery’s pricing model. However, Dangote Group quickly responded, describing the NNPC’s statement as “misleading and mischievous”.

“We successfully loaded PMS at the Dangote Refinery today. The claim that we purchased it at N760 per litre is incorrect. For this initial loading, the price from the refinery was N898 per litre,” Soneye said in an interview with Daily Trust.

In contrast to the above statement issued on September 15, 2024, Sunday evening, Dangote Group’s Anthony Chiejina denied these claims. He emphasised that the refinery had not yet set its final petrol price and that the figure of N898 per litre was not accurate.

“Our attention has been drawn to a statement attributed to NNPCL spokesperson, Mr Olufemi Soneye, that we sell our PMS at N898 per litre to the NNPCL. This statement is misleading and mischievous, deliberately aimed at undermining the milestone achievement recorded, September 15, 2024, towards addressing energy insufficiency and insecurity, which has bedevilled the economy in the past 50 years,” Chiejina stated.

Chiejina further clarified that the refinery sells its products in dollars because the crude oil is procured in foreign currency. The official pricing announcement will come from the Technical Sub-Committee on Naira-based crude sales to local refineries, which will begin its work on October 1, 2024.

The statement concluded with a call for patience from Nigerians as they await a formal pricing announcement to align with the country’s broader economic and energy policies. Chiejina assured Nigerians that the Dangote Refinery is working towards ensuring the availability of high-quality petroleum products, which will ultimately reduce fuel scarcity across the country.

A Billion-Dollar Question: Will the Price go Down?

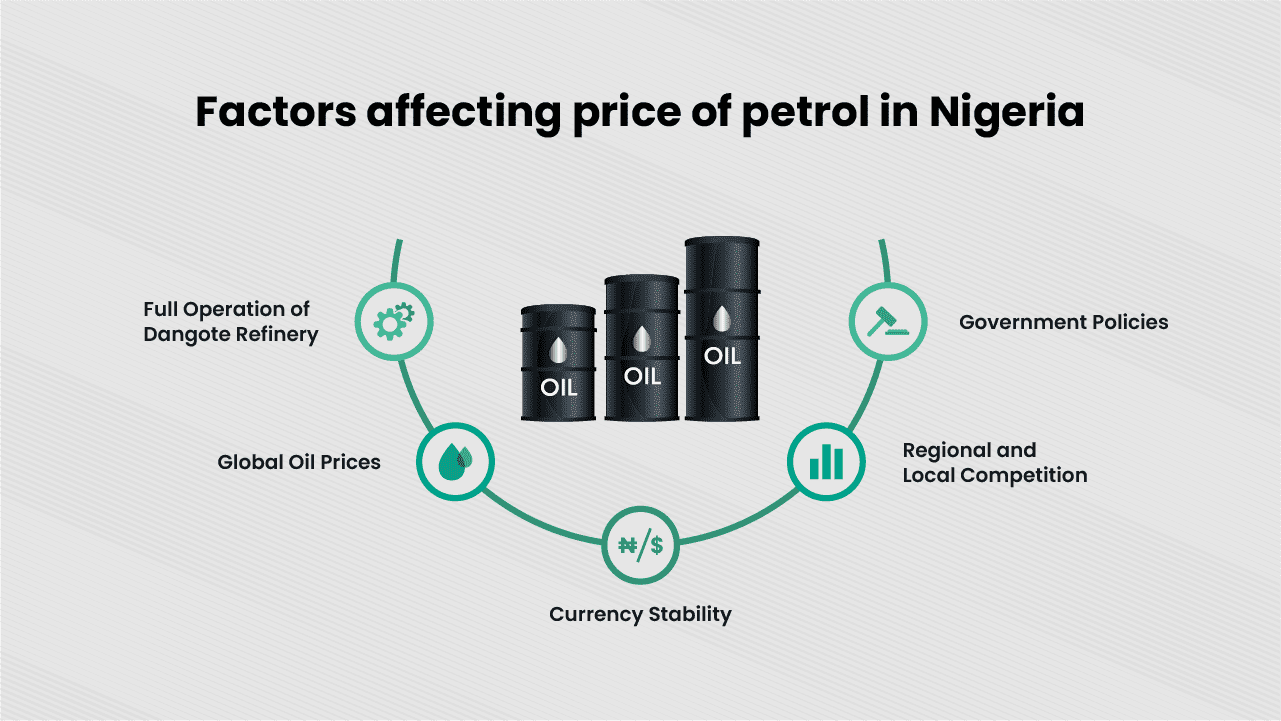

Whether petrol prices in Nigeria will go down depends on several internal and external factors. While the Dangote Refinery holds the potential to stabilise or reduce prices in the long term, there are key elements to consider:

- Full Operation of Dangote Refinery: Once the Dangote Refinery reaches its full refining capacity of 650,000 barrels per day, the increased supply of locally refined petrol will likely reduce Nigeria’s dependency on fuel imports. This could lead to lower fuel costs as import expenses and logistics costs are reduced. However, it may take time before the refinery fully scales up production, potentially delaying any immediate price relief.

- Global Oil Prices: Global oil prices still impact Nigeria since crude oil is priced in the international market. If global crude prices decrease, this could lower the cost of petrol production and reduce local prices. Conversely, if oil prices remain high or increase further, local prices will likely stay elevated. As of September 2024, global oil prices are above $70 per barrel, which has kept petrol prices high globally.

- Currency Stability: Another critical factor is the value of the naira. Since fuel imports and crude oil purchases are made in U.S. dollars, the strength of the naira directly affects petrol prices. If Nigeria stabilises its currency and strengthens the naira, fuel prices may decrease. However, this is a significant hurdle in the current foreign exchange challenges.

- Government Policies: The removal of fuel subsidies in May 2023 has played a major role in the current high petrol prices. Prices could come down if the government reintroduces any subsidy or provides relief measures. However, this is unlikely, given the government’s focus on reducing subsidy spending to free up resources for other sectors.

- Regional and Local Competition: Once the Dangote Refinery is fully operational and exporting fuel to other countries, competition could drive prices down, particularly if local refineries or alternative energy sources like renewable energy become more widespread. Increased local refining capacity could create competition, which might also lower prices.

In the short term, a significant reduction in petrol prices is unlikely unless global oil prices fall or the government intervenes with policy adjustments. However, in the long term, the full operation of the Dangote Refinery, currency stabilisation, and potential competition in the fuel market could lead to lower prices.

Dangote’s Refining Operational Delays

While the Dangote Refinery has enormous potential, the facility is still in its early stages of operation. Reports indicate that the refinery has yet to ramp up to full production capacity, crucial for achieving the anticipated economic benefits. According to the company, full-scale operations may not commence until late 2024 or early 2025 due to technical and logistical challenges.

This delay in full production means Nigeria still relies on imported fuel to meet a significant portion of its domestic needs. The Dangote Refinery is expected to bridge this gap, but until it reaches its optimal production levels, the Nigerian market remains vulnerable to external shocks, including the volatility of global oil prices and the rising costs associated with importing petroleum products.

The operational delays at the Dangote Refinery are primarily caused by several interrelated factors involving the Nigerian National Petroleum Corporation (NNPC), the federal government, and broader regulatory and infrastructure challenges. Key causes of the delays include:

- Crude Oil Supply Negotiations with NNPC: The NNPC acquired a 20% stake in the Dangote Refinery in 2021, making it a key partner in the project. However, Dangote explained that the NNPC’s share has been reduced to 7.2% because the corporation failed to pay the balance of its share, which was due in June. The lengthy negotiations between the NNPC and the refinery over crude oil supply agreements have delayed operations.

- Complex Bureaucratic Processes: The refinery needs a steady supply of crude oil to meet its target of refining 650,000 barrels per day, but bureaucratic delays in securing these agreements have slowed progress. Government entities like the NNPC often involve complex decision-making and bureaucratic red tape. This has slowed the finalisation of critical agreements, permits, and other regulatory approvals necessary for the refinery to become fully operational.

- Regulatory Hurdles: Navigating Nigeria’s regulatory environment, characterised by complex and sometimes inconsistent policies, has contributed to the delay. The refinery has faced challenges in securing necessary permits and adhering to changing regulations, which has prolonged the process of becoming fully operational.

- Infrastructure Deficits: Nigeria’s weak infrastructure, particularly transportation and logistics, has hindered the refinery’s progress. Poor road networks, unreliable power supply, and inefficient transportation systems have slowed down the refinery’s supply chain, further delaying its ability to operate at full capacity.

- Political and Institutional Bottlenecks: The NNPC, as a state-owned entity, operates under both business and political considerations, which has led to institutional bottlenecks. Decisions on crude supply, collaboration, and pricing agreements often become subject to political negotiation, adding friction and delaying operational progress.

To overcome these delays, the Dangote Refinery will need continued cooperation from the NNPC and the federal government. A streamlined and transparent process for securing crude oil supplies and regulatory reforms will allow the refinery to reach its full production capacity. The federal government will also need to address infrastructure deficits and ensure that its policy shifts—such as the removal of subsidies—are well-coordinated with industry stakeholders to prevent market disruptions.

Amidst operational delays at Dangote’s refinery, how can Nigerians cope with rising petrol prices?

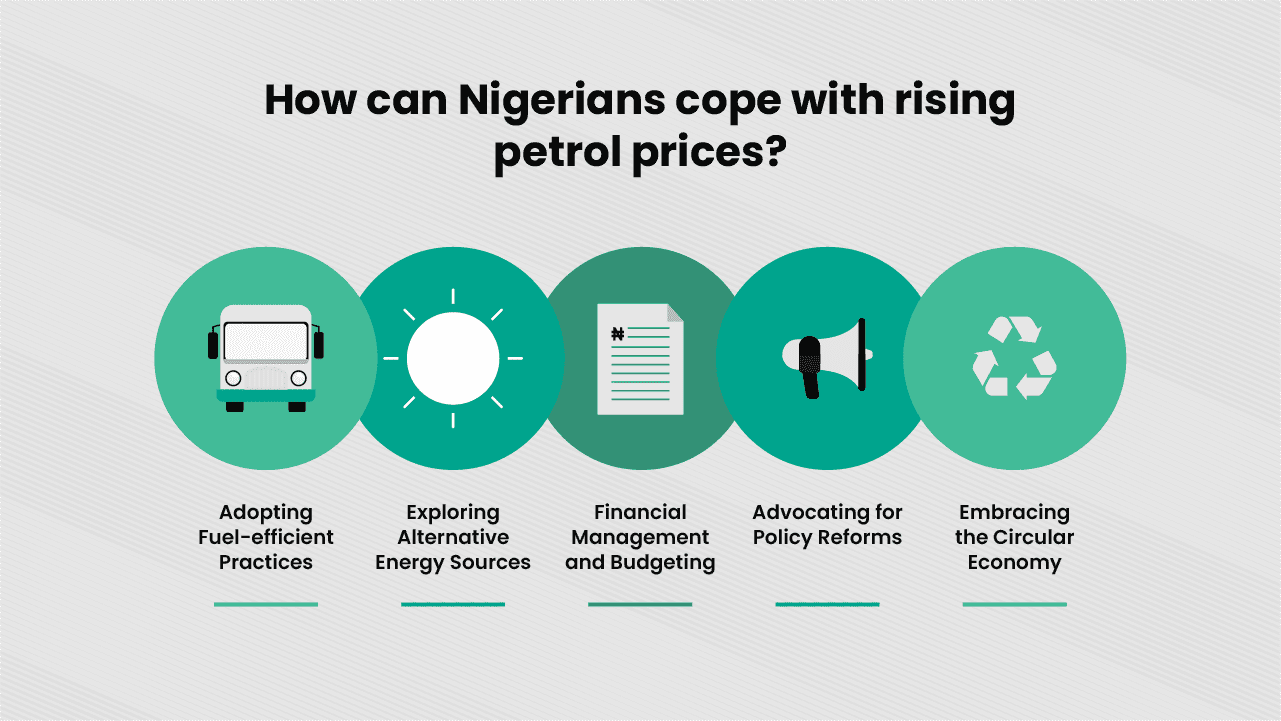

The high cost of petrol due to global oil market fluctuations has put immense pressure on the average Nigerian. As the Dangote Refinery ramps to total capacity and hopes for future price stability remain, Nigerians need strategies to navigate this challenging period. Here are several ways they can cope:

1. Adopting Fuel-efficient Practices

Public Transportation: More Nigerians can use public transportation instead of relying on private vehicles. While Nigeria’s public transport system has room for improvement, it is still a more affordable option compared to using private vehicles daily.

Vehicle Maintenance: Keeping vehicles in optimal condition ensures efficient fuel consumption. Regularly servicing cars, maintaining proper tyre pressure, and driving at moderate speeds can reduce fuel consumption by up to 20%.

2. Exploring Alternative Energy Sources

Liquefied Petroleum Gas (LPG): With the rising cost of petrol, Nigerians can consider switching to alternative energy sources where possible. LPG can be a more cost-effective alternative for cooking and powering small generators. Increasing awareness and access to LPG could help reduce the overall demand for petrol.

Solar Energy: To reduce our overdependence on fossil fuels, investing in clean energy, such as solar panels and batteries, for household electricity needs could offset the need for petrol-powered generators. Although the initial solar installation cost may be high, the long-term savings on energy bills can be substantial.

3. Financial Management and Budgeting

Budgeting for Essentials: The sudden rising cost of living means Nigerians must rethink their financial strategies to make the most of their income. Prioritising spending on essential items such as food, housing, and transportation is critical. Households should create strict budgets to manage their expenses and reduce non-essential spending.

Exploring Supplementary Income: As inflation eats into household budgets, seeking supplementary income sources through part-time jobs or small-scale entrepreneurial ventures can provide some financial relief.

4. Advocating for Policy Reforms

Engagement with Government: Nigerians can advocate for the government to provide targeted support to vulnerable populations affected by rising fuel costs. This support could include subsidies for essential goods and services or direct financial assistance for low-income families.

Policy Monitoring: Engaging with policymakers and monitoring the implementation of reforms can help ensure that government policies effectively and equitably address the root causes of economic challenges.

5. Embracing the Circular Economy

Recycling Programs: Nigerians can adopt a more sustainable way of living through the circular economy, which emphasises reducing waste, reusing materials, and recycling. By embracing this concept, households and businesses can lower costs. Participating in recycling programs benefits the environment and can generate additional income, particularly for those in waste management businesses.

Reusing and Upcycling: Households can reduce costs by upcycling old items or reusing materials instead of buying new products. The rising cost of petrol and the broader economic pressures in Nigeria are undoubtedly challenging, but they also present an opportunity for resilience, creativity, and policy reform.

Nigerians can mitigate the impact of high fuel prices by adopting fuel-saving strategies, investing in alternative energy, and pushing for economic reforms. While the long-term benefits of the Dangote Refinery and other economic reforms are still on the horizon, the immediate priority for Nigerians is to adjust their lifestyle, finances, and consumption habits. Government support through policy interventions and citizen-led initiatives can create a more sustainable and resilient economy facing global energy uncertainties.

Economic Optimism and Long-Term Prospects

With the current economic strain, some analysts remain optimistic about the Dangote Refinery’s long-term impact. The Nigerian government has already negotiated with the refinery to allocate a substantial portion of its refined products to the domestic market. Once the refinery reaches its full operational capacity, it is expected to help stabilise fuel prices, reduce the need for imports, and save billions in foreign exchange.

Furthermore, the refinery’s capacity to export refined products to other African countries and beyond could generate significant revenue for Nigeria. According to estimates from the Nigerian Investment Promotion Commission (NIPC), the refinery could generate up to $6 billion annually from exports, further bolstering the country’s foreign exchange reserves.

Additionally, the refinery could catalyse industrial growth, particularly in sectors like petrochemicals and plastics manufacturing, creating jobs and stimulating the broader economy. The refinery is also expected to spur investments in infrastructure development, including pipelines, storage facilities, and distribution networks, which will enhance Nigeria’s energy security.

What to Expect: The Economic Impact of Dangote Refinery at Full Capacity

Once fully operational, the Dangote Refinery is expected to have a significant economic impact on Nigeria and the broader West African region. Key areas of impact include:

- Reduction in Fuel Imports: Nigeria currently imports a large portion of its refined petroleum products despite being one of the largest oil producers. The refinery’s capacity to process 650,000 barrels of crude oil per day will meet domestic demand, reducing fuel imports and saving billions of dollars in foreign exchange.

- Job Creation: The refinery will directly and indirectly create thousands of jobs during construction and operation. It will also stimulate growth in ancillary industries, such as petrochemicals, logistics, and manufacturing, providing a boost to the labour market.

- Boost to Local Industries: By supplying locally refined products like gasoline, diesel, aviation fuel, and polypropylene, the refinery will strengthen industries that rely on petroleum products, reduce production costs, and improve competitiveness.

- Foreign Exchange Earnings: In addition to meeting domestic needs, the refinery will export refined products to neighbouring countries, generating significant foreign exchange earnings and improving Nigeria’s balance of trade.

- Government Revenue: The refinery’s operations will increase government revenue through taxes, royalties, and the reduction of fuel subsidies, easing pressure on public finances.

- Stimulation of Downstream Sectors: The refinery will promote growth in Nigeria’s downstream oil sector, including petrochemical production, which could lead to more industrial diversification.

- Energy Security: By making Nigeria self-sufficient in refined petroleum products, the refinery will enhance energy security and reduce vulnerability to global oil price fluctuations.

Overall, the Dangote Refinery is set to transform Nigeria’s energy sector and contribute significantly to the country’s economic growth and stability.

Looking Ahead: Government Policy and Long-Term Solutions

While the immediate impacts of the Dangote Refinery’s partial operation and the subsidy removal are challenging, the Nigerian government is expected to address these issues through policy reforms and long-term strategies. These strategies should focus on:

- Diversification of the Economy: Reducing reliance on oil by investing in other sectors, such as agriculture, manufacturing, and technology, can mitigate the impact of global oil price fluctuations on the Nigerian economy. Diversification can create new job opportunities and foster economic stability.

- Investment in Infrastructure: Infrastructure projects, such as improved transportation networks and energy facilities, can help reduce business costs and improve overall economic efficiency.

- Enhanced Regulatory Oversight: Effective regulation and oversight of the petroleum sector are crucial for preventing corruption and ensuring that the benefits of the Dangote Refinery are realised for all Nigerians. This includes monitoring fuel pricing and ensuring transparency in the supply chain.

- Strengthening Social Safety Nets: Implementing and strengthening social safety nets can help protect the most vulnerable segments of the population from the adverse effects of economic reforms. This includes direct cash transfers, food subsidies, and support for small businesses.

Conclusion: A Balancing Act Between Expectations and Realities

The Dangote Refinery represents a monumental investment in Nigeria’s future, but the road to realising its full potential remains fraught with challenges. While it promises to reduce Nigeria’s dependency on imported fuel and generate significant economic benefits, the immediate impact on petrol prices has frustrated many Nigerians.

The removal of fuel subsidies, combined with the influence of global oil prices, has created a perfect storm of high costs for consumers, raising concerns about the refinery’s ability to ease the economic burden in the short term. However, as production ramps up and operational efficiencies are achieved, the long-term benefits could outweigh the current pains.

In conclusion, the Dangote Refinery holds significant potential to transform Nigeria’s oil sector and reduce dependency on imported fuels. However, the challenges of operational delays, rising petrol prices, and the removal of subsidies have highlighted the need for comprehensive policy measures and strategic reforms. By addressing these issues and investing in long-term solutions, Nigeria can harness the benefits of its refinery and pave the way for a more stable and prosperous economic future.

The Dangote Refinery now stands at the crossroads of expectation and reality. Whether it ultimately fulfils its promise as a beacon of economic hope or becomes an additional burden on the Nigerian economy depends on a delicate balancing act of policy, global market dynamics, and operational success. Time will tell if the refinery can deliver the relief millions of Nigerians desperately seek. Still, for now, Nigerians should prepare for high prices and remain hopeful that local production will eventually bring some relief.

pcl. can assist by offering strategic advisory services to the government and private sector on policy formulation and market dynamics, helping mitigate the impact of subsidy removal and global oil price fluctuations. pcl.’s operational and technology consulting can streamline Dangote Refinery’s operations, addressing delays and enhancing efficiency through automation and process optimisation. Additionally, pcl. can conduct market analysis to forecast fuel price trends and provide advisory support on transparent pricing strategies that align with market realities, ensuring a smooth transition to local refining while managing public expectations.

Written by:

Sunday Kolawole

Analyst

![]()