Introduction

Nigeria’s financial sector is at the forefront of Africa’s digital transformation. Over the past decade, the country has seen explosive growth in digital banking, mobile payments, and fintech platforms. Millions of Nigerians now use apps and wallets for everything from bill payments to investments, but as the financial ecosystem has grown more sophisticated, so have the threats.

Fraud, once confined to counterfeit cheques or stolen ATM cards, has evolved into a digital phenomenon. Cybercriminals exploit system vulnerabilities, launch phishing campaigns, and leverage advanced social engineering schemes that drain accounts in minutes. According to the Nigeria Inter-Bank Settlement System (NIBSS), electronic payment fraud losses exceeded ₦5.2 billion in 2023 alone, representing only the reported cases. For banks and fintechs, the battle against fraud is no longer a side issue; it is a matter of survival, customer trust, and regulatory compliance.

This is where Artificial Intelligence is transforming fraud prevention. By combining machine learning with real-time data analysis, AI systems can detect anomalies instantly, block suspicious transactions before they occur, and continuously learn from new patterns of attack. For Nigeria’s financial sector, the adoption of AI is not just a technological upgrade but a strategic imperative that will define the future of trust, resilience, and competitiveness in digital finance.

The Fraud Landscape: Rising Incidents in Nigeria’s Payment Systems

Fraud in Nigeria’s financial ecosystem is both broad and deep. The most common schemes range from:

1. Phishing and social engineering – Criminals manipulate individuals into revealing passwords or OTPs.

2. Card-not-present fraud – Exploiting stolen card details in online transactions

3. SIM swap fraud – Criminals hijack a user’s mobile line to intercept OTPs.

4. Internal collusion – Insider threats from staff collaborating with external fraudsters.

A 2023 report by the Economic and Financial Crimes Commission (EFCC) highlighted that cyber-enabled fraud remains one of the top five economic crimes in the country. The Central Bank of Nigeria (CBN) has also issued repeated warnings to banks and fintechs about heightened attacks targeting real-time payment systems such as NIP (NIBSS Instant Payments).

Consider the case of a commercial bank in Nigeria that suffered a ₦500 million loss in less than two weeks. The attackers exploited delays in the bank’s fraud monitoring systems and performed rapid-fire transactions across multiple accounts. Traditional rule-based detection tools, which only flagged known suspicious patterns, were too slow and inflexible to stop the attack.

This reality underscores the urgency of smarter tools. In today’s environment, fraud is not static; it constantly mutates. Nigerian financial institutions require solutions that can learn, adapt, and predict in real time.

AI’s Role: From Reactive to Proactive Defence

Unlike rule-based systems that rely on predefined alerts “flag any transfer above ₦1m”, AI-driven fraud detection is dynamic. Using machine learning and behavioural analytics, AI systems build profiles of normal customer behaviour and instantly spot anomalies.

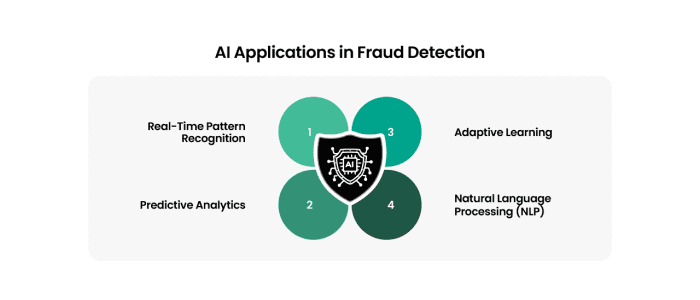

Key applications include:

1. Real-Time Pattern Recognition: AI analyses thousands of transactions per second, comparing them against historical behaviour. If a customer who normally transacts within Lagos suddenly makes a high-value transfer from Europe at midnight, the system raises a red flag instantly.

2. Predictive Analytics: Machine learning models don’t just react; they forecast potential risks based on subtle patterns. For example, they can detect the “digital fingerprint” of fraudsters hopping between different fintech platforms.

3. Adaptive Learning: As fraudsters invent new techniques, AI models update themselves. This ability to evolve keeps defences one step ahead.

4. Natural Language Processing (NLP): AI can even analyse suspicious emails, SMS, or chat conversations to detect phishing attempts before users fall victim.

Globally, institutions that use AI-driven systems have reported a 30–50% decrease in fraud-related losses. For Nigerian banks, where customer trust is fragile, AI doesn’t just protect balance sheets; it strengthens credibility and competitive advantage.

Bridging the Gaps

Despite its promise, the adoption of AI in Nigeria’s financial sector is not without its hurdles.

- Data Quality and Availability – AI thrives on data, yet many Nigerian institutions still struggle with fragmented systems and incomplete datasets. To build accurate fraud models, banks need integrated, clean, and well-structured data pipelines.

- High Implementation Costs – Deploying AI systems requires significant investment in infrastructure, cloud computing, and skilled personnel. Collaboration with fintech startups, which can offer modular AI tools, and government-backed incentives to encourage adoption.

- Talent Gap – There is a shortage of Nigerian professionals with advanced AI, machine learning, and fraud analytics expertise. Tailored training programs for risk managers, data scientists, and IT teams, bridging academic knowledge with real-world applications.

- Regulatory Concerns – AI systems, if poorly implemented, may generate false positives that frustrate customers or even raise privacy concerns. This can be addressed by establishing clear AI governance policies that are aligned with CBN and NDPR (Nigeria Data Protection Regulation).

Integration with Training: Building Human Intelligence for AI

While AI systems can detect fraud at lightning speed, their effectiveness is only as good as the people who deploy and manage them. Risk managers and compliance officers must understand how these systems work, how to interpret alerts, and how to fine-tune detection models to maximise their effectiveness.

This is where training programmes become critical. Practical fraud detection training should include:

- Hands-on workshops with real fraud scenarios.

- Case studies from Nigerian and international institutions.

- Guidance on integrating AI insights into risk management strategies.

- Continuous professional development, ensuring teams keep pace with evolving fraud techniques.

Future Outlook: Preparing for AI-Enhanced Defences

Looking ahead, the financial landscape will continue to grow more digitised and vulnerable. The rise of open banking APIs, cross-border digital payments, and cryptocurrency adoption will introduce new layers of risk. Nigerian institutions that succeed will be those that:

- Deploy AI-powered fraud detection systems as standard infrastructure.

- Invest in cyber-resilient architectures that integrate blockchain and biometrics.

- Cultivate AI-literate workforces trained to handle evolving threats.

- Collaborate across banks, fintechs, regulators, and cybersecurity experts to share intelligence.

Why Phillips Consulting Leads the Charge

In this transformation, Phillips Consulting stands out as a trusted partner for institutions determined to stay ahead of fraudsters. With decades of experience in advisory, fraud investigation, technology implementation, and capacity building, Phillips Consulting combines deep local insight with global best practices.

Our Training is designed to bridge Nigeria’s most pressing gaps:

- Tailored content that reflects the realities of Nigeria’s fraud landscape.

- Practical simulations, ensuring participants can act decisively in real-world scenarios.

- Expert facilitators with hands-on industry experience.

- Integration of AI concepts with practical risk management strategies.

At a time when Nigeria’s financial sector faces relentless attacks, Phillips Consulting provides not just knowledge but a competitive edge. We equip institutions with the tools, skills, and mindset to build fraud-resilient organisations in the era of AI.

Written by:

Sonia Akawushim

DTC