Access to finance or credit constitutes a significant growth driver for businesses (large and small scale). The dearth of credit is a critical barrier to industrial productive capacity and growth in the economy. In a twist of events, the Covid-19 pandemic has led to a severe differential impact within and across industries, further exacerbating the financing pressure businesses face.

The supply chain disruption, slowdown in retail and cross-border trade activities took a significant toll on businesses. According to a recent publication from the United Nations Conference on Trade and Development (UNCTAD), the disruptions caused by the coronavirus pandemic could result in a loss of more than $4 trillion to the global economy. Specifically, while large-scale organisations have the infrastructure and capital assets to weather the storm, the Micro, Small and Medium Enterprises (MSMEs) are constrained by a huge financing gap.

In developing countries like Nigeria, the potential demand for MSMEs credit/finance is estimated at $8.9 trillion compared to a credit supply of $3.7 trillion (World Bank, 2020). It implies that the finance gap from formal MSMEs is valued at $5.2 trillion in developing countries, equivalent to 19% of the gross domestic product (GDP).

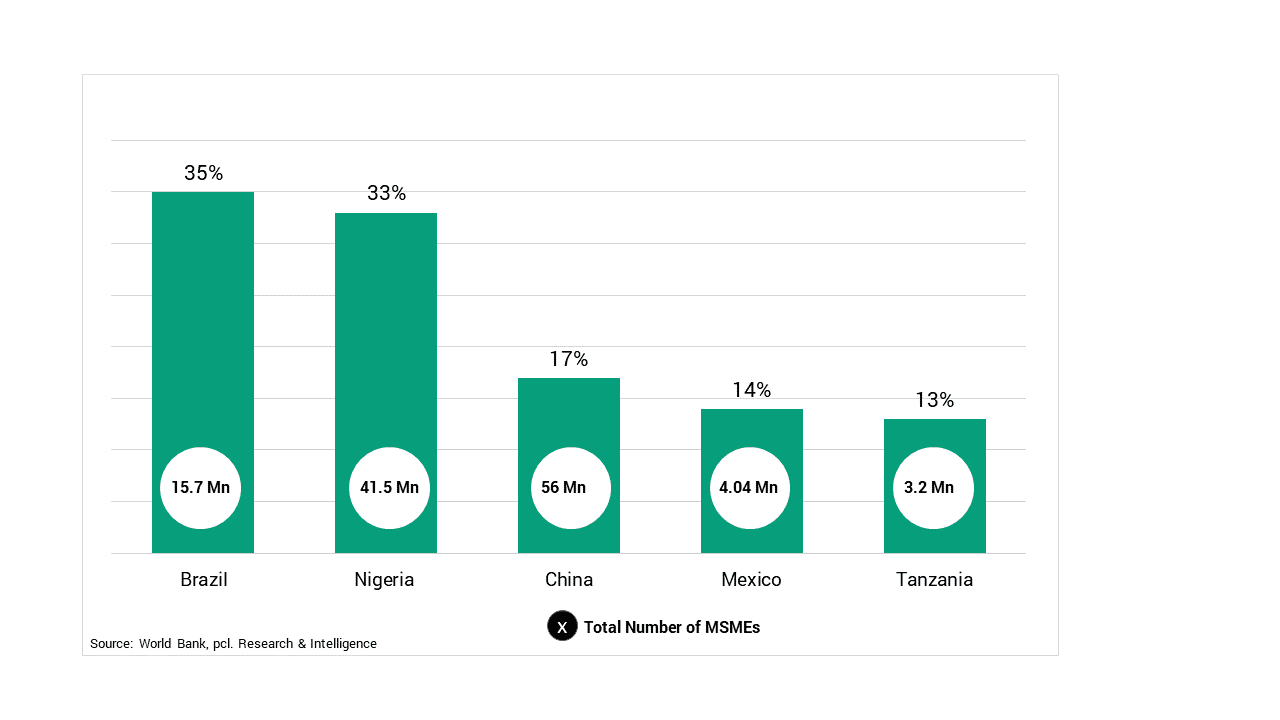

The Upper-middle-income countries, including China and Brazil, are the two largest contributors to MSMEs globally. In addition, the lower-middle-income countries are the second-largest category, with Nigeria as the third-largest contributor to MSMEs in the world and the largest in Sub-Saharan Africa.

MSMEs play a significant role, particularly in developing countries, where they account for about 90% of businesses and create over 50% of employment. Despite the growth and developmental impact of MSMEs, In Nigeria, several challenges (access to finance, high cost of doing business, lack of skilled workforce, the multiplicity of taxes, among others) persist, and these hinder the growth and development of the sector. In this article, we x-rayed the credit financing gap for MSMEs and the Nigerian economy.

MSMEs landscape in Nigeria

According to the National Bureau of Statistics (NBS) SMEDAN MSME survey 2019, MSMEs in Nigeria contributed about 49.78% to Nigeria’s GDP and 7.64% of export receipts. Given a total of 41.5 million enterprises and 59.6 million jobs created the role of MSMEs to economic prosperity in Nigeria is pivotal.

Simply put, MSMEs could play a catalytic role in employment, production diversification, improvement of local technology, integration of large-scale enterprises, and Nigeria’s overall economic transformation.

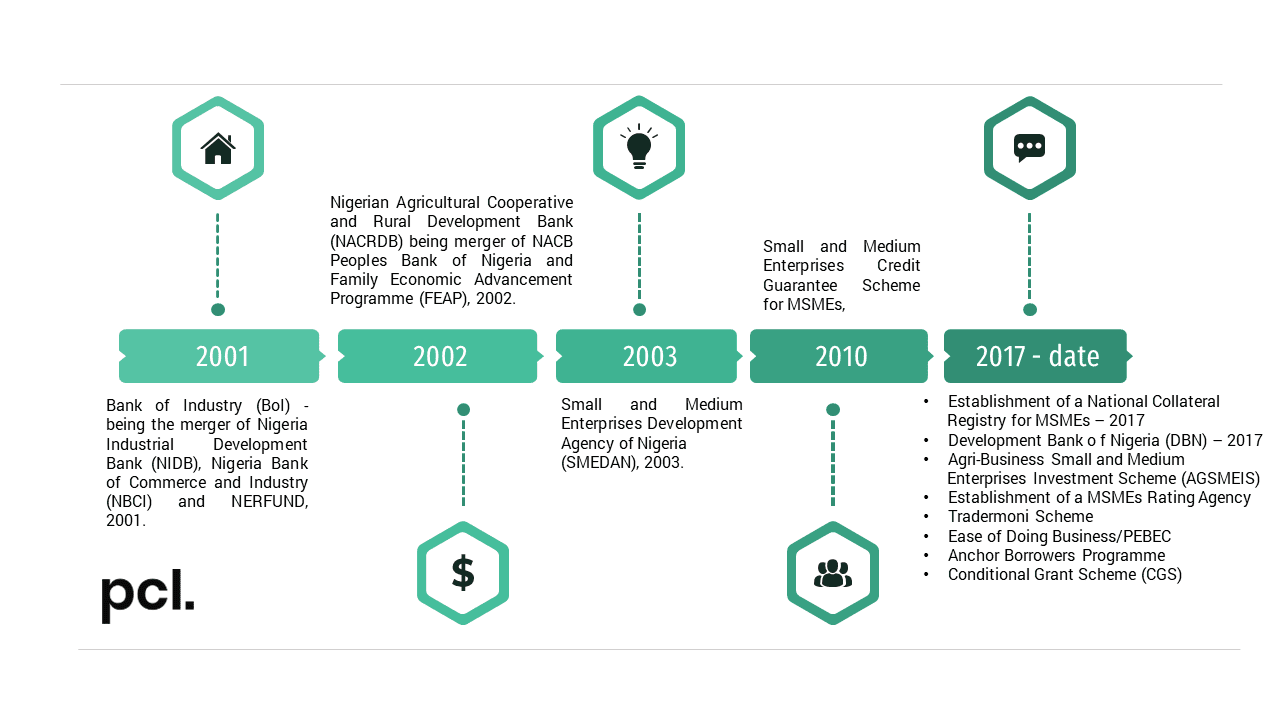

Exhibit 1:

Despite the significant contribution of MSMEs to the Nigerian economy, access to formal credit and alternative financing instruments remains a major constraint. Instructive to note that, in the past thirty (30) years, the federal government of Nigeria has created a raft of support institutions and initiatives to enable MSMEs to access funding (Exhibit 1).

For instance, one of the overarching objectives of the Small and Medium Agencies Development Agency of Nigeria (SMEDAN) in 2003 was “Linking MSMEs to internal and external sources of finance, appropriate technology and technical skills as well as large enterprises”. However, almost three decades since its establishment, access to credit remains a bane inhibiting MSMEs growth.

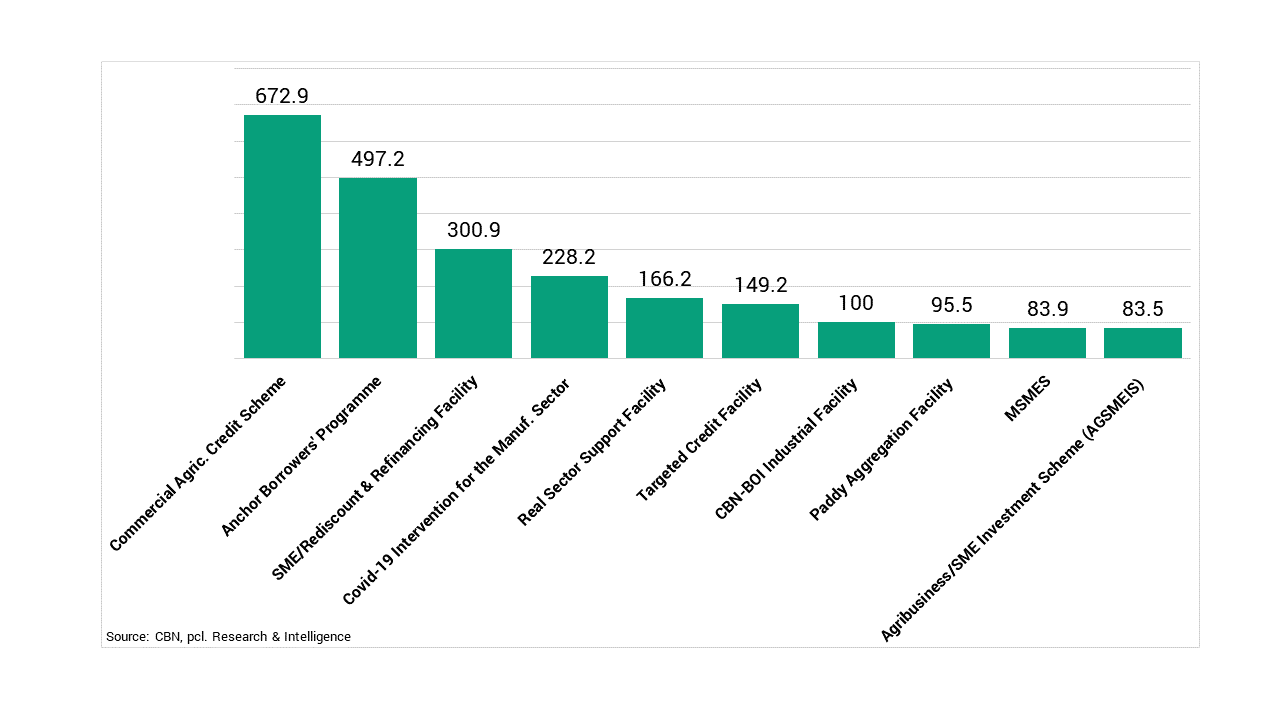

The disruptive and lasting impact of covid-19 on MSMEs in Nigeria has further revealed that with a poor credit system, MSMEs in Nigeria are just one shock away from insolvency. Cumulatively, across several initiatives, the Central Bank has injected N3.9 trillion (2.6% of GDP) to critical sectors targeted at MSMEs to stimulate real sector growth in the economy.

In Nigeria, the share of total employment in the agriculture sector (% of total) is estimated at 48% (NBS, 2017). Consequently, more than 30% of Nigeria’s cumulative financing initiatives disbursement for MSMEs is concentrated in the agriculture sector (Exhibit 2).

Exhibit 2: MSMEs cumulative Disbursement Interventions Schemes from Inception to November 2020 (N=Billion)

Progress made, albeit MSMEs financing gap remains wide

While the financing interventions to MSMEs by the Central Bank is crucial and commendable, Nigeria’s MSMEs financing gap is the second-largest behind Brazil. According to the World Bank, Nigeria’s financing gap for MSMEs is estimated at $158.1 billion. In developing countries, there are about 162 million MSMEs. Brazil, China, and Nigeria contribute 67% to the total MSMEs, equivalent to 109 million enterprises. While China has the highest number of MSMEs, it ranks after Nigeria in the MSMEs financing gap (Exhibit 3).

In a recent wealth mapping exercise conducted by pcl. in Nigeria, we found that several factors are vital in accessing finance from traditional financial institutions or existing sources. In addition, we found that the lack of structured or organised information through a single source on how to access finance further compounds the MSMEs challenges associated with funding.

In addition, findings from the NBS SMEDAN MSME survey 2019 reveal that personal savings were the most common source of capital for most enterprises – both Micro and SMEs. Nationally, only 49.5% of SMEs (sole proprietorships) reported having access to bank credit.

Exhibit 3: Finance Gap/GDP in Top 5 countries with the highest number of MSMEs

Bridging MSMEs financing gap

The MSMEs credit/financing scheme industry in Nigeria is still at its nascent stage. While policymakers are making continued efforts to increase access to financing for MSMEs, the volume of guarantees remains low compared to peers in other economies. Hence, the quantum of SME financing needs across the country remains high. Here are some solutions (not exhaustive) to close the existing financing gap in Nigeria:

- Strengthening Credit Institutions – To boost access to credit, the CBN recently released a guideline for regulating and supervising credit guarantee companies in Nigeria. The guideline serves as a regulatory framework for credit guarantee firms that seek to minimise credit risks and promote lower interest rates. Bearing that MSMEs often lack the necessary technical knowledge to prepare sound financial statements for loan applications, if implemented appropriately, we expect this move to address some bottlenecks facing MSMEs in securing credit.

- The role of Fintechs – Technology is the crucial differentiator in the access to finance landscape. In Nigeria, with the unbanked population at 37%, the role of technology financial services institutions is vital. For instance, globally, sandbox efforts have emerged to facilitate interaction between financial institutions and technology firms. Similarly, the recently introduced Regulatory Sandbox by the Central Bank is expected to expand electronic solutions and deepen credit penetration in the country.

- Improving insolvency regimes – Not all MSMEs are bound to succeed. Therefore, when small businesses fail, and there is no effective insolvency system to ensure that capital is reallocated such that the business can re-enter the economy, millions/billions of naira in business value, jobs, and capital can be lost or sidelined. Like Nigeria, several countries across the globe lack a well-structured insolvency framework to deal with MSMEs effectively, creating a significant legal gap. Implementing an insolvency regime that allows for a fresh start for failed MSMEs will enhance confidence and credit recoveries in Nigeria.

- Enabling Environment – Strong regulatory frameworks to support a more diverse financial landscape include improving competition within the financial system and creating a stable policy environment that allows various financial institutions to operate. In addition, directed lending schemes and risk-sharing arrangements can have significant impacts on MSMEs’ access to credit.

Written by:

Samuel Bamidele

Head, Research and Intelligence