Introduction

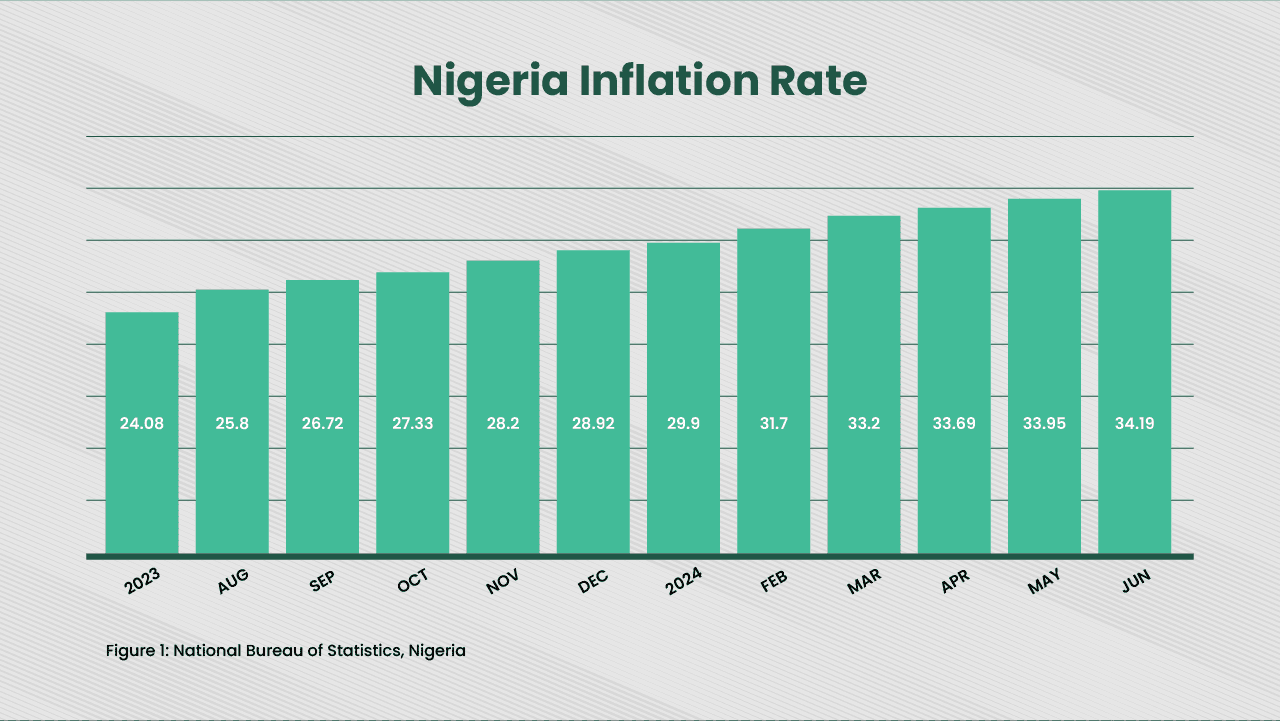

In today’s turbulent economic climate, where inflation rates soar and market volatility reigns, Nigeria’s small and medium-sized enterprises (SMEs) face an uphill battle for survival. With inflation reaching a staggering over 34% as of June 2024, many SMEs struggle to keep their doors open while balancing the rising costs of raw materials and labour. However, this challenge can also be an opportunity for innovation and resilience.

By adopting strategic measures tailored to their unique needs, SMEs can weather the storm of inflation and emerge stronger and more competitive. In this article, we’ll explore actionable strategies that empower Nigerian SMEs to thrive amidst economic uncertainty, showcasing success stories and proven tactics that can transform challenges into pathways for growth. Get ready to discover how your business can adapt, innovate, and flourish in an unpredictable economic landscape!

Understanding Inflation in Nigeria

Several factors contribute to inflation in Nigeria, including fluctuating oil prices, exchange rate volatility, supply chain disruptions, and socio-political instability. These elements drive up raw materials, labour, and other operational expenses. As the Bureau of Statistics reported, Nigeria’s inflation rate hit 34.19% in June 2024, the highest since March 1996, mainly due to the removal of fuel subsidies and a weakening local currency. Food inflation has also surged, severely impacting SMEs reliant on affordable raw materials.

A notable example is the impact of rising food prices on SMEs in the food production sector. Businesses like Mama Put, a local restaurant chain, reported significant challenges in maintaining menu prices as the cost of ingredients surged. An excellent measure to implement is negotiating bulk purchasing agreements with local farmers. This can help stabilise costs and offer competitive pricing while ensuring food quality.

Given these conditions, businesses, especially SMEs, must find innovative ways to manage rising costs without compromising their competitive edge or profitability. Below are tailored strategies that can help SMEs effectively manage inflation.

Strategic Cost Management

One of the primary strategies for coping with inflation is effective cost management. This involves identifying areas where costs can be reduced without affecting product quality or service delivery. Here are some cost management tactics:

- Lean Operations: Lean manufacturing principles can help eliminate waste, streamline processes, and improve efficiency. For example, small manufacturers can implement just-in-time inventory systems to minimise storage costs and avoid overproduction.

- Automation and Technology: Investing in automation and technology can significantly reduce labour costs and improve operational efficiency. SMEs can invest in affordable digital tools to reduce labour costs and improve productivity. Simple automation tools, such as cloud accounting systems or inventory management software, can streamline operations and cut overhead costs for SMEs.

- Supplier Negotiations: Building solid relationships with suppliers and negotiating favourable terms can help mitigate the impact of rising input costs. SMEs can form cooperatives or buy in bulk with other businesses to secure lower prices. Long-term contracts can also offer price stability. Companies like Nigerian Breweries have successfully negotiated long-term agreements with suppliers to stabilise prices and ensure consistent supply.

Diversification of Revenue Streams

Diversifying revenue streams is another effective strategy for managing inflation. By expanding into new markets or offering new products and services, businesses can reduce their reliance on a single revenue source and spread risk.

- Product Line Expansion: SMEs can introduce new products or services that cater to different customer segments. For example, a local beauty brand might expand its offerings by introducing a line of organic skincare products, tapping into a new market while diversifying revenue. SMEs should learn from the Dangote Group, which has successfully diversified its portfolio beyond cement to include sugar, salt, flour, pasta, and beverages, thereby reducing its dependence on any product.

- Digital and E-commerce Expansion: SMEs should consider expanding their business online to reach a broader customer base. Small companies can create websites or sell on digital marketplaces to attract customers from different regions and mitigate reliance on physical sales. A geographical expansion can also be considered; SMEs with enough revenue can expand their business geographically as a means of revenue diversification and a way to resist inflation

- Strategic Partnerships: Forming partnerships with complementary businesses can help SMEs access new customer bases and share resources. For example, a local catering service could partner with a farm-to-table restaurant, ensuring a steady product demand while expanding its market.

Pricing Strategies

Effective pricing strategies can help businesses manage the impact of inflation on their profitability. SMEs must find the right balance between maintaining competitive prices and covering rising costs.

- Dynamic Pricing: Implementing dynamic pricing strategies allows SMEs to adjust prices based on real-time market conditions and demand fluctuations. A good example is raising prices during peak seasons and offering discounts during off-peak times to optimise revenues. Price increases during peak periods can be challenging for SMEs. However, Transparency is critical to ensuring customers understand why prices fluctuate. Communicate that price increases during peak periods are due to high demand or increased cost. In turn, during off-peak periods, provide discounts. This can promote customer satisfaction and loyalty.

- Value-Based Pricing: Focusing on the value delivered to customers rather than just the cost of production can help justify price increases for SMEs. For example, introducing premium packages offering additional services ensures customers are willing to pay more for enhanced value. The Buy 5 and get 1 for free technique has been adopted by many SMEs with many success stories.

Talent Management

Managing labour costs is critical for SMEs as inflation increases wages and benefits. To remain competitive without overburdening the business, SMEs should consider these approaches:

- Employee Retention: Retaining skilled employees can reduce recruitment and training costs. Offering competitive salaries, benefits, and professional development opportunities can help retain top talent. SMEs can emulate well-established firms such as Phillips Consulting Limited (pcl.), which currently employ comprehensive employee retention programs to minimise turnover.

- Flexible Workforce: SMEs Adopting a flexible workforce model, such as utilising part-time or contract workers, can help businesses manage labour costs more effectively. This approach allows companies to scale their workforce based on demand and reduce fixed labour expenses.

- Performance-Based Compensation: SMEs can Introduce performance-based pay structures, ensuring that employees are compensated based on their contribution to business goals, aligning incentives with growth and controlling wage costs.

Conclusion

Adapting to inflation requires a multifaceted approach encompassing cost management, revenue diversification, strategic pricing, and talent management. SMEs proactively implementing these strategies can navigate inflationary pressures, sustain growth, and maintain their competitive edge in an evolving economic landscape. By learning from successful case studies and continuously innovating, Nigerian SMEs can build resilience and thrive despite the challenges posed by inflation.

Call to Action

As a business leader in Nigeria, it’s imperative to take proactive steps to shield your company from the impacts of inflation. We help organisations by assessing their current strategies and identifying areas where cost management, revenue diversification, and innovative pricing can make a difference. We help organisations Invest in their workforce by implementing retention programs and performance-based compensation schemes to maintain productivity and morale.

Organisations must stay ahead of the curve by leveraging technology and automation to streamline operations and reduce costs. Expand your horizons by exploring new markets and diversifying your product offerings. Collaborate with suppliers to secure favourable terms and stabilise your supply chain.

By taking these actions, organisations can mitigate the effects of inflation and position their business for sustained growth and success in Nigeria’s dynamic economic environment. Start today and transform inflationary challenges into opportunities for innovation and resilience.

For more inquiry, kindly send an email to strategy@phillipsconsulting.net

Written by:

Chidubem Ugo

Analyst

![]()