Over the years, the financial industry has been one of the resilient industries that have shaped and transformed the world’s economy into what it is today. Even if emerging technologies have threatened many businesses and caused them to fold up or lag, the modern financial sector has used these technologies to enhance its processes using fintech and digitisation. This has enhanced the need for accelerated changes in every firm or business in the financial industry whose major offerings are core services and value creation. These changes, however, did not affect the industry’s core services. Core services like risk management, deposits, loan servicing and transactions, financial advice and investments, and corporate financing remain the same.

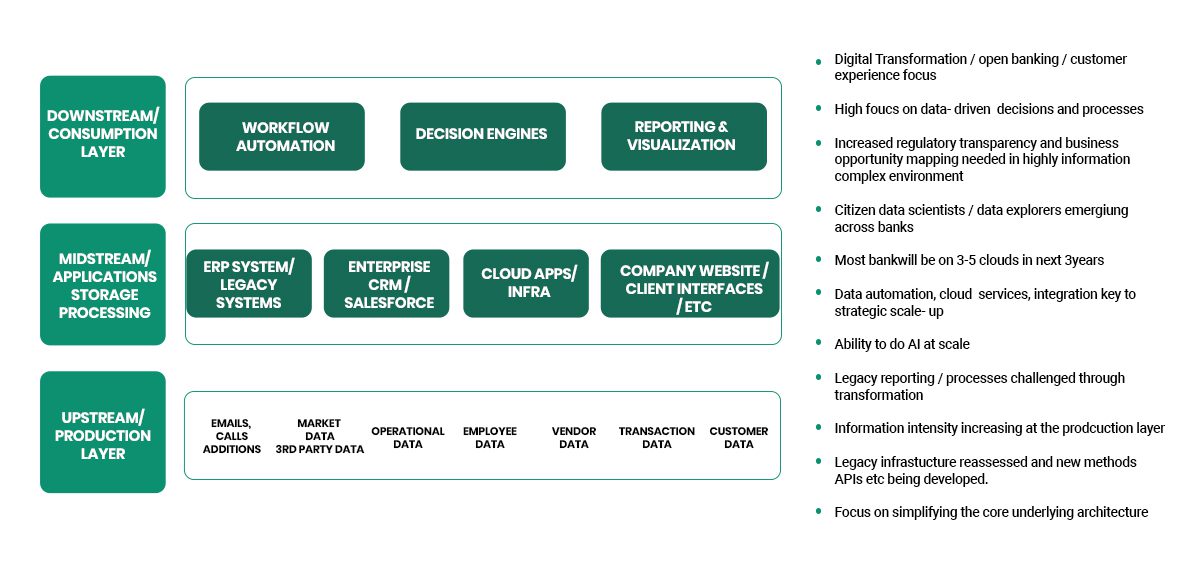

On the other hand, value creation, such as expertise, skills, and relationship management, has significantly evolved in terms of technical and structural changes. Although financial industries are still offering the same services since their inception, how we apply, transact, access, and manage money differs significantly from using apps today. This has made it more convenient and customer-interfacing than how it was 50 years ago. This could only be attained as a result of DATAFICATION; which is a technological trend turning many aspects of our life into data which is subsequently transferred into information realised as a new form of value-Wikipedia.

Nowadays, in banks, through the use of datafication, data is used to understand an individual’s risk profile and likelihood to pay a loan. It is safe to say that the financial industry dabbles with massive data, ranging from customer interaction, transactions, and other processes that create electronic data to record, store and utilise. The ability of a financial company to withstand the test of time with the ever-evolving technological changes lies in its utilisation of data to improve its business process. Even if the saying “Data is the new oil” is a cliché, it is most functional in the financial industry because it relies on accurate data and information to carry out its day-to-day activities to generate profit. Data has always been central in customer segmentation, risk assessment, personalised marketing, predictive fraud analysis, or attaining compliance. Data science is a requirement for banks to keep up with their rivals, attract more clients, increase the loyalty of existing clients, make more efficient data-driven decisions, empower their businesses, drive operational efficiency, promote existing services/products and create new ones, and enhance security; because of all these actions, derive additional revenue.

In Nigeria, the application of data by banks has evolved over the years owing to new and emerging technology that has helped to improve business processes and create value for customers. So much so that organisations that offer financial services no longer have to wait to analyse data to get results before they make decisions. Instead, analysis and evaluation are done in real time, thus, making decision-making accurate and faster. There are processes where datafication is used to enhance accuracy, which are:

1. Risk assessment

According to Soludo, in 2007, approaches to risk changed across organisations and the globe recently. This means that more business leaders are beginning to recognise that risks are not just hazards to avoid. Still, they also, in many instances, represent opportunities to be adopted. Soludo (2007) further said that the CRO of Royal Bank Canada stated that “risk is not bad in itself; however, what is bad is a risk that is mismanaged, misunderstood, mispriced or unintended”. He, therefore, defined risk management as a discipline at the core of every financial institution and encompasses all the activities that affect its risk profile. In 2014, Thomas. D . Ayodele and Raphael Oladele Alabi, in their analysis of Nigerian banks, gave their findings that risks in the form of fraud and forgery, operational risk, market risk, and system risk abound in the Nigeria banking operations which needed to be managed appropriately to improve performances and profitability of the banks. Fraud and forgeries also play an adverse role in daily banking operations. However, the risk management techniques put in place by the banks have curbed or reduced the various risks confronting Nigerian banks. For risk management, information is always power. The more you know, the better for you. Advancement in data analytics has given extreme powers to banks. Data technologies have enabled banks to collect loan history, credit card details, etc. Combining data from multiple databases and services make risk evaluation accurate and effective with data.

2. Predictive fraud analysis:

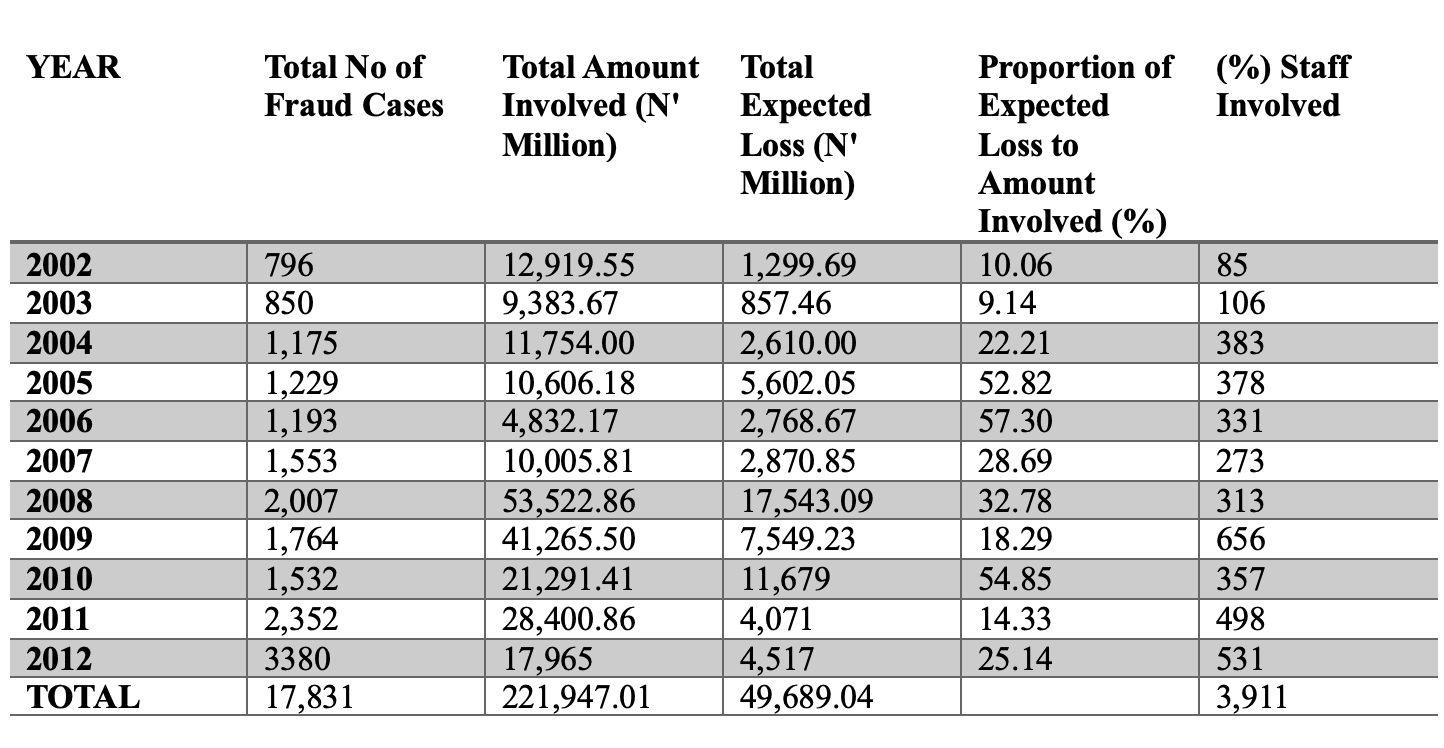

According to the report carried out by FITC Nigeria in 2021, a total of twenty-six thousand five hundred and sixty-six (26,566) incidents of Frauds and Forgeries were recorded in the fourth quarter of 2021, compared to twenty thousand, one hundred and ninety-five (20,195) documented cases in the third quarter of 2021, representing a 31.55% increase between the periods. Computer/web, mobile banking, and ATM withdrawal fraud had the highest occurrences of fraud observed during the periods. Fraud is the number one enemy of the business world. No entity or work is immune from it (Nwankwo, 1991). The fear is widespread that the increasing wave of fraud in recent years, if not prevented, might pose specific threats to the economy and political stability, financial institutions’ survival, and the industry’s performance. Nwachukwu (1995) wrote that more money is stolen in or through banks through fraud committed with a pen than through other means. In a report from NDIC, Fraud may take the form of; theft of inventory assets, misuse of an expense account, secret commission and bribery, false invoicing, electronic and telecommunication fraud, unofficial use of information, cheque forgery, fake financial statements, etc., however, regardless of the form it takes, the vital point is that any financial company that falls prey to fraudulent acts suffers the impact.

Total Amount Involved in Fraud and Forgeries from 2002-2012

Source: Adapted from NDIC ANNUAL REPORTS (2002 – 2012)

The most challenging task the financial industry must carry out is detecting fraud. Fraud detection is difficult when there are millions of consumers using various services. But not when machine learning is combined with forecast analysis. Services can now monitor every action in real-time thanks to machine learning and data integration. A bank’s daily operations are analysed by machines, which also maintain track of them. Any fake activity is quickly identified. Banks can immediately take legal action, including blocking an account, a card, etc. For a very long time, frauds have affected the financial sector, the telecommunications sector, and other groups. There is a type of fraud popularly known as Credit card transaction fraud. This fraud costs financial institutions millions a year, making it a critical task for banks to implement. Due to its effectiveness, data mining is a standard method of preventing fraud. Data mining is a well-defined process that uses data as input and generates patterns as its outcome.

Data mining aims to evaluate vast amounts of data and draw out relevant information that can be used in the future. Once the proper model has been chosen for the data, it can be used to categorise it and forecast future events. Fraud identification can be thought of in terms of data mining as the classification of the data. The proper model analyses the input data and determines whether it suggests fraudulent activity. A precise classification algorithm is created by identifying the trends of previous fake activities; this algorithm is now used to predict any suspected actions in a different data set.

3. Customer Segmentation

A bank’s ability to manage its customers’ data quality is critical to making a profit. The banking sector in Nigeria targets a vast number of customers, and publicising the correct type of service to every of its customer is essential. Every customer needs a well-tailored approach according to their behaviour. It could hurt the bank if its customers are dissatisfied with the services/products rendered. Here, customer segmentation targets customers according to their behaviour, making it the logical and scientific reason for banks to promote tailored services/products. If customer segmentation is carried out properly, it is also an excellent way to enhance personalised marketing. Hence, banks in Nigeria need to adopt customer segmentation objectively to increase customer loyalty, retain existing customers and attract new customers.

Written by:

Ogonna Okorie

Senior Analyst