Nigeria’s economy pre-COVID-19; too weak to win COVID-19

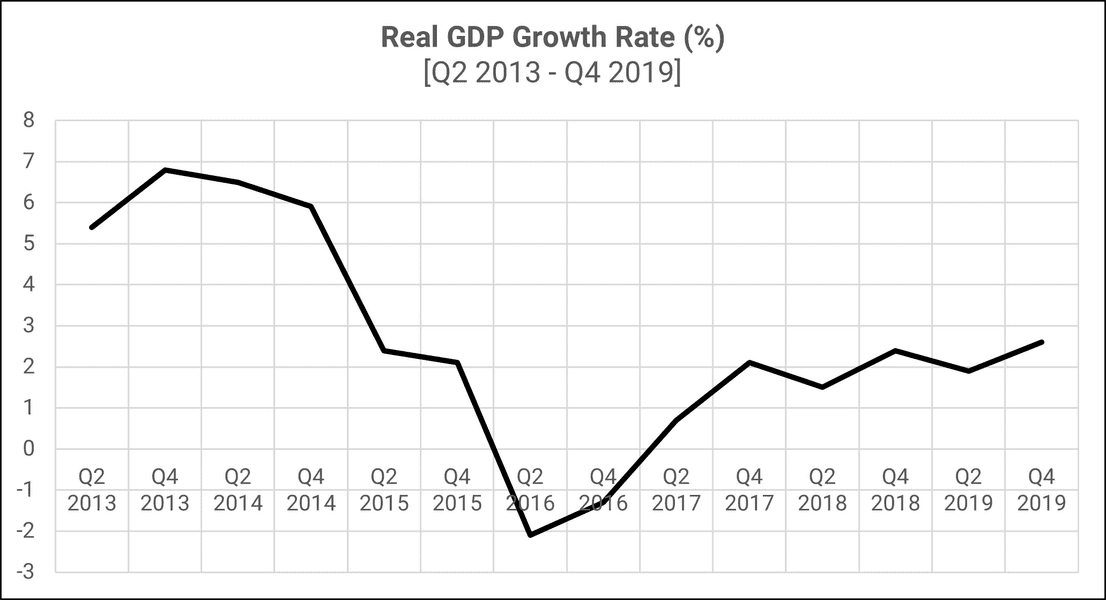

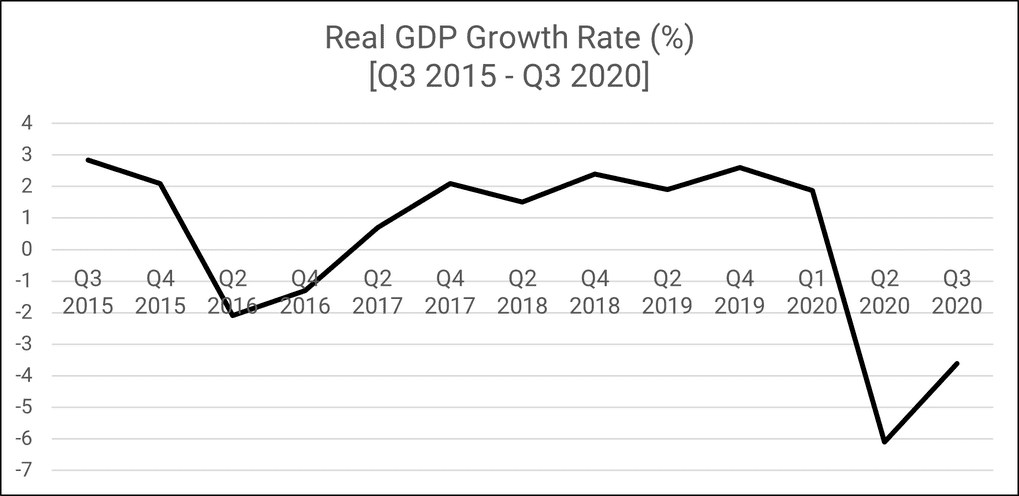

The Nigerian economy has been growing steadily but marginally since the recession of 2016. The economy slipped into recession in Q2 2016 with a negative growth rate of 2.1%, which was 4.2% points lower than the corresponding quarter in 2015. It, however, grew by 2.1% in Q4 2017, retained the same 2.1% growth rate in Q1 2019 and has maintained an average quarterly growth rate of 2.1% from Q1 2018 to Q4 2019. It implies that Nigeria’s economy is still fragile and not mature to easily recover from another economic downturn, not even a global one.

Source: NBS & pcl. analysis

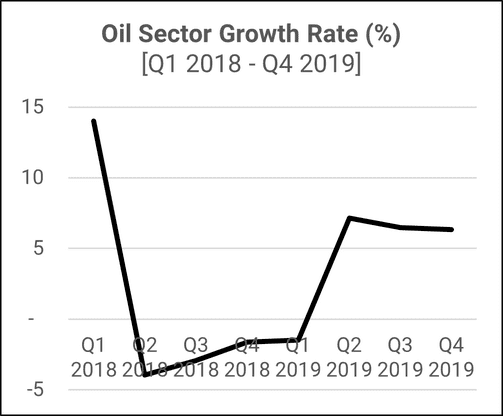

The last two consecutive years shows a weak and highly volatile oil sector, a sector not prepared for another crash.

The oil sector declined by 55% between Q1 2018 and Q4 2019. The sector growth rate sharply dropped from 14% to -3.95% between Q1 2018 and Q2 2018 due to a decline in crude oil price and production volume. This negative growth trend continued four quarters in a row- from Q2 2018 into Q1 2019. However, the sector bounced back in Q2 2019 with a growth rate of 7.2%. It was 8.5% higher than Q1 of 2019 and 11% higher than the corresponding quarter in 2018. In Q4 2018, the oil sector marginally increased by 0.11%, representing a drop by 0.8% points and 0.1% when compared to 2019, Q2 and Q3 growth respectively. Still, it will be considered as an improvement by 9% points when compared to the corresponding quarter in 2018. In short, the oil sector’s performance in terms of contribution to total GDP declined by 23%. This is from 10% to 7% between Q1 2018 and Q4 2019.

Source: NBS & pcl. analysis

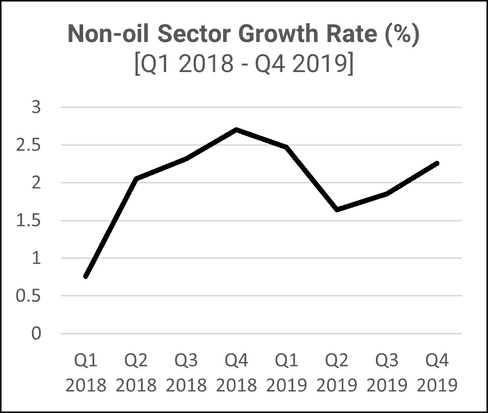

The improved non-oil sector performance was too marginal to absorb any economic shock in the future.

The non-oil sector growth rate peaked at 2.7% in Q4 2018, and the lowest non-oil sector growth rate was recorded at 0.7% in Q1 2018 between a 2-year period of 2018 and 2019. However, the non-oil sector grew by 255% between first quarter in 2018 (Q1 2018) and fourth quarter in 2018 (Q4 2018).

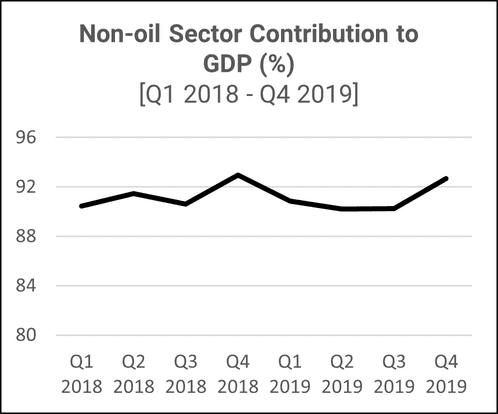

Conversely, the non-oil sector contribution to the GDP increased by 24% between Q1 2018 and Q4 2018 from 90.78% to 92.94%. Q4 2019 contributions to GDP of 92.68% was also higher than Q1 2019 by 1.8% points, which stood at 90.86%. The improved performance of the non-oil sector at the end of 2019 was perhaps due to the increased economic activity that usually occurs during the period – crop harvest and festive seasons.

Source: NBS & pcl. analysis

Source: NBS & pcl. analysis

Back to recession: Nigeria economy amidst COVID-19

The global pandemic forced Nigeria into another recession within a short period. The economy was not strong enough to withstand the negative impact of the worldwide crisis. Consequently, the country went into recession as the economy declined by 3.62% in Q3 2020, the second decline in a row, year-on-year real GDP. However, the global pandemic’s impact started affecting the economy in Q1 2020 as the economy performed poorly compared to the GDP growth rate in the same quarter in 2019 (Q1 2019) and the preceding quarter (Q4 2019). The economy grew by 1.87% in Q1 2020, representing a decline of 0.11% and 0.27% compared to the corresponding quarter’s performance in 2019 (Q1 2019) and the preceding quarter (Q4 2019). By the second quarter in 2020 (Q2 2020), the economy slipped into negative growth for the first time after the recession in 2016. The GDP declined by 6.10% (year-on-year) in real terms in Q2 2020, but there was an improvement in the year on year real GDP growth rate in Q3 2020. The Q3 2020 was 2.48% point higher than the preceding quarter but was 5.9% lower than its corresponding quarter in 2019 (Q3 2019).

Source: NBS & pcl. analysis

Navigating through the post-COVID era

Early this year, after the novel virus outbreak, the International Monetary Fund predicted that Nigeria might enter into its worst economic recession in 30 years. The prediction has started to materialise, as shown above. Still, it is not too late for the country to reverse the current negative growth, if proper policies, initiatives and programmes are implemented in good faith. To successfully navigate through the current economic downturn, organisations (both public and private) need to apply the four (4) major principles articulated below:

- Apply the ‘Pareto Principle’: As the federal government continues to salvage the economy from the current depression, the focus should not only shift from the oil sector to the non-oil sector but also leverage the ‘Pareto Principle’ (the 80/20 rule) to drive the economy out of recession. The private organisation should also apply this principle to boost the bottom line. This will ensure maximum use of scarce resources and guarantee the organisation’s stability in liquidity and profitability amid a global economic and financial crisis.

- Apply the external research principle: Public and private institutions should also evaluate the current operating environment to identify opportunities and threats. Successful identification of viable opportunities must be backed up by deliberate action steps to capture and exploit the same. Similarly, threats identified must be measured in the likelihood of occurrence and consequence, after which each risk ranked according to impact. It is vital to develop strategies to mitigate them.

- Apply the cost optimisation principle: Organisations must be strategic about managing their cost element. Otherwise, such cost optimisation initiatives might go wrong. To achieve long-term cost optimisation, organisations must instil a cost optimisation culture into the minds of employees. Employees should imbibe the habit of operational efficiency, and the management team must continuously look for ways to optimise processes for the benefit of the organisation.

- Apply the revenue expansion principle: During these trying times, private and public organisations should focus more on this principle rather than try hard to optimise cost. Cutting down the numbers of employees or employees’ salaries to increase the bottom line might reduce employees’ productivity, leading to a reduction in the quality of products or services offered. This will turn-around to negatively impact sales and profit in the short-term or long-term. Hence, firms must re-imagine revenue generation and develop strategies to boost sales and ultimately improve the bottom line.

Written by:

Timileyin Osunbunmi

Consultant