Fuel prices fluctuate, the foreign exchange market remains volatile, and government policies can shift with little notice. For many small and medium-sized enterprises (SMEs) in Nigeria, uncertainty is not an exception but a constant.

Despite accounting for 96 per cent of all businesses, contributing 48 per cent to national GDP, and providing 84 per cent of employment (Ochigbo, 2025), Nigerian SMEs face a complex and demanding operating environment. Long-term survival remains a significant challenge, with only 5 to 20 per cent making it past the five-year mark, according to SMEDAN data (Ikpoto, 2023). These structural and economic pressures continue to constrain the growth potential of one of the country’s most vital economic segments.

This is where business continuity becomes essential. It’s more than just disaster recovery; it’s a proactive approach to ensure critical operations continue, even when unexpected disruptions occur. Whether it’s a power outage, cash crunch, or policy change, continuity planning helps businesses bounce back quickly with minimal downtime. Simply put, it’s about ensuring the company keeps going, no matter what.

In this article, I share practical lessons on how Nigerian SMEs can build continuity plans that thrive, not just survive, in a turbulent economy.

Why Continuity Planning Is No Longer Optional

Many Nigerian SMEs operate without safety nets, emergency funds, backup suppliers, or digital systems. So, when disruption hits, the impact is immediate and often severe. Recent events have shown just how vulnerable small businesses can be. The naira redesign left many unable to transact. Fuel shortages stalled logistics. Sudden regulatory changes created confusion and loss. These aren’t rare occurrences but part of the operating environment.

This is precisely why business continuity can no longer be viewed as a “big company” concern. For SMEs, it’s a matter of survival. It means being prepared for everyday disruptions, not just rare catastrophes. It’s the difference between businesses that shut down and those that adapt and keep going.

So, how can SMEs build resilience in a way that feels practical and not overwhelming?

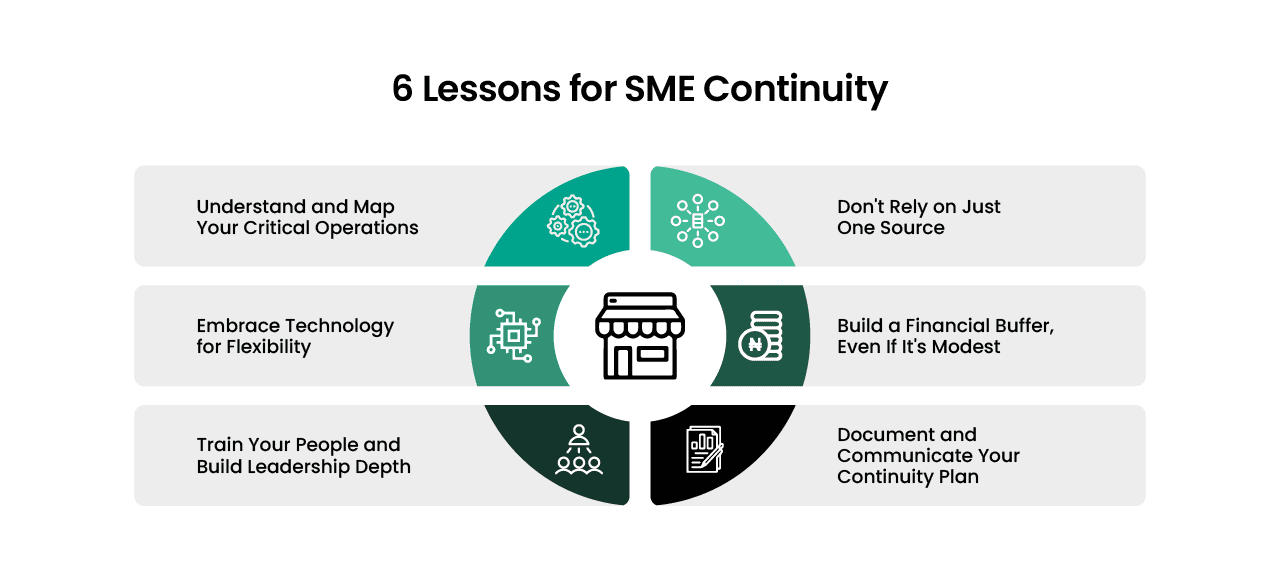

It starts with small but deliberate steps. Business continuity isn’t about having all the answers; it’s about knowing your business well enough to protect what matters most. The following lessons offer a simple path forward for SMEs looking to prepare, adapt, and stay operational amid uncertainty.

Lesson 1: Understand and Map Your Critical Operations

The first step in building business continuity is awareness. Many SMEs are so focused on daily operations that they haven’t taken time to identify what parts of their business they can’t afford to lose. Think of your business as the human body; what are the vital organs if everything shuts down? Is it your delivery process, your payment system, a particular supplier, or even a key employee?

Mapping out your critical operations helps you understand where to focus your energy during a crisis. This process, often called a Business Impact Analysis (BIA), doesn’t have to be complex. For SMEs, it could be as simple as listing your key products, services, people, and processes and asking: If this stopped working today, how long could I stay afloat?

Take a small logistics business, for example. If fuel scarcity hits, delivery timelines crash, customers cancel, and revenue dips. However, continuity is easier to maintain if the business already has a fuel backup plan or alternative transport options.

Knowing what keeps you running helps you prioritise what to protect.

Lesson 2: Don’t Rely on Just One Source

One of the fastest ways a business can collapse during a disruption is by being overly dependent on one supplier, one payment method, one product, or even one major client. In a volatile economy like Nigeria’s, diversification is not a growth strategy; it’s a survival tactic.

During COVID-19, Lagos SMEs leveraged digital tools to expand into new markets, shift from B2B to B2C, and overhaul payment and operational processes, all reinforcing continuity through agility.

If your business depends on just one vendor for key materials, a delay on their end could bring your entire operation to a halt. If you only accept bank transfers, what happens when mobile banking systems go down, as they often do? If most of your revenue comes from one client, a single cancellation could leave you scrambling without help.

Start small:

- Source from more than one vendor where possible

- Offer multiple payment options, bank transfer, POS, USSD, and even QR codes

- Explore alternative sales channels like WhatsApp storefronts, online marketplaces, or local delivery apps

- Look into low-cost digital exports if your product or service has diaspora appeal

Business continuity means having options. The more flexible your business is, the better your chances of staying afloat when the unexpected happens.

Lesson 3: Embrace Technology for Flexibility

For many small and medium-sized businesses in Nigeria, technology can feel out of reach, costly, complicated, or unnecessary. But in an unpredictable economy, even simple tools can make a big difference during disruptions.

Business continuity often depends on staying connected to customers, accessing key information, and continuing service delivery, even when things are unplanned. Whether you’re running a small tailoring shop or managing a regional distribution business, digital tools can help maintain operations:

- WhatsApp Business for customer orders and updates

- Google Drive or OneDrive for storing invoices and business records

- POS, USSD, or QR codes to ensure payment options stay flexible

- Social media to stay visible when foot traffic drops

Medium-sized businesses may also benefit from cloud tools like Microsoft 365 or Zoho for collaboration, or basic accounting platforms for remote financial tracking. According to EFInA’s 2023 Access to Financial Services report, 45% of Nigerian adults now conduct digital financial transactions, up from 34% in 2022 (EFInA, 2024). This rapid adoption of digital tools, particularly USSD and POS, demonstrates how simple tech solutions can keep businesses operational even during disruptions.

You don’t need a complex setup or tech team. What matters is being reachable, organised, and able to adjust when the unexpected happens.

Lesson 4: Build a Financial Buffer, Even If It’s Modest

Many Nigerian businesses often operate with limited cash flow, making it difficult to plan beyond immediate needs. But when disruptions hit, even a small financial cushion can be the difference between staying open and shutting down.

Disruptions often come with immediate costs, whether it’s urgent repairs, stock replacement, or covering salaries during a slow period. Having a small reserve gives you the flexibility to respond without stalling operations. Here’s how to start:

- Set aside a portion of profits monthly, no matter how small

- Cut back on non-essential spending where possible

- Explore cooperative savings or micro-savings platforms for business

Medium-sized businesses may also consider low-risk investment accounts or emergency business insurance, where available.

Business continuity goes beyond having systems; it also means being financially equipped to handle unexpected challenges.

Lesson 5: Train Your People and Build Leadership Depth

No continuity plan works without people who can carry it out. In many Nigerian businesses, operations often pause when the founder or manager is unavailable, creating unnecessary risk.

Team members should be equipped to make informed decisions, especially during a disruption. Cross-training staff so they can temporarily step into each other’s roles can keep things running when someone is absent, delayed, or unreachable.

Also consider:

- Creating a basic crisis communication plan: who notifies customers, partners, and suppliers when something changes?

- Sharing key contacts and business tools with more than one trusted team member

- Encouraging a culture of responsibility, not just task-following

Prepared systems matter but so do prepared people.

Lesson 6: Document and Communicate Your Continuity Plan

A good plan is only helpful if people know and understand how to follow it. Many disruptions escalate simply because teams are unsure what to do or who is responsible when things go wrong.

Your continuity plan doesn’t need to be lengthy or technical for SMEs. It could be a simple checklist or a short document outlining key steps for handling common disruptions, like delayed supplier deliveries, sudden staff absence, Inflation-driven price hikes for stock or raw material or Payment platform failures (e.g., bank transfer delays, POS not working).

What matters is clarity:

- Who should be contacted first when something goes wrong?

- What are the backup options for getting paid or delivering services?

- Where are essential documents or contacts stored, and how can people access them?

Share your plan with staff, partners, or vendors who help keep the business running. Medium-sized companies can also assign roles and conduct brief scenario walkthroughs during regular meetings.

Continuity planning is most effective when it’s shared, understood, and easy to activate.

Conclusion: The New Definition of SME Success

For small and medium-sized businesses in Nigeria, success can no longer be measured by growth alone. In today’s unpredictable economy, resilience is just as important as the ability to keep going when things don’t go as planned.

Disruptions, from fuel shortages to payment delays, are part of the operating environment. Business continuity is no longer a luxury for large corporations; it’s a practical way for SMEs to protect their people, customers, and operations.

By identifying what matters most, diversifying where possible, embracing simple tech, saving consistently, training your team, and documenting your plan, you’re not just reacting but building a stronger, more sustainable business.

At pcl., we believe resilience should be within reach for every business. Sharing knowledge supporting sustainable growth across the business landscape is one way to contribute to a more prepared, more confident economy.

Written by:

Sopirinye Millar-Jaja

DTC